COMMENT: In the latest in our monthly series on the top 250 greenhouse gas emitters, Tim Nixon of Signal Analytics says investors seeking to decarbonise their portfolios need more tools than ESG rankings and vague promises from companies

News that the Net Zero Asset Managers Initiative has tripled in size since its launch in December, and now represents $32tn of assets under management - 36% of the global total - is a sign of the growing intent of the finance industry to align with global efforts to limit warming to 1.5C.

The initiative, which now boasts two of the largest asset managers among its 73 signatories, BlackRock and Vanguard, has received the UNFCCC’s seal of approval.

Not only do signatories commit to working with clients to reach net-zero by 2050 or sooner, their clients will be expected to set interim targets to cut emissions by 2030, in line with climate science.

According to a new report by the UK’s Energy and Climate Intelligence Unit, 21% of the world’s 2,000 largest public companies now have decarbonisation targets.

Yet for all the net-zero talk, few companies have committed to cutting their emissions in line with science, and fewer still have plans to do so by 2030.

Over the course of 2021, Signal Climate Analytics, in partnership with Reuters, is shining a light on what the world’s 250 biggest greenhouse gas emitters are doing in the battle against climate change in a series of articles in this magazine.

In the third of the series, looking at the top 51-75 of the largest publicly traded emitters, we have refined our methodology to include whether the companies that have set science-aligned targets have also set goals to transform their businesses over the coming decade.

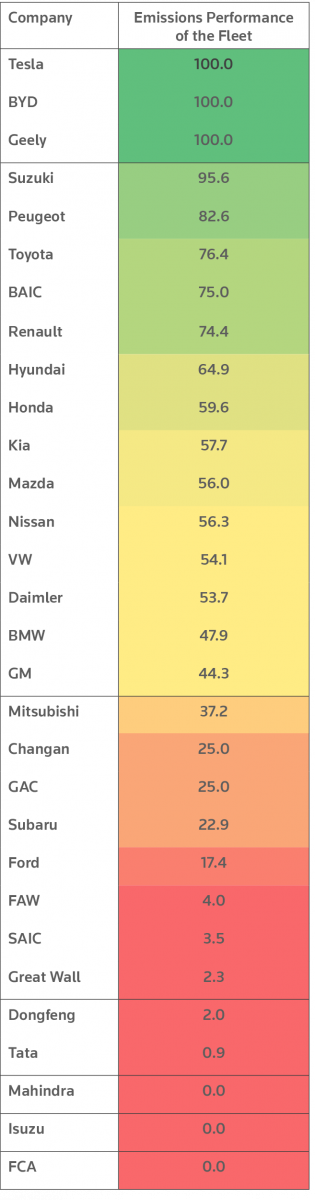

Graph: Top 51-75 emitters (including interim targets)

Of the 25 constituent companies, 11 have science-aligned targets, but only six meet the higher bar of setting interim targets for 2030.

These are Spanish oil and gas company Repsol, building materials giant HeidelbergCement, German energy company RWE, two French utilities, Engie and EDF, and the U.S. consumer goods company Walmart, which has been on CDP’s climate change A-list for the past two years.

Repsol and RWE, which is the world’s second-largest offshore wind producer, are also singled out in a new benchmark by the Climate Action 100+ group of investors, which assesses the decarbonisation performance of 167 “systematically important emitters”.

They are two of only six companies that have explicitly committed to align their future capital expenditures with long-term emissions reduction according to CA100+. The others are Total, BP, Unilever and WEC Energy Group. (See Biggest emitters ‘dangerously off track’ in race to tackle emissions).

But it’s not just about target-setting. To determine whether companies are actually walking the walk on decarbonisation, stakeholders need to also look at sector-specific industrial benchmarking data not generally available from ESG data providers.

Ford, for example, is one of the better performers on our list this month because it has set a science-aligned target. But it has a long way to go in terms of reducing the emission performance of its

sold fleet, measured by the carbon intensity of its vehicles. In the auto sector, the keystone decarbonisation metric is the measurement of the average grams of CO2 emitted for each kilometre travelled by the sold fleet. In the table overleaf, we rank 30 of the largest auto manufacturers on this metric. A score of 50 represents average performance in the sector. Ford scores a 17.4, the lowest performer of the top five global producers of automobiles, which includes VW, Toyota, GM and Honda.

Importantly, in addition to the incumbent auto manufacturers, we also include the new disrupters in our sector view. Firms like Tesla, BYD, BIAC and Geely will not be found on the target lists of many investor decarbonisation initiatives, but they play a crucial role in the transformation of the sector, perhaps more so than any stakeholder activism.

Disrupters like Tesla and BYD tend to perform very poorly on traditional measures of transparency and governance. But is this poor performance a good indicator of their importance as catalysts of sector decarbonisation? Plenty of executives at the world’s largest auto manufacturers would be happy to enjoy the market cap premium commanded by a relatively small manufacturer like Tesla, which is beginning to figure out how to scale a 100% electric fleet.

The risk of disrupters gaining scale displacing increasing numbers of relatively dirty competitors while commanding investor premiums is a crucial driver of the change we all seek. It’s a mistake to place a company like Ford ahead of Tesla when measuring climate impact and transition-readiness because Tesla doesn’t play by Ford’s disclosure rules.

But like Ford, investors and stakeholders of all types hoping to find worthy candidates for a true net-zero portfolio still have a foggy road ahead. Needless complexity and counter-intuitive rankings are still rampant. Company exaggerations and greenwashing abound.

But by combining enhanced disclosure analysis, including near-term goals, with ongoing decarbonisation analysis, it becomes more possible to achieve the climate goals to which investors in the Net Zero Asset Managers Initiative are committing.

Tim Nixon is co-founder and CEO of Signal Climate Analytics

Main picture credit: Bannafarsai_Stock/Shutterstock

Graph: Auto sector transformation

This article appeared in the March 2021 issue of The Sustainable Review: See also:

Brand Watch: WBCSD warns members it’s time to get serious as it raises climate action bar

ESG Watch: Heat turned up under banks for role in financing fossil fuels

Policy Watch: Substance on climate action in short supply despite entreaties of UN Secretary-General

Interview: Kering’s net-positive evangelist

Biggest emitters ‘dangerously off track’ in race to tackle emissions

Net Zero Asset Managers Initiative Repsol RWE Ford Walmart Tesla ESG data HeidelbergCement EDF ENGIE