EU unveils plan to counter U.S. subsidies; U.S. solar installs could triple in 2023

The solar news you need to know.

Related Articles

EU unveils state aid, funding plan to compete against U.S.

The European Commission has set out a Green Deal Industrial Plan to mobilise state aid and EU funding for clean technology companies and accelerate the permitting of manufacturing facilities.

The EU's plan comes as a lack of federal financing in Europe, along with volatile regulation and permitting challenges, are making the United States more attractive for investment.

President Biden's Inflation Reduction Act provides $369 billion of green subsidies, including tax credits that increase the profitability of U.S. solar and wind projects as well as new manufacturing facilities.

The EC proposes to loosen EU state aid rules until the end of 2025 to allow the bloc's 27 governments to help with investments in renewable energy or decarbonising industry, the commission announced on February 1.

EU members will be allowed to draw on existing EU funds, since national budgets differ between members, the EC said. The principal source of EU funding will be the 225 billion euros ($245 billion) of loans and 20 billion euros of grants remaining from the EU's 800 billion euro post-pandemic recovery fund. Longer term, the commission will propose creating a European Sovereignty Fund to invest in emerging technologies.

EC will also produce a Net-Zero Industry Act that includes measures to accelerate the permitting of clean technology factories.

In December, EU energy ministers agreed temporary regulation that aims to shorten permitting times for renewable energy projects.

The Green Deal plan must be agreed by EU members and will be debated at a summit of leaders on February 9-10.

Industry group SolarPower Europe criticised a "lack of focus" in the plan.

"Not all net-zero technologies are in the same boat – not in terms of strategic importance, or even the impact they’re feeling from the Inflation Reduction Act," said SolarPower Europe Policy Director Dries Acke.

SolarPower Europe is also concerned about the proposed 2025 timeframe for EU state aid rules.

"The U.S. is operating on a 10-year timeframe," Acke said. "We were advocating for flexibility until 2030.”

U.S. utility-scale solar installs set to triple after 2022 slump

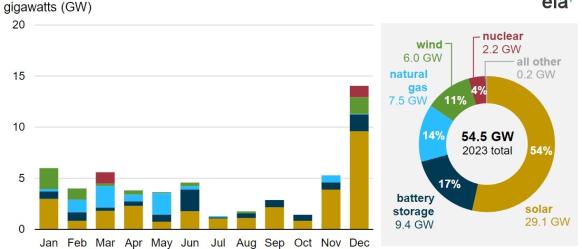

U.S. solar developers plan to install a record 29.1 GW of utility-scale capacity this year, almost triple the capacity installed in 2022 and more than double the previous record of 13.4 GW set in 2021, the U.S. Energy Information Administration (EIA) said in a research note based on generator plans.

Last year, solar installations fell by 23% and were far lower than forecast by the EIA due to a combination of volatile prices and supply disruptions following the coronavirus pandemic and uncertainty over U.S. import tariffs. In addition, a ban on solar imports from China's Xinjiang region under the Uyghur Forced Labor Prevention Act (UFLPA) blocked inflows at U.S. ports (see below article).

To ease tariff uncertainty, President Biden waived import tariffs on the four largest supplier countries in Southeast Asia until 2024.

"We expect that some of those delayed 2022 projects will begin operating in 2023," EIA said.

Solar installations will represent 54% of all new power capacity connected to the grid this year, according to data collected from generators. Utility-scale battery installations are set to double to 9.4 GW and much of this capacity will be coupled with solar.

U.S. planned power plant installations in 2023

(Click image to enlarge)

Source: U.S. Energy Information Administration (EIA)

Texas and California will continue to drive solar growth, installing 7.7 GW and 4.2 GW respectively, and these two states will also host 71% of all new battery storage connections, EIA said.

New tax incentives in President Biden's Inflation Reduction Act are set to stimulate investment in the coming years but the U.S. lies far behind President Biden's goal of a decarbonised power sector by 2035.

Solar installations must hit 60 GW/year by the middle of the decade and 70 GW/year in 2031-2035 to meet the President's goals, the Department of Energy (DOE) said in a report in 2021.

U.S. solar PPA prices climb as imports blocked

Solar power purchase agreement (PPA) prices in North America climbed by 8.2% in the fourth quarter of 2022 to $45.66 per MWh, while wind prices fell for the first time in nearly two years, pricing platform LevelTen Energy said in a statement on January 31.

Average solar PPA prices in Q4 were 33% higher than a year ago as developers passed on inflationary pressures from higher global materials costs, supply chain issues and U.S. trade policy.

A ban on solar imports from China's Xinjiang region under the Uyghur Forced Labor Prevention Act (UFLPA) caused a pileup of solar components at U.S. ports as customs agents checked products.

"Those delays and access to that equipment is introducing significant amounts of uncertainty on timelines, and therefore PPA prices are going up to cover that risk," LevelTen Senior Director of Developer Services Gia Clark told Reuters in an interview.

Demand for solar projects remains strong and prices might stabilize in the second half of 2023, Clark said.

Meanwhile, President Biden's Inflation Reduction Act is expected to supercharge solar and wind deployment in the coming years, and may already be impacting wind PPA prices, LevelTen said. Wind prices fell by 1.9% last quarter to $48.71 per MWh, LevelTen said.

Signed into law in August, the inflation act provides $369 billion of green subsidies, including tax credits that increase the profitability of U.S. solar and wind projects as well as new manufacturing facilities.

Reuters Events