White House extends solar tariffs, exempts bifacial; California targets 19 GW new solar

The solar news you need to know.

Related Articles

White House extends solar import tariffs; Bifacial panels exempted

The White House has extended tariffs on solar panel imports for a further four years but with adjustments that raise the minimum volume threshold and exclude bifacial panels.

Implemented by the Trump government in 2018, the Section 201 import tariffs aim to protect US manufacturers of crystalline silicon photovoltaic cells from lower cost products, mainly from China. The tariffs started at 30% and have fallen each year to 15%.

The Biden administration has doubled the amount of cells that can be imported before the levies kick in to 5 GW and exempted bifacial panels that generate power from both sides, it said February 4, confirming an exclusive report by Reuters on January 27.

Demand for bifacial modules is soaring as solar plant developers seek greater efficiency. By 2028, bifacial cells could represent 40% of the global solar market, according to the International Technology Roadmap for Photovoltaic (ITRPV).

The Section 201 safeguard measures were implemented in 2018 following a case brought by manufacturers Suniva and SolarWorld, which has since been acquired by SunPower. The US Solar Energy Industry Association (SEIA) has called for the tariffs to be scrapped, saying they increase project costs and slow down solar deployment. President Biden aims to decarbonise the power sector by 2035, requiring a rapid acceleration of solar and wind capacity.

In November, the U.S. International Trade Commission (USITC) recommended the federal government extend the tariffs.

The USITC found the tariffs continue to be "necessary to prevent or remedy serious injury to the US industry." The domestic solar industry is making a "positive adjustment to import competition," it said.

Just days after the Biden administration extended the tariffs, US solar panel maker Auxin Solar asked federal trade officials to investigate whether to impose tariffs on imports from four other Asian countries.

In a petition to the U.S. Department of Commerce on February 9, Auxin Solar argued that Chinese manufacturers had shifted production to Malaysia, Thailand, Vietnam and Cambodia to avoid paying duties.

The Department of Commerce recently rejected a request for import duties on solar panels from Chinese-owned factories in Vietnam, Malaysia and Thailand, filed by an anonymous group of US manufacturers.

Imports represented 89% of US solar module shipments in 2020, a similar proportion to 2019, data from the Energy Information Administration (EIA) shows. Module shipments include imports, exports and modules manufactured and installed domestically.

"Vietnam was the leading importer...followed by Malaysia, South Korea, and Thailand," EIA said.

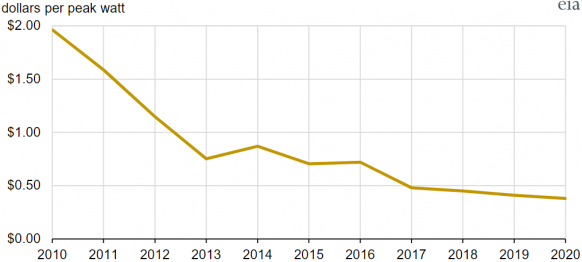

Average value of US solar module shipments

Source: U.S. Energy Information Administration (EIA)

PJM halts new grid approvals to fast-track older projects

US grid network operator PJM plans to pause grid approvals for new solar and wind to prioritise projects submitted before 2021, the network operator said February 9.

PJM's Planning Committee agreed to reform its grid connection process to clear a huge backlog of projects, it said.

PJM will prioritise projects that have financial and technical requirements in place and fast-track projects that do not require grid upgrades or facility studies, it said. Staff resources are a key challenge and PJM will continue to increase its staff count through 2023.

“We’re not closing the door on new projects,” Ken Seiler, Vice President - Planning, said.

"We are prioritizing more than 1,200 projects that we have in our backlog, most of them renewables, and they represent more than [100 GW] of nameplate capacity - that’s half the capacity we have on our system today.”

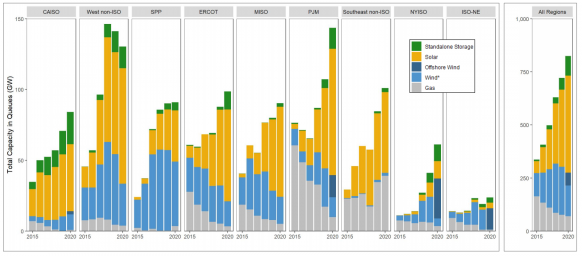

US power generation in interconnection queues

(Click image to enlarge)

Source: Berkeley Lab, May 2021

The PJM network spans 13 states in central and eastern US. Falling solar costs, rising corporate demand for renewables, and policy changes in some states have accelerated solar activity, extending interconnection queues.

California PUC targets 19 GW of new solar by 2032

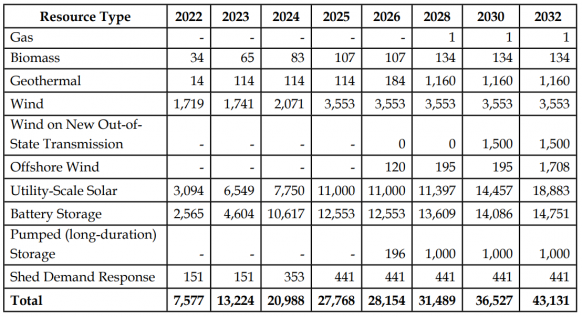

The California Public Utilities Commission (CPUC) has approved a plan to build 18.9 GW of solar and 14.8 GW of battery storage by 2032 in order to increase the share of zero-carbon energy resources to 86% of power generation and meet the state's carbon reduction goals.

As solar capacity increases, most developers in California are including storage in their projects to dispatch during high value periods. Some 89% of solar projects in California's grid interconnection queues at the end of 2020 included energy storage, far higher than any other US market, research from Berkeley Lab shows.

The CPUC's plan also includes 1 GW of long-duration pumped hydro storage, 1.7 GW of offshore wind capacity, and 1.5 GW of new imported wind capacity and will require "only limited transmission upgrades," according to a preliminary analysis, the CPUC said February 10.

"This finding will be validated at a more granular level by the California Independent System Operator (CAISO) in its 2022-2023 Transmission Planning Process (TPP)," it said.

A lack of grid capacity is a major challenge for solar and wind developers and the U.S. Department of Energy (DOE) recently launched $20 billion of federal financing tools and planning authority changes to strengthen and expand the US power grid. The US needs to expand transmission systems by 60% by 2030 and the DOE plans to conduct a National Transmission Needs Study this year to identify "high-priority" projects, it said.

California's generation build plan

(Click image to enlarge)

Source: CPUC, February 2022

The CPUC's resource plan adopts a stricter power sector emissions target of 38 MMT, compared with 46 MMT in the previous plan.

Last June, the CPUC ordered utilities to procure 11.5 GW of new renewable energy or demand management measures in 2023-2026 to reduce supply crunches from extreme weather events and meet California's clean energy goals. The new resources will replace 3.7 GW of retiring gas-fired capacity and Pacific Gas and Electric Company’s 2.2 GW Diablo Canyon nuclear plant, due to be shut down in 2024-2025. Several GWs of new capacity were already set to come online in 2021-2023 following earlier procurement orders.

Investor CIP to build giant green hydrogen plant in Spain

Danish investment group Copenhagen Infrastructure Partners (CIP) has partnered with wind turbine supplier Vestas and Spanish energy groups to build a giant green hydrogen plant in north-eastern Spain.

The first phase of 'Project Catalina' will include 1.7 GW of solar and wind capacity and a 500 MW electrolyser capable of producing over 40,000 tons of green hydrogen per year, CIP said in a statement February 1. Hydrogen will be sent to a new ammonia plant in Valencia or blended into the natural gas grid, it said.

Project partners include Spanish gas and power supplier Naturgy, pipeline operator Enagas and fertiliser-maker Fertiberia.

The first phase is expected to be permitted within two years, allowing construction to start at the end of 2023. In a later phase, the partners intend to expand solar and wind capacity to 5 GW and increase electrolyser capacity to 2 GW, enough to supply 30% of Spain's current hydrogen demand.

Vestas acquired 25% of CIP in late 2020 in a move which widens its role in offshore wind and solar and expands its long-term income potential. CIP was an early investor in the offshore wind market and Vestas said it would invest in a CIP fund focused on green hydrogen and other “power-to-x” technologies.

The Catalina plant will be located in the region of Aragon, south of the Pyrenees, where there is "excellent solar and wind resource, political backing as well as the proximity to demand centers," Soren Toftgard, partner at CIP, said.

Reuters Events