Vineyard Wind calls on BOEM to resume review; UK offshore hub picked for first rare earth plant

Our pick of the latest wind power news you need to know.

Related Articles

Vineyard Wind calls on BOEM to resume approval process

Developer Vineyard Wind has called on the U.S. Bureau of Ocean Energy Management (BOEM) to resume the review of the US' first large-scale offshore wind project after concluding a switch of turbine supplier required no changes to the project plan.

The 800 MW Vineyard Wind project in Massachusetts is a joint venture of Iberdrola subsidiary Avangrid and Copenhagen Infrastructure Partners (CIP) and would be built in two 400 MW phases. Vineyard Wind expects to reach financial close in the second half of 2021 and start to deliver power in 2023.

Last month, Vineyard Wind temporarily withdrew its Construction and Operations Plan (COP) from the federal permitting process after it switched from MHI Vestas to GE Renewable Energy as preferred turbine supplier.

On January 25, Vineyard wind rescinded this withdrawal request to allow the permitting process to resume.

“We have completed our final review and determined that no changes to the COP are necessary as a consequence of selecting the GE Haliade-X Turbine for the project,” Lars Pedersen, CEO of Vineyard Wind, said in a statement.

"We expect that BOEM can finalize their review based on the extensive analysis and studies of the project over the last three years," he said.

The federal approval process for Vineyard Wind is being closely watched by the offshore wind industry.

BOEM issued an initial draft environmental impact statement (EIS) on Vineyard Wind in December 2018. Following feedback from regional stakeholders, BOEM expanded this into a Supplement to the Environmental Impact Statement (SEIS), delaying the project schedule.

The SEIS introduced previously unavailable fishing data, a new transit lane alternative, larger turbine considerations and cumulative risks from multiple offshore wind projects.

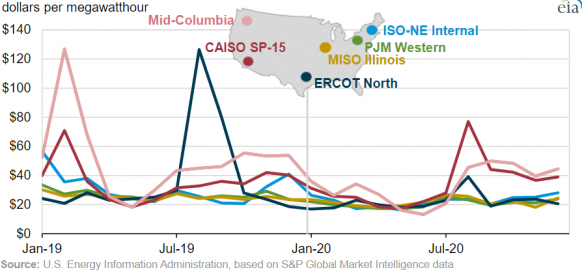

US power prices fell in 2020 as pandemic sliced demand

US electricity prices fell in most markets in 2020 as COVID-19 restrictions cut electricity demand and gas prices slumped, the Energy Information Administration (EIA) said in a note.

The largest fall was seen in the Texas ERCOT market, where average wholesale electricity prices fell by 45% year-on-year to $22/MWh. Milder summer temperatures and increasing wind capacity helped to reduce the number of price spikes, EIA said.

US monthly average wholesale power prices

(Click image to enlarge)

In California's CAISO market, prices fell by just 5% over the whole year due to a surge in prices in August as heat waves prompted supply shortages.

In the Midcontinent Independent Service Operator (MISO) and PJM markets, average wholesale prices fell by 14% and by 22%, respectively.

Rising gas prices and increasing renewable energy penetration will reduce gas consumption in the power sector in 2021 and 2022, EIA said.

The EIA predicts natural gas prices will climb above $3 per million British thermal units (MMBTu) in 2021 and 2022. Gas prices have been recovering since falling below $2/MMBTu in the first half of 2020.

Forecast monthly Henry Hub gas price

Source: EIA, January 2020

Rare earth plant for turbine magnets proposed in north-east England

Pensana Rare Earths has submitted a planning application in Hull, north-east England to build Europe's first processing facility for rare earths that are critical for offshore wind turbines, the Financial Times (FT) reported January 25.

The UK is the world's leading offshore wind market with over 10 GW of installed capacity and the government aims to hit 40 GW by 2030.

Proposed in the Saltend Chemicals Park, Pensana's $125 million facility would have a nameplate capacity of 4,500 tonnes/year and be only the second major facility outside of China to process rare earths used in magnets for wind turbine generators and electric vehicles, the company said in a presentation. China controls around 87% of the market and Australia's Lynas Corporation produces around 4,700 tonnes/year from its facility in Malaysia.

Pensana plans to source the rare earths from its Longonjo mine project in Angola, where development is expected to start in the coming months.

If approved, the new processing facility in Hull could be completed within 18 months of a final investment decision, the company said.

Hull and the surrounding Humber region is one of the UK's largest offshore wind hubs and benefits from strong local industry and port facilities. The Saltend Chemicals Park already hosts BP Petrochemicals, Ineos, Nippon Gohsei and Air Products, among other companies.

To promote industrial growth, the UK government plans to set a minimum local content requirement for offshore wind projects of 60%.

Domestic content currently represents 48% of total UK offshore wind project value on a lifetime basis, according to data published by industry association RenewableUK in 2017. This figure includes development and operations and maintenance (O&M) costs and the UK share of project capex is just 29%.

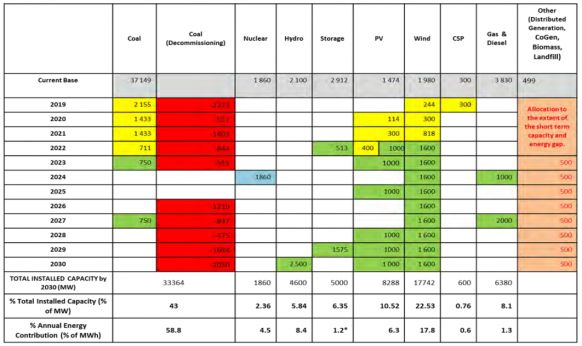

South Africa to tender for 6.8 GW of wind, solar

South Africa plans to tender for 6.8 GW of new renewable energy projects over the next year through three separate procurement rounds, Reuters reported January 25, citing a presentation by the governing African National Congress (ANC) party.

A tender for 2.6 GW of wind and solar will be held in January or February, followed by a tender for 2.6 GW in August and a third tender for 1.6 GW in January or February 2022, according to the presentation made at a three-day meeting of party officials.

A separate procurement round for 500 MW of energy storage would be held around September, followed by tenders for 1.5 GW of coal and 3 GW of gas-fired capacity, it said.

The renewable energy capacity announced by the ANC is in line government's plans to build around 14.4 GW of new wind capacity and 6 GW of solar by 2030, as set out in its latest Integrated Resource Plan (IRP) in 2019.

South Africa Integrated Resource Plan 2019

(Click image to enlarge)

Source: Department of Mineral Resources and Energy

An earlier draft IRP had set out a three-year gap before the deployment of new wind and solar plants in 2025, but the government filled this gap with a more steady deployment in the 2019 IRP after objections from industry stakeholders.

The proposed three-year gap in procurement would have damaged the development of local industry, Kilian Hagemann, Managing Director of G7 Renewable Energies, told the Reuters Events Africa New Energy 2018 conference.

A delay to wind projects since the previous procurement round in 2014 forced the mothballing of DCS group’s Coega wind tower manufacturing facility in 2016, Hagemann noted.

"These stops in procurement are toxic for the very thing that government wants to create-- that is jobs, local content," he said.

A procurement gap would have also lead to higher costs for future wind projects, James Cumming, Principal, African Clean Energy Developments, said at the conference.

"We hinder efficient local content delivery, skills retention, a highly competitive market...we will see developers and IPPs [independent power producers] focus elsewhere," Cumming said.

"At the end of the day, you are undermining the idea of a least-cost path," he said.

Reuters Events