Germany urged to clarify offshore wind auctions after raising targets

Germany must rapidly adapt its offshore wind auction model and implement a multi-year plan to avoid supply chain bottlenecks towards the end of the decade, project partners said.

Related Articles

Germany is accelerating its renewable energy plans under new legislation that will ramp up offshore wind installations alongside onshore wind and solar growth.

Germany's new coalition government plans to open up new sea areas and install 30 GW of offshore wind by 2030, four times the current level and 10 GW higher than the previous target.

By 2035, Germany aims to operate 40 GW of offshore wind and fully decarbonise its power sector under new laws scheduled to be implemented by the summer.

Germany was a pioneer in onshore wind deployment and is Europe's second largest offshore wind market behind the UK which benefits from a far longer coastline. Offshore wind farms supplied around 4% of Germany's power in 2021 while onshore wind supplied around 20% and solar 10%, government statistics show.

Germany now looks set to optimise its North Sea territory to achieve its climate goals.

To hit targets, annual tender volumes will need to triple to around 3.5 GW by 2025, according to draft government documents.

Permitting must also be accelerated and industry stakeholders will need to expand supply chain and logistics capabilities, a spokesman for wind and solar developer WPD told Reuters Events.

Supply chain partners need planning certainty for "at least five years" to significantly ramp up volumes, Marco Lange, Communications Manager, Siemens Gamesa Renewable Energy, said.

Suppliers need a smooth and consistent flow of projects and "as it looks now, the largest additions of the new capacity will come at the end of the decade,” Lange said.

"We would welcome it if projects were moved from the end of the decade to an earlier point in time," he said.

Auction pipeline

Offshore wind suppliers need more surety of confirmed projects to expand manufacturing capacity, John Wawer, a spokesman for Vestas Wind Systems, said.

“Consistency of awarded capacity to be built is the key trigger for the industry across the entire supply chain," he said.

Investments in ports, infrastructure and installation vessels will be needed “to handle the larger size of machines, towers and blades and also the increased overall volume in the market,” Lange said.

Under the current process, Germany pre-approves offshore wind sites and allocates leases, public support through long-term contracts, and grid connection rights in a combined auction.

The Federal Ministry for Economic Affairs and Climate Action (BMWK) is now looking at allocating pre-approved sites and non-approved areas through separate auction models, Wawer said. Bids for pre-approved areas would be based on 20-year Contract for Difference (CFD) subsidies or private Power Purchase Agreements (PPAs), while non-approved areas would be based on PPAs only.

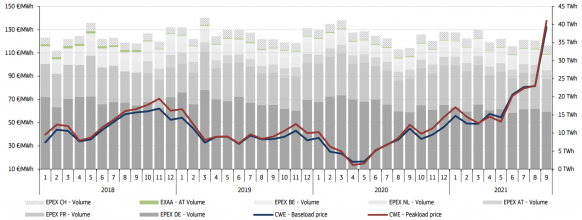

Spot power prices in Central & Western Europe

(Click image to enlarge)

Source: European Commission's latest Quarterly Electricity Market Report

Competition between offshore wind developers remains fierce, pressuring margins along the supply chain. In September, Germany allocated three offshore wind sites to RWE and EDF at zero subsidy bids but suppliers and developers currently face a volley of global cost pressures that are inflating project costs.

“Bids without support, or so-called negative bids with refunding obligations for the successful bidder, could become unsustainable with increasing material costs and power market price risks,” Wawer warned.

To support Germany's wind industry, the BMWK is considering implementing new qualitative criteria such as those based on project sustainability or innovation, he said.

Any qualitative criteria established in Germany must be "in line" with other markets as fragmented rules could damage the overall competitiveness of Europe’s offshore wind industry, Wawer said.

“Special national rules and administrative barriers for manufacturers must be prevented to help manage costs and maintain the speed of [industry development],” he said.

Stefan Thimm, Managing Director, the Federal Association of Wind Farm Operators Offshore (BWO), warned competitive lease bidding could inflate final project costs and lead to higher energy costs for German consumers. Lease bids will have a greater impact on project economics than in the UK, where wind resources are higher, he argued.

"This is the wrong approach. We need cheaper energy for our industry, otherwise we’re at a competitive disadvantage,” Thimm said.

Transmission plan

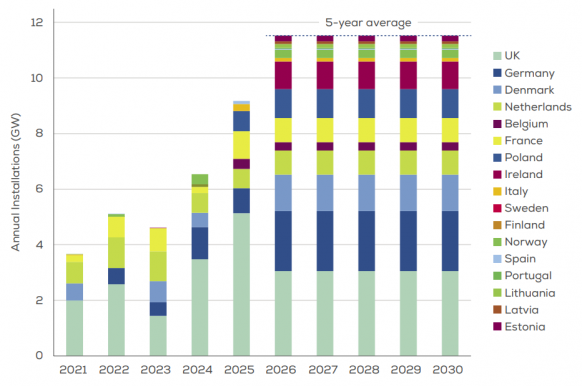

A rapid expansion of German offshore capacity will require careful spatial planning with its neighbours. In December, the German government signed a declaration with other North Sea states to develop a shared long-term vision for offshore wind power. The European Commission (EC) has set an offshore wind target of 60 GW by 2030, five times the current level.

Europe offshore wind installation forecast in 2021

(Click image to enlarge)

Source: WindEurope, February 2021

Wind turbine performance can be impacted by nearby arrays and national grid operators must cooperate to optimise distribution and minimise risks for developers.

Grid operator Tennet recently unveiled a proposal for a high voltage offshore transmission grid in the North Sea that could connect 6 GW of additional offshore wind capacity to Germany by 2032, three years ahead of current plans. Europe’s grid operators currently have plans for 20 GW of offshore transmission capacity in the North and Baltic Seas, it said.

Tennet's proposed LanWin grid hub would be located 150 kilometres off the German coast and distribute offshore wind power from several European countries.

The project would help Germany meet its carbon reduction targets and allow faster buildout of green hydrogen facilities in the north, the grid operator said.

Reporting by Ed Pearcey

Editing by Robin Sayles