US House approves $3.5 trillion spending plan; Federal office aims to cut land costs

Our pick of the latest wind power news you need to know.

Related Articles

US House approves $3.5 trillion climate, social plan

The U.S. House of Representatives approved August 24 a framework for President Joe Biden's $3.5 trillion spending plan that includes game-changing climate initiatives, Reuters reported.

The budget bill would address climate change, expand social programs and pay for new initiatives with tax hikes on US corporations and the wealthy - objectives that Republicans and some moderate Democrats reject.

Already approved by the Senate, the budget bill framework was approved by the House in a party line 220-212 vote, leaving lawmakers to nail down the full details in the coming weeks.

The House also agreed to vote by September 27 on a $1 trillion infrastructure bill, already passed in the Senate, that authorises spending on road, rail and water infrastructure and electricity networks.

The budget bill would introduce far greater measures to combat climate change. The Biden administration wants to include a Clean Electricity Payment Program (CEPP) that incentivises utilities to switch to renewable energy and nuclear power, expand tax credits for renewable energy developers and upgrades to power grids, and fund new electric vehicle programs.

The CEPP is a system of payments and penalties that aims to push utilities to increase power generation from clean energy sources including wind, solar and nuclear power. Many lawmakers and the White House had originally favored a Clean Electricity Standard, which is similar but includes mandates.

President Biden has pledged to fully decarbonise the power sector by 2035, requiring a rapid acceleration in renewable energy deployment and an expansion and modernisation of the power grid.

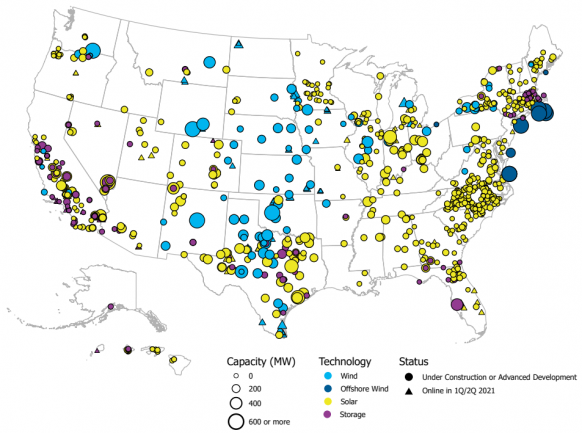

US wind capacity in interconnection queues at end of 2020

Source: Berkeley Lab, May 2021

The Democrats hope to pass the budget bill in the coming months through a reconciliation process that allows the legislation to pass with a simple majority.

Biden administration aims to cut land costs for developers

The Biden administration plans to lower the cost of procuring federal land for wind and solar power projects by revising lease regulations, Reuters reported August 31.

The Interior Department's Bureau of Land Management (BLM) has initiated a process to revise permitting and right-of-way regulations related to renewable energy permitting and rights-of-way on public lands.

“We recognize the world has changed since the last time we looked at this and updates need to be made,” Janea Scott, senior counselor to the U.S. Interior Department’s assistant secretary for land and minerals, told Reuters.

President Biden aims to fully decarbonise the power sector by 2035 and this will require faster growth in wind and solar capacity.

Developers are seeking to build larger projects to maximise economies of scale but the area of potential development is dwindling as new projects come online.

The BLM will tackle the rental rate and fee scheme for federal wind and solar leases, implemented by President Barack Obama's administration in 2016, that is designed to keep rates in line with nearby agricultural land values.

Developers argue the charges represent a substantial premium to private land rents.

To date, the Interior Department has permitted less than 10 GW of wind and solar power on its more than 245 million acres (99 million hectares) of federal lands, according to the Energy Information Administration (EIA).

US wind installations hit record for second quarter

US wind developers installed 2.8 GW of new capacity in April-June, 10% higher than a year ago and a new record for the second quarter, industry group American Clean Power (ACP) said in its latest quarterly report.

The rise in installed capacity was in part due to the commissioning of projects that were originally planned for the first quarter, ACP said. Some 5.7 GW of wind capacity was installed in the first half of the year, 30% higher than a year ago.

Renewable energy installations in H1 2021

(Click image to enlarge)

Source: American Clean Power (ACP)

Energy storage installations shot up in the second quarter, rising almost fivefold on the previous quarter to 674 MW. Utility-scale installations in the first half were seven times higher than in 2020, lifting total US storage capacity to 2.5 GW by the end of June.

Solar installations picked up in the second quarter but first-half installations remained 13% below 2020 levels at 3.5 GW.

Siemens Gamesa to raise turbine prices by up to 5%: media

Siemens Gamesa will raise wind turbine prices by 3%-5% in response to rising raw material prices and close its turbine sales operations in China, company CEO Andreas Nauen told WirtschaftsWoche magazine.

The company will continue to produce wind turbines in China's Tianjin for export to other markets in the region including Japan, Nauen reportedly told the magazine in an article published August 27.

Siemens Gamesa is the largest global supplier of offshore wind turbines and will continue to sell offshore turbine blades made at its factory in Shanghai to Chinese client Shanghai Electric as well as customers abroad, a company spokesperson said.

Years of intense price competition have dented the margins of turbine suppliers and in July Siemens Gamesa issued its second profit warning this year because of rising raw materials costs.

Steel is a key material in wind turbines and global prices have risen by up to 100% over the past year as industries rebound after the COVID-19 slowdown. The price of other materials used in turbines such as carbon fibre, copper and the resin used in blades have also jumped. Squeezed freight capacity has also pushed up shipping costs.

In Europe, the extension of EU import tariffs and new carbon levy plans are set to intensify inflationary pressures on manufacturers.

In July, Nauen warned the scale of the material cost increases “cannot stay with us," suggesting a proportion would have to be passed on to customers.

"It is not normal for the suppliers to take on the risk of commodity pricing,” Danielle Lane, UK Country Manager for Vattenfall, a Swedish utility and wind developer, told Reuters Events earlier this month.

"Projects work (traditionally) on a balance of risk and the developers are in a better position to take on pricing risk for most commodities (such as steel, copper, currencies etc)," Lane said. "The cost for suppliers to take on commodity pricing would most likely push the cost of wind projects upwards."

Reuters Events