California floating wind launch quickens infrastructure need

Grid constraints will limit California's first large offshore wind projects mainly to central coast sites and developers and state authorities must resolve supply chain and offtaker risks, industry experts told Reuters Events.

Related Articles

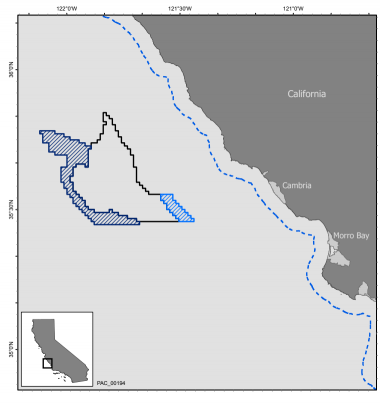

In July, the U.S. Bureau of Ocean Energy Management (BOEM) called for offshore wind proposals in Morro Bay in central California, a key step towards the first West Coast offshore wind projects. California lies behind the East Coast on offshore wind development as the deeper West Coast waters require floating wind technology which is yet to be deployed commercially on a large-scale. The Morro Bay Call Area East and West Extensions span 399 square miles and could host 3 GW of capacity and the BOEM has also formally designated a 270 square-mile site in Humboldt Bay for development and will proceed with an environmental review of the area, it said.

BOEM's call comes as California seeks new ways to fill gaps in power supply with renewable energy. In June, the California Public Utilities Commission (CPUC) ordered utilities to procure 11.5 GW of new renewable energy or demand management measures by 2026, to reduce supply crunches during evening peak demand and extreme weather events. Offshore wind should be deployed “as expeditiously as possible," it said.

BOEM plans to auction the first offshore wind leases in autumn 2022, the bureau told Reuters Events.

California Morro Bay call areas

(Click image to enlarge)

Source: Bureau of Ocean Energy Management (BOEM), July 2021

Onshore transmission constraints will limit the capacity deployed in the first wave of projects.

In Morro Bay, transmission capacity has been freed up by the decommissioning of gas-fired generation and the closure of the nearby 2.2 GW Diablo Canyon nuclear plant in 2025 presents another opportunity. Developers hope the Biden administration's infrastructure spending plans will help to reduce grid blockages going forward.

With strong coordination between state and federal authorities, the first wave of offshore projects in California could provide around 3 GW of new power capacity by 2030, Alla Weinstein, CEO of developer Castle Wind, told Reuters Events. Castle Wind, a joint venture of Trident Winds and German utility EnBW is developing a 1 GW project in Morro Bay.

Grid and port investments would allow a significant ramp up of offshore capacity in the 2030s. California could potentially host up to 21 GW of offshore wind capacity and a recent report for California lawmakers concluded the state may need 10 GW offshore wind by 2045 to achieve its target of 100% renewable energy.

Tailwinds

US offshore wind development is gathering pace as the federal government increases support programs and accelerates legislative procedures.

In May, the Biden administration approved Vineyard Wind, the US' first large scale offshore wind farm. President Biden aims to install 30 GW of US offshore wind capacity by 2030 and complete environmental reviews of 16 offshore wind projects by 2025, setting up a boom in manufacturing, assembly and installation in the coming years.

In December, the U.S. Congress agreed to implement a new 30% investment tax credit (ITC) for offshore wind farms that start construction by 2025 as part of a COVID-19 recovery package. The Internal Revenue Service (IRS) also extended the deadline for project completion from four years to 10 years. Projects could also benefit from support proposed in the Biden administration’s $3.5 trillion budget bill currently being debated by Congress.

"We have been encouraged by the Biden-Harris administration’s support for the development of offshore wind projects in California," Weinstein said. "We expect more federal support and cooperation moving forward given the recognition of the economic, energy, and climate benefits offshore wind projects stand to produce."

Transport limits

Transmission upgrades and regional supply chain infrastructure will be required to fulfil California's offshore wind potential.

The CPUC has asked California grid operator CAISO to evaluate the transmission needs and costs associated with interconnecting 8.3 GW of offshore wind at various potential locations including Morro Bay and Humboldt, with the potential to increase this up to 21 GW.

CAISO has already noted there are currently “limited transmission facilities in the northern Humbolt area coming south," a CPUC spokesperson said.

"The transmission investment needed to accommodate large amounts of offshore wind may be significant," the spokesperson said.

On the northern coast, a "small project of 100 MW-200 MW would require some [grid] upgrades, while larger projects would require new transmission," Jonah Margulis, Head of US Operations at Aker Offshore Wind, told Reuters Events.

Aker is part of a consortium with European utility EDPR, floating wind designer Principle Power and the Redwood Coast Energy Authority (RCEA) that is developing a project of capacity around 150 MW in Humboldt Bay.

A $1 trillion bipartisan infrastructure bill passed by the US Senate in August 2021 includes $73 billion for power sector infrastructure and $17 billion for port and waterway projects. The bill is being debated in Congress alongside the larger budget bill which contains a raft of further measures to combat climate change.

“Any future infrastructure funding for port and/or transmission development would be a significant show of support,” Margulis said.

Cost focus

In California, strong offshore wind resources during the evening peak power demand period mean projects can complement the state's large PV fleet. California has around 30 GW of solar capacity and 5.5 GW of onshore wind and will increasingly rely on higher cost energy storage to avoid switching to fossil fuel plants as the sun goes down.

California forecast peak capacity - summer 2021

Source: CAISO's 2021 summer loads and resources assessment, May 2021

West Coast developers must control costs while deploying emerging floating wind technology for the first time on a large commercial scale. In contrast, East Coast offshore wind projects are based on fixed-bottom structures which benefit from years of deployment experience in Europe.

Studies by the National Renewable Energy Laboratory (NREL) show that offshore wind can be competitive in California. NREL estimated offshore wind capacity could be brought online at Morro Bay by 2030 at a levelised cost of energy (LCOE) of $67/MWh.

“Allowing for the Investment Tax Credit, available if the developer can start construction by the end of 2025, this is approx. $45/MWh," the CPUC spokesperson said. "For context, this is similar to onshore California wind, which by 2030 will not benefit from the Production Tax Credit. Meanwhile, solar is projected to be in the low $20’s/MWh in 2030.”

Multiple buyers

Larger projects offer economies of scale but developers face the challenge of securing multiple offtakers in California's progressive electricity market.

Demand for renewables will mostly come from corporations and smaller community choice aggregators (CCAs), the local government agencies that are acquiring power procurement duties from the three large investor-owned utilities [IOUs] Pacific Gas and Electric, San Diego Gas & Electric and Southern California Edison, Arne Olson, Senior Partner at consultants Energy and Environmental Economics, told Reuters Events.

"Today the largest buyers in California are the CCAs, the municipal utilities (SMUD, LADWP, city of Riverside, etc.), and large corporations with direct access to a competitive retail market,” Olsen said. “This dispersement of procurement authority among multiple entities may make it difficult to achieve the scale required for a large offshore wind procurement.”

Given the large size of offshore wind projects, “a state-led process is probably going to be necessary,” Olsen said. The state authorities could commit to signing power purchase agreements (PPAs) or introduce price support or other mechanisms that incentivise procurement, he said.

Developers could be aided by a Clean Electricity Payment Program (CEPP) proposed by the Biden administration as part of the budget bill. The CEPP would incentivise utilities to switch to renewable energy and nuclear power and would be key to achieving the President's goal of a zero-carbon power sector by 2035.

Reporting by Neil Ford

Editing by Robin Sayles