Spain's bulging solar pipeline heaps pressure on permitting

Spain's solar market is thriving on surging demand from corporate power buyers but developers need faster permitting and a clearer market outlook to reduce delays and fulfil renewable energy goals.

Related Articles

Spain is set to be a key growth engine of solar and wind capacity as the European Union looks to accelerate away from fossil fuel energy.

Stable power prices, a diversified supply of gas and a strong renewable energy outlook will help Spain through Europe's energy crisis, Rystad Energy said in a research note. Energy prices soared in Europe following Russia's invasion of Ukraine, crushing the finances of households and businesses and prompting governments to take action.

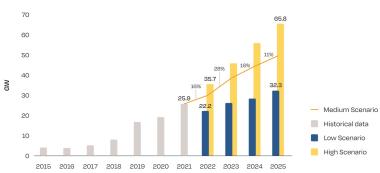

Spain is expected to install 4 GW of solar capacity this year and has the largest solar pipeline in Europe, Pratheeksha Ramdas, Renewable Energy Analyst at Rystad Energy, told Reuters Events. Spain is set to install 19 GW new capacity between 2022 and 2025, according to the latest baseline forecast from industry group Solarpower Europe. There were over 100 GW of projects with grid approval in October and a further 23 GW awaiting permission, Rystad Energy said.

Forecast annual solar installations in EU

(Click image to enlarge)

Source: SolarPower Europe, September 2021

Spain has the highest solar yields in the EU and good availability of land. Strong market fundamentals have made Spain the most attractive market in the world for renewable energy power purchase agreements (PPAs), according to a report by consultancy EY in October 2021.

Assets in Spain are often used as the basis of pan-European PPAs, EY noted.

Spain aims to double its share of renewable energy to 74% of power generation by 2030 but permitting processes must be accelerated to process a flood of projects. Spain has streamlined permitting of low-impact projects but these changes will take time to impact installations and some projects will lose out due to the surge in demand.

“The government is asking to withdraw project applications which has environmental constraints, as reviewing them is time consuming and requires high workload from relevant authorities,” Ramdas said.

Developers also seek regulatory certainty after a flurry of market interventions by EU and national authorities.

Spain’s government capped gas prices for power generation, stopping power prices from soaring to levels seen in other major European nations, but the fallout of new EU price limits continues to evolve as other nations impose additional national limits.

Permit queue

The permitting of solar and wind projects in Europe can take around five years, compared with less than a year for construction. Approvals authorities have been inundated with solar and wind applications and a lack of resources combined with bureaucratic processes are holding back projects.

Less than one fifth of projects in Spain's permitting queue earlier this year had received environmental and construction permits, Spanish PV industry group UNEF said.

Some 45 to 50% of solar projects in Spain were behind schedule because of environmental impact assessments, according to a Deloitte report.

Developers are often not given a reliable date of authorisation, disrupting project schedules, a spokesperson at power utility Endesa told Reuters Events. Endesa connected 12 new solar plants totalling 500 MW in 2021 through its subsidiary Enel Green Power Espana, doubling its Spanish solar capacity. The company aims to install a further 4 GW of renewable energy capacity by 2024, increasing its installed capacity from solar, wind and hydro to 12.3 GW.

To accelerate deployment, Spain's government implemented new planning rules in March that shorten the permitting process for projects of capacity below 150 MW that have low or medium impact on the environment. The new rules, in place until 2024, could halve the time it takes to receive permits to around two years but the benefits will depend on the stage of the project and some developers may continue to focus on larger projects to gain economies of scale.

Other European countries are rolling out similar measures after the EU called on all member states to accelerate permitting, but implementation will take longer in some countries and a lack of resources at permitting authorities remains a concern.

Private buyers

Power production can either be contracted through regulated auctions, or via the market in the form of wholesale contracts or power purchase agreements (PPAs).

In 2021, 2.4 GW of solar capacity was contracted through PPAs in Spain, representing around two thirds of installations nationwide and around one third of the PPA volume contracted across Europe, Luis Lopez-Polin, senior manager of business development at PPA pricing platform LevelTen Energy, said.

PPA prices generally track wholesale market prices and prices are currently far higher than solar auction prices. The average price of solar projects in Spain in the latest auction in October 2021 was 30 euros/MWh, compared with October wholesale market prices of around 127 euros/MWh, "hence developers will look for PPAs to get reasonable returns," Ramdas said.

PPA contracts require developers to commission projects ahead of power delivery date, but there are fewer intermediate deadlines to meet than for auction contracts, the Endesa spokesperson noted. Developers can lose bank guarantees if they miss deadlines, increasing project risk.

Some projects are being developed on a merchant basis, without a long-term PPA contract, allowing developers to take advantage of wholesale electricity prices.

One example is Renovalia’s 79.2 MW El Bonal solar plant, completed in December 2020, which sells its entire output on the wholesale market.

It is these types of projects that will be particularly sensitive to price caps imposed at EU and national level in recent months.

Market intervention

Spain moved fast to curb soaring electricity prices following Russia's invasion of Ukraine, imposing a cap on gas prices for power generation that saw prices diverge from other European countries.

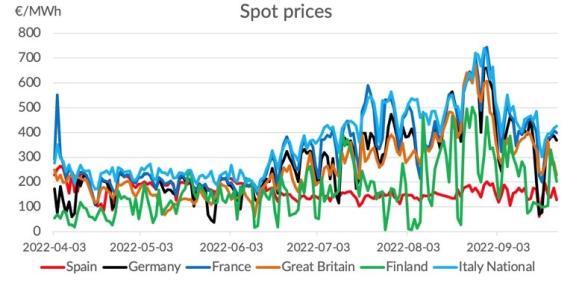

In September, the EU imposed a limit on revenues from solar, wind and nuclear generation of 180 euros/MWh from December until the end of June. Spain's wholesale power prices were already below that level due to the national gas price cap, so the impact on PPA demand in Spain should be minimal, said Lopez-Polin.

European wholesale power prices by country

(Click image to enlarge)

Source: LevelTen Energy

The EU limits had a greater impact elsewhere in Europe. Some 42% of developers in Europe said they would submit less PPA offers under a price cap of 180 euros/MWh, while 42% said they would not change their PPA offer activity, according to a survey conducted by LevelTen after the limits were proposed. The remaining 16% of developers said they had stopped submitting any offers for new PPAs until they had more information.

The EU rules allow nations to impose additional national limits, adding further uncertainty to future revenues.

Some EU members such as Germany are rolling out national price caps that will likely be below 180 euros/MWh, and developers in Spain "need more clarity on how the Spanish government will interpret and implement the mechanism," Lopez-Polin said.

Reporting by Neil Ford

Editing by Robin Sayles