Wind, solar builders adapt power contracts as market risks swirl

Bullish wholesale power prices are helping developers pass on inflation and grid risks but non-standard contracts are becoming more common to mitigate volatile markets and secure smaller offtakers.

Related Articles

After years of falling costs, wind and solar power purchase agreement (PPA) prices are rising as developers tackle inflationary pressures, supply chain constraints and grid connection delays.

European renewable energy PPA prices rose by 7.8% in the fourth quarter of 2021 to 52.5 euros/MWh ($59.5/MWh), data from LevelTen Energy PPA platform shows. Wind prices rose 8.2% to 57.0 euros/MWh while solar prices climbed 7.2% to 48.0 euros/MWh. Year-on-year, renewable energy prices hiked 17.5%.

In the U.S., renewable energy PPA prices rose 15.7% year-on-year, putting average wind prices at $38.36/MWh and solar at $34.25/MWh.

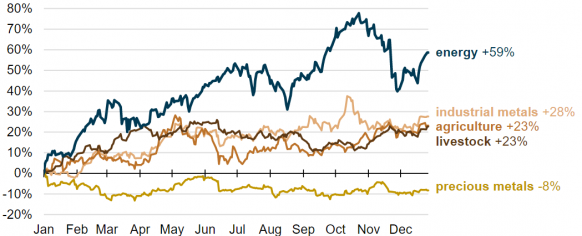

The price of steel and other commodities has soared and supply chains have struggled to keep up with surging demand following the removal of Covid restrictions. Developers in Europe and the U.S. also face delays to grid interconnections that extend project timelines and raise costs.

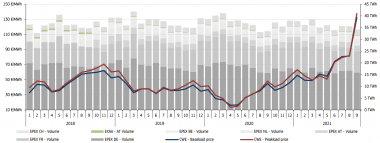

Meanwhile, wholesale power prices have soared on the back of tight gas supplies, providing room for developers to increase PPA offers.

Spot power prices in Central & Western Europe

(Click image to enlarge)

Source: European Commission's latest Quarterly Electricity Market Report

“Higher overall energy prices have helped mitigate the increases in renewable prices by preserving the hedge value of renewable PPAs," Ben Serrurier, Manager Carbon-free Electricity at clean energy analysts RMI, told Reuters Events.

The combination of inflationary pressures and volatile energy prices has increased uncertainty for PPA counterparties and hiked demand for risk mitigation measures, Serrurier said.

Many developers are now opting for non-standard PPA contracts, LevelTen said in a report last month. The most common of these are upside sharing above a set price ceiling and delayed contract start, it said.

Further PPA innovations loom as developers look to capitalise on growing demand from smaller corporate offtakers, Flemming Sorensen, Vice President, Europe at LevelTen Energy, said.

“Particularly around aggregation models and credit sleeving arrangements in the near term," he said.

Sharing the spoils

When signing PPA contracts, developers must forecast long-term underlying power prices years before project completion. Global inflation and energy price volatility have complicated this outlook. Some 75% of developers said procurement and supply chain challenges drove PPA volatility last quarter, while 53% blamed commodity prices and 46% cited grid connection delays, a LevelTen survey showed.

Renewable energy developers typically contract most of the project capacity through PPAs and sell the remainder into the wholesale market.

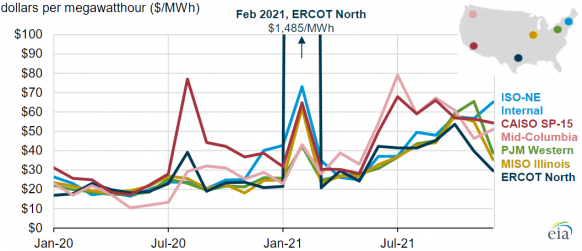

Developers will want to capitalise on current high wholesale prices but it is not clear how long prices will stay high. Offtakers will not want to be exposed to soaring short-term wholesale prices, but these prices will also influence long-term contract negotiations.

US monthly average power prices by market

(Click image to enlarge)

Source: U.S. Energy Information Administration (EIA). Data S&P Global Market Intelligence

Upside sharing PPA structures were created in the U.S. and are yet to become widely used in Europe. They allow developers and offtakers to agree on a lower fixed PPA price and share the reward of potential upside from higher wholesale prices as well as the downside from lower price levels. In a standard fixed price PPA, the offtaker assumes the whole risk and reward of being locked into a fixed price.

Upside sharing enables developers to benefit from higher wholesale settlement values which can offset lost revenues from the lower flat PPA price, Sorensen said.

It may also be a "good option for conservative offtakers that want to limit risk as much as possible, and that are willing to forgo potential profits to do so,” he said.

Later starts

By delaying PPA contract start dates, developers can mitigate against potential delays to projects due to supply chain issues, delayed procurement decisions, price volatility, or interconnection queues.

In Europe, some developers are also looking to sell power on a merchant basis while wholesale prices are so high. The offtaker may be willing to renegotiate an earlier start date if wholesale prices fall earlier than expected. If this is not the case, the developer "may be stuck selling into the volatile spot market until the original contract date is reached," warned Sorensen.

Given the current cocktail of inflationary pressures, offtakers may prefer to start the contract based on more favourable outlooks a few years out. However, the offtaker is then exposed to retail or wholesale prices during the delayed start period.

Commodity price index by industry

(Click image to enlarge)

Source: EIA. Data: S&P Dow Jones and Bloomberg. S&P Goldman Sachs Commodity Index (GSCI)

Europe's energy crisis has also hiked demand from offtakers for PPA structures that deliver annual or monthly volumes of baseload power delivered throughout the day and night, Sorensen said. This flat shape better aligns with the consumption profiles of factories and other industrial groups.

Offshore wind developers and owners of wind and solar assets are better placed to provide baseload contracts, Sorensen said.

"Offshore wind generates a profile that is close to baseload. And a combination of wind and solar is also quite complementary in trying to build a baseload PPA," he said.

Stacking buyers

As corporate demand for renewable energy widens to new markets, developers are finding ways to bring in smaller offtakers.

PPA transaction costs are a barrier for many smaller corporate offtakers and can increase for non-standard deals, Serrurier said.

The aggregation of buyers can allow these companies to enter the market, he said. "Bringing together multiple buyers to aggregate into a larger deal can diversify credit risk, lower transaction costs and provide a pathway forward for larger and smaller buys alike."

The emergence of non-standard PPAs is a natural evolution of the industry, Serrurier said.

"As buyers, sellers, brokers and their legal and financial representatives gain familiarity with these new concepts they will become standards in their own right," he said.

Reporting by Neil Ford

Editing by Robin Sayles