Europe targets 120 GW offshore wind by 2030; US wind pledges create thousands of jobs

The wind power news you need to know.

Related Articles

Europe aims to install 120 GW of offshore wind in northern seas by 2030

European leaders pledged on April 24 to install 120 GW of offshore wind capacity in northern sea areas by 2030, more than quadruple current capacity, to reduce their reliance on Russian gas and accelerate emissions cuts.

Leaders from seven European Union countries including Germany, France and the Netherlands, alongside non-EU countries UK and Norway, pledged to speed up offshore wind deployment, develop energy islands and deploy carbon capture and green hydrogen projects. By 2050, the countries will aim to install 300 GW offshore wind in the North Sea and other northern areas such as the Irish Sea, the leaders said in their declaration.

"Because of Russia's brutal war on Ukraine, it has made it absolutely clear that we need to produce more energy ourselves," said Danish Prime Minister Mette Frederiksen.

The UK has already set a target of 50 GW of offshore wind by 2030 and Germany is looking to install 30 GW after hiking its national renewable energy target to 80% of power by 2030.

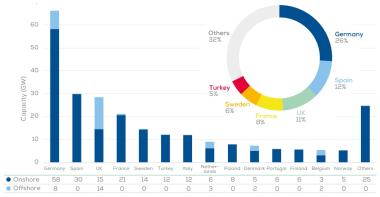

Installed wind capacity in Europe at end of 2022

(Click image to enlarge)

Source: WindEurope

The nine countries also pledged to work together to protect offshore energy infrastructure against security threats.

"This declaration is also a great chance to really get security into the design of all new wind farms and infrastructure," said Dutch energy minister Rob Jetten.

French President Emmanuel Macron said the buildout of offshore wind must be driven by European manufacturers.

"This is a very important opportunity in terms of sovereignty and resilience," Macron told a news conference.

Offshore wind suppliers will require more policy support from European governments to meet the objectives, renewable energy companies warned in a joint declaration.

Currently, Europe's industry can only manufacture 7 GW of offshore wind capacity per year, more than 100 companies and industry groups said in their joint statement.

"Our industry is not large enough today to deliver the nine governments' commitments," the companies said.

To encourage investment, the EU has pledged to provide funding to companies that matches the level offered in the U.S. under President Biden's Inflation Reduction Act.

The UK government is yet to respond with equivalent incentives and currently lacks a clear green economic growth plan, industry officials have warned.

US wind factory pledges create thousands of jobs

Wind power suppliers have announced at least 11 new manufacturing facilities or factory expansions since President Biden's Inflation Reduction Act was signed into law in August 2022, creating several thousand jobs in the next few years, the American Clean Power (ACP) association said in a report on April 17.

The inflation act sets out $369 billion of subsidies for the green economy and includes tax credits for renewable energy manufacturers and developers. Wind and solar growth must accelerate rapidly to meet the President's target of a zero carbon power sector by 2035.

Clean technology companies announced $150 billion of capital investments between August 2022 and March 2023, including suppliers and developers, ACP said.

Wind suppliers committed to expand manufacturing capacity for turbines, blades, nacelles, gearboxes and towers, across several states.

Korean group CS wind and U.S. company Arcosa announced plans to expand tower manufacturing capacity in Colorado and New Mexico respectively, creating over 1,000 jobs, ACP said.

Other commitments include Siemens Gamesa's plan for a major offshore wind nacelle manufacturing facility in New York and a pledge by GE subsidiary LM Wind Power to build an offshore wind blade manufacturing facility, both of which depend on upcoming project tenders.

Other announcements include a pledge by German gearbox manufacturer Flender to expand its factory in Illinois and a plan by American group Nucor Steel to ramp up production at a new facility in Kentucky to meet growing demand from the offshore wind industry.

ACP also listed 26 new factory commitments from solar manufacturers as well as 10 from energy storage suppliers.

US grid connection requests jump on surging solar, storage

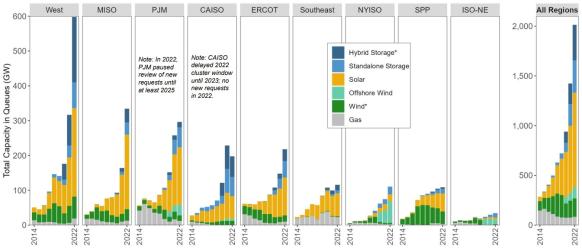

U.S. annual grid connection applications hiked by 40% in 2022 to over 700 GW as demand for solar and storage projects soared, the Lawrence Berkeley National Laboratory (Berkeley Lab) said in its latest annual grid connection report.

Most new solar applications include energy storage and combined they accounted for over 80% of new capacity entering grid queues in 2022, the data from Berkeley Lab shows.

Over 2,000 GW of projects were seeking grid connection at the end of last year, including 950 GW of solar, 680 GW of battery storage, and 300 GW of wind capacity, Berkeley Lab said. This included 110 GW of East Coast offshore wind projects, representing 38% of all wind capacity in the queues, it said.

Power capacity in U.S. grid connection queues

(Click image to enlarge)

Source: Berkeley Lab, April 2023

The U.S. must rapidly expand its power grid to achieve President Biden's target of a decarbonised power sector by 2035 and the soaring number of new applications comes despite growing delays to approvals as grid operators struggle to keep up with demand.

The average time from connection request to plant operations rose to around five years in 2022, Berkeley Lab said.

Total applications surged despite two key markets not accepting new requests as they processed the backlog. California's Operator CAISO did not accept any requests in 2022 while PJM, operator of the largest network, paused new reviews until at least 2025.

The biggest increase in requests was seen in the West region outside of CAISO's network, Berkeley Lab said.

Much of the capacity will not be built, and an increasing number of developers are withdrawing their applications at a later stage, which can disrupt other projects going through the process, it said.

Applications are likely to increase further as developers take advantage of tax credits in the Biden administration's Inflation Reduction Act, increasing the pressure on approval authorities.

“The large backlogs, increasing wait times, and high withdrawal rates in the queues suggest growing interconnection and transmission challenges and highlight the need to improve institutional processes,” Julie Kemp, a research scientist at Berkeley Lab, said.

Reuters Events