UK must act on storage to ditch gas for offshore wind

The UK government's planning law changes will accelerate offshore wind build but critical energy storage policies are lagging behind, developers told Reuters Events.

Related Articles

Last week, the UK raised its offshore wind target by 10 GW to 50 GW by 2030 and pledged faster onshore wind and solar build in a new energy security strategy that could see 95% of power from low carbon sources by 2030.

The government will reform offshore wind planning processes to cut approval times from four years to one and hold annual auctions for contract for difference (CFD) subsidies every year, it said, rather than every two years under the current process.

Large amounts of long duration energy storage (LDES) are needed to achieve the government’s renewable energy goals and deployment is being held back by a lack of supportive market mechanisms, industry experts warned.

The UK will require up to 24 GW of LDES to achieve net zero power generation, almost 10 times the current installed capacity, Aurora Energy Research said in a report published in February.

Gas-fired plants are currently the UK's main source of power balancing but developers say zero carbon alternatives are already available. Technologies range from mature concepts such as pumped hydro storage to more cutting edge electrical, thermal, and green hydrogen systems.

A "massive ramp up" of LDES is required, a spokesperson for utility SSE Renewables told Reuters Events.

LDES would reduce the UK’s reliance on imported gas and when combined with renewables “will be a more cost-effective and deliverable solution for UK energy security,” the spokesperson said.

There’s “no shortage of desire” for zero carbon power, Keith Anderson, CEO of ScottishPower, said. “But we’ve got to get real on removing the barriers.”

Goodbye gas

The government's energy security strategy offers less support for onshore wind and solar developers and includes plans for a new fleet of nuclear power plants to help curb the UK's reliance on imported gas and stabilise soaring power prices.

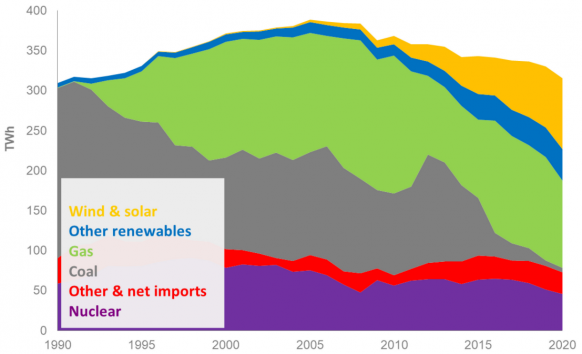

Gas-fired power plants generated 40% of UK electricity in 2021, making electricity prices particularly sensitive to gas markets. European gas prices climbed as economies staggered out of the pandemic and Russia's invasion of Ukraine propelled prices to new heights, exacerbating a cost-of-living crisis that is rippling through Europe.

UK electricity generation by fuel type

(Click image to enlarge)

Source: UK Department for Business, Energy and Industrial Strategy (BEIS), 2021.

Advancement of energy storage technologies “will be vital in our transition towards cheap, clean and secure renewable energy," Greg Hands, Minister of State at the Department for Business, Energy and Industrial Strategy (BEIS), said in February.

These technologies "will allow us to extract the full benefit from our home-grown renewable energy sources, drive down costs, and end our reliance on volatile and expensive fossil fuels,” he said.

Storage mechanisms

The government's energy security strategy will support the buildout of "large-scale" LDES by developing "appropriate policy to enable investment," it said.

"The strategy is positive about the role of long duration storage but falls short of including a policy decision," the SSE spokesperson said. "Therefore we encourage BEIS to implement a cap and floor regime for long duration storage following their call for evidence last year."

A cap and floor mechanism would provide a minimum revenue to developers to help them secure financing. It would not likely be implemented until next year at the earliest.

SSE sources 100% of its power from renewable energy and hydroelectric plants and is developing the Coire Glas Pumped Hydro Storage project in the Scottish Highlands that could deliver 1.5GW/30GWh of storage capacity by 2030.

Even mature technologies such as pumped hydro storage need support through a cap and floor regime to "stabilise revenues and de-risk the investment," the SSE spokesperson said.

The proposed cap and floor is a "significant step in the right direction," Jeffrey Douglass, Markets and Analytics Manager at Invinity, a vanadium flow battery developer, said.

Markets should be structured in a way that does not disadvantage zero carbon energy storage over fossil fuel generation, Douglass said.

"This could take the form of a direct zero-carbon premium or zero-carbon capacity market for example," he said.

The government is also supporting the development of less mature LDES technologies to accelerate their route to market.

In February, BEIS allocated 6.7 million pounds ($8.7 million) towards new LDES technologies in the first funding round under a 68-million-pound LDES support program.

Winners included utility EDF, which received 2 million pounds of funding for several demonstration projects including hydrogen, compressed air, and large batteries.

Offshore aid

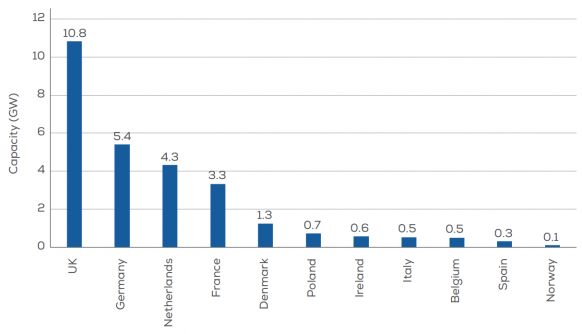

The UK was already leading Europe on offshore wind build and to accelerate deployment the government will reduce the burden of environmental assessments on developers. New measures will include "nature-based design standards to accelerate deployment whilst enhancing the marine environment," more "strategic level" decisions on environmental concerns, and compensation measures for projects already in the system to "offset environmental effects and reduce delays," it said.

Forecast offshore wind installations in Europe in 2022-2026

(Before UK energy security strategy)

Source: WindEurope's Wind energy in Europe report, February 2022

The government will hold annual CFD auctions from March 2023 and will propose changes from 2024 that will incentivise lower overall system costs, it said. CFD subsidies have helped drive UK offshore wind growth and developers have long since called for more frequent auctions to provide a clearer and more consistent deployment timeline.

The government will increase its floating wind target from 1 GW to 5 GW to meet its offshore wind objective, it said. Floating wind activity is rising and in January Scotland allocated 15 GW of floating wind projects, putting the UK at the forefront of floating wind development.

"The measures outlined in the strategy to accelerate offshore wind are the right ones. Specially those needed to reduce planning decision timescales and speed up grid connections," SSE said. "Now it is important that Government works together with industry, regulators and wider stakeholders to implement those measures," it said.

Major grid investments will be required to accommodate such vast amounts of offshore wind and reduce the impact on onshore infrastructure.

Until now, offshore wind projects have been connected to individual “radial” offshore transmission links. The UK government is developing plans for a coordinated offshore wind grid that would cut costs but the timeline remains unclear.

"We know we will need all of these wind projects to meet targets so an incremental approach is not cost-effective," SSE said.

Government, power authorities and industry must now “collectively focus on delivery," John Pettigrew, CEO of National Grid, said.

"A strategy with clean energy at its heart is critical,” he said. “Net zero is achievable and affordable and is a clear route to long-term resilience.”

Reporting by Ed Pearcey

Editing by Robin Sayles