Europe counters U.S. with clean energy package; EU solar installs soar

The solar news you need to know.

Related Articles

EU unveils state aid, funding plan to compete against U.S.

The European Union is planning to mobilize state aid and a sovereign fund for renewable energy companies within a new Net-Zero Industry Act, to keep firms from moving to the United States, European Commission President Ursula von der Leyen said on January 17.

The announcement at the World Economic Forum in Davos comes as volatile regulation, permitting challenges and a lack of federal financing in Europe are making the U.S. more attractive for investment.

The U.S. and Europe have both set ambitious renewable energy targets but financial support differs greatly and developers in Europe also face permitting delays.

Most importantly, President Biden's Inflation Reduction Act provides tax credits that increase the profitability of U.S. solar and wind projects as well as new manufacturing facilities.

The EC will propose to "temporarily" adapt EU state aid rules that prevent countries from providing direct support to domestic companies to "speed up and simplify," von der Leyen said. The sovereign fund will provide both loans and grants and the EU will aim to "focus investment on strategic projects along the entire supply chain," she said.

"We will especially look at how to simplify and fast-track permitting for new clean tech production sites," von der Leyen said.

"To keep European industry attractive, there is a need to be competitive with the offers and incentives that are currently available outside the EU," she said.

The EC must gain the backing of EU member states for the proposed fund and von der Leyen proposed introducing a short-term bridging solution without giving details. In November, the EC launched a new Clean Tech Europe initiative to identify challenges and encourage investment but concrete funding measures are yet to be announced.

Hanwha Q Cells to invest $2.5 billion in U.S. solar

South Korea's Hanwha Q Cells plans to invest $2.5 billion to build a solar power manufacturing value chain in the U.S. state of Georgia that will increase its U.S. production capacity from 1.7 GW to 8.4 GW by 2024, the company announced January 11.

The Hanwha Q Cells board approved a $2.3 billion investment to build a solar power ingot, wafer, cell and module factory, the company said in a regulatory filing. Late last year, the group approved an additional $200 million of U.S. investments.

Most U.S. solar developers rely on imported solar panels from Asia and the announcement by Hanwha Q Cells is the latest in a flurry of new U.S. factory plans following President Biden's Inflation Reduction Act (IRA) that aims to accelerate solar and wind deployment and create jobs.

The act includes new tax incentives designed to spur domestic manufacturing, including a 30% Investment Tax Credit (ITC) and a production tax credit (PTC) that is product specific. Tax credits for solar builders have been extended by ten years.

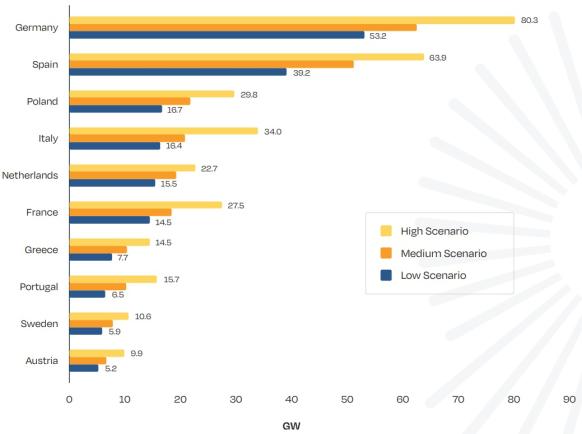

EU solar installs forecast to hike 29% in 2023, smash record year

Annual solar installations in the European Union are forecast to rise 29% in 2023 to hit a record 53.6 GW, following a 47% growth rate in 2022, industry group SolarPower Europe said in its latest annual market report.

After years of falling costs, demand for solar is soaring as governments and consumers seek to reduce carbon emissions and strengthen energy security.

Total installed solar capacity in the EU hiked by 25% last year, to 208.9 GW, SolarPower Europe said. The European Union aims to increase solar capacity to 320 GW by 2025 and hit 600 GW by 2030 as it looks to end the region's reliance on Russian gas and oil.

Germany installed 7.9 GW last year while Spain installed 7.5 GW. Poland was the next largest market at 4.9 GW while the Netherlands installed 4.0 GW and France 2.7 GW.

The hike in installations came despite significant supply chain challenges from rising prices and logistics issues following the coronavirus pandemic.

“The numbers are clear. Solar is offering Europe a lifeline amid energy and climate crises," Walburga Hemetsberger, CEO of SolarPower Europe, said in a statement.

Annual solar installations are forecast to hit 85 GW by 2026, under a "most likely" scenario, SolarPower Europe said.

Germany and Spain are set to remain key drivers of growth, provided market intervention aimed at protecting consumer prices does not deter investment.

Forecast largest solar markets in the EU in 2023-2026

(Click image to enlarge)

Source: SolarPower Europe, December 2022

Germany aims to quadruple solar power capacity to 200 GW in a bid to increase renewable energy to 80% of power generation by 2030.

Spain's solar market is thriving on surging demand from corporate power buyers and the government aims to double the share of renewable energy to 74% of power generation by 2030.

Permitting delays are a key challenge for developers and the EU has approved emergency regulation that aims to shorten permitting times in a bid to accelerate growth (see below).

EU members agree faster permitting rules

EU energy ministers formally agreed emergency regulation on December 19 that is set to shorten permitting times and reduce developer costs. The agreement was part of an overall package of emergency measures that included a much contended limit on gas prices.

In place for 18 months, the emergency regulation aims to speed up solar and wind permitting while EU officials negotiate wider measures set out in the REPowerEU plan. REPowerEU comprises a package of measures to tackle the energy crisis sparked by Russia's invasion of Ukraine and will be incorporated in the Renewable Energy Directive pending agreement by EU officials.

Delays in environmental permitting and grid connections have slowed solar and wind growth. Permitting can take several years due to complex administrative processes and a lack of resources at approval authorities.

The EU's emergency regulations define solar and wind as projects of overriding public interest and clarify the environmental and grid permit deadlines that approval authorities must meet within two years. The burden of proof for environmental protection is shifted from developers to public agencies and developers can use a wider range of measures to protect endangered species.

EU members agree to cap gas prices

European Union energy ministers agreed an EU-wide cap on gas prices on December 19 to curb soaring prices that have driven up gas and electricity bills following Russia's invasion of Ukraine.

The agreement followed weeks of negotiations between the 27 EU members over the level and mechanism of the price cap.

Effective from February 15, the EU-wide cap will be implemented if prices exceed 180 euros/MWh ($195.8/MWh) for three days on the front-month contract at the benchmark Dutch Title Transfer Facility (TTF) gas hub. The TTF price must also be 35 euros/MWh higher than a reference price based on existing liquefied natural gas (LNG) price assessments for three days.

Once triggered, trades would not be permitted on the front-month, three-month and front-year TTF contracts at a price more than 35 euros/MWh above the reference LNG price.

"We have succeeded in finding an important agreement that will shield citizens from skyrocketing energy prices," said Jozef Sikela, industry minister for the Czech Republic, which holds the rotating EU presidency.

An earlier proposal by the European Commission set the cap at 275 euros/MWh but countries said this price was too high and would not have curbed soaring prices last August when month-ahead TTF prices approached 314 euros/MWh on August 26 and stayed above 225 euros/MWh for two weeks in a row.

In September, EU energy ministers agreed to limit revenues from solar, wind and nuclear power generation to 180 euros/MWh from December until the end of June and several national governments are imposing lower price caps.

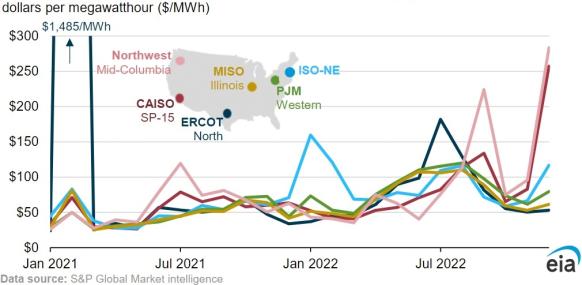

U.S. power prices predicted to drop in 2023

U.S. wholesale power prices are broadly expected to drop in 2023 on lower gas prices and rising renewable energy capacity, Reuters reported January 10, citing government data and industry analysts.

Texas' industry could see power prices fall by as much as 45% to $42.95/MWh, according to the Energy Information Administration (EIA). Texas is the fastest-growing solar market in the U.S. and power prices rose in 2022 due to heatwaves.

"We're seeing a lot of build-out of solar generation in ERCOT (Electric Reliability Council of Texas) in the populated zones where the load centers are," said Rob Allerman, senior director of power analytics at data provider Enverus.

U.S. monthly average wholesale power prices

(Click image to enlarge)

Source: Energy Information Administration (EIA), S&P Global Market intelligence

Four severe weather-related events caused major spikes in wholesale electricity prices in 2022, EIA said.

In January, prices in New England spiked on cold temperatures and gas pipeline constraints. In July, Texas hit record-breaking electricity demand during a heatwave in which wind resources also slumped.

In September, a heatwave across the Western U.S. resulted in record-breaking electricity demand and in December, winter storms in the Western Pacific led to record high prices.

Overall, U.S. wholesale power prices will decline by 10% to 15% this year, estimates researcher Rystad Energy. Consumption could fall 1% in 2023 and then grow by the same amount in 2024, the EIA forecast. Electricity generation is expected to follow a similar trend.

Reuters Events