UK wind, solar builders seek urgent response to U.S., EU aid

UK developers want tax allowances and subsidy contracts that will compete with the U.S. and EU and mitigate inflation, fearing key sectors such as offshore wind could lose investors.

Related Articles

Last month, five energy trade groups warned the UK lacks a "clear government plan to deliver green economic growth” and risks losing investments following new support measures implemented in the U.S. and the European Union.

In a letter to government, RenewableUK, Energy UK, Scottish Renewables and Solar Energy UK and the Nuclear Industry Association, called for the introduction of an investment allowance in the new Electricity Generators Levy, imposed by the government to limit excessive power revenues in 2023-2028, as well as a greater capital tax allowance.

The UK should also adapt renewable energy subsidy regimes to help mitigate against rising costs, developer Vattenfall told Reuters Events. Vattenfall has been a key player in offshore wind, the U.K.'s largest renewable energy sector, and also develops onshore projects.

The call to government comes as UK Chancellor Jeremy Hunt prepares the UK Spring Budget for March 15 and power authorities prepare to allocate renewable energy contracts in a fifth licensing round.

Companies fear $369 billion of green subsidies in President Biden’s Inflation Reduction Act and a looming EU support package will widen the competitive gap and lure investors away from the UK. The U.S. inflation act includes tax credits for renewable energy manufacturing and deployment while the EU's Green Deal Industrial Plan temporarily relaxes state aid rules and simplifies regulation, allowing member states to support their own supply chains.

The UK government is yet to respond with its own support measures but told Reuters Events it was concerned the U.S. measures could fragment supply chains and "risk weakening our shared economic, security and net zero objectives."

Developers and suppliers have been squeezed by inflationary pressures from the energy crisis and supply chain issues following the pandemic, so they want more help to support margins.

The U.S. inflation act “will divert investment away from the UK” as there is no clear UK green economic growth plan, Andrew MacNish Porter, Policy Manager for Economics & Markets at industry association Scottish Renewables, told Reuters Events.

“Many clean energy projects are already delaying final investment decisions because of the green subsidies being introduced in the U.S.”, he said.

Offshore battle

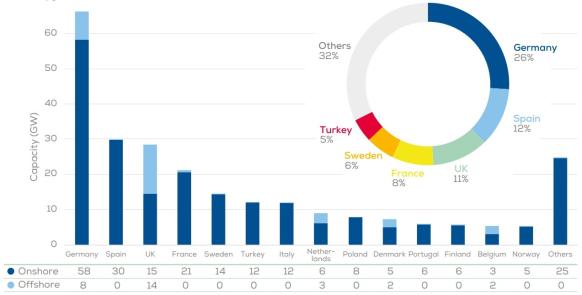

The UK has soared ahead on offshore wind deployment but a lack of incentives could disrupt supply chains, delay projects and prevent it from reaching its net zero targets. The government aims to quadruple offshore wind capacity to 50 GW by 2030 and reach net zero power generation by 2035.

Installed wind capacity in Europe by country

(Click image to enlarge)

Source: WindEurope, February 2023

The U.S. is currently building its first large-scale offshore wind farm and aims to install 30 GW by 2030. Local content requirements in the inflation act, combined with U.S. state wind auctions, are set to stimulate "entirely new offshore wind supply chains in the U.S," Andy Strowbridge, Associate Director at consultants BVG Associates, told Reuters Events.

"This combination of demand and supply has raised the fear that resources and investment will be floored in other markets,” he noted.

Meanwhile, EU countries are ramping up offshore wind activity and the EU's Green Deal plan temporarily relaxes state aid rules allowing member states to subsidise supply chains.

Some EU members have warned against subsidy battles between EU countries and companies have argued that a fragmented approach could disrupt Europe-wide expansion plans.

Supply chain investors will also be wary of policy reversals by subsequent governments.

“Investments in manufacturing plans are long term decisions. There is an often febrile political atmosphere for any ‘green’ initiatives, especially in the U.S.,” Strowbridge said.

Pricing risks

UK offshore wind mechanisms must reflect the new reality of rising costs, Vattenfall told Reuters Events. Ongoing inflationary pressures follow a decade of intense competition that drove down prices and narrowed the margins of suppliers and developers.

Vattenfall was awarded contracts for difference (CFDs) for its Norfolk Offshore Wind Zone in the fourth licensing round in July 2022 and is concerned about UK regulation on renewable energy pricing.

The UK will open its fifth licensing round this month and the government “needs to provide a framework that delivers value for money for customers while being financially sustainable for developers," a Vattenfall spokesperson said.

Developers need "a fair and investable administrative strike price" to give them confidence that they can secure "commercially viable" CFDs for consented projects, the spokesperson said.

Faster projects

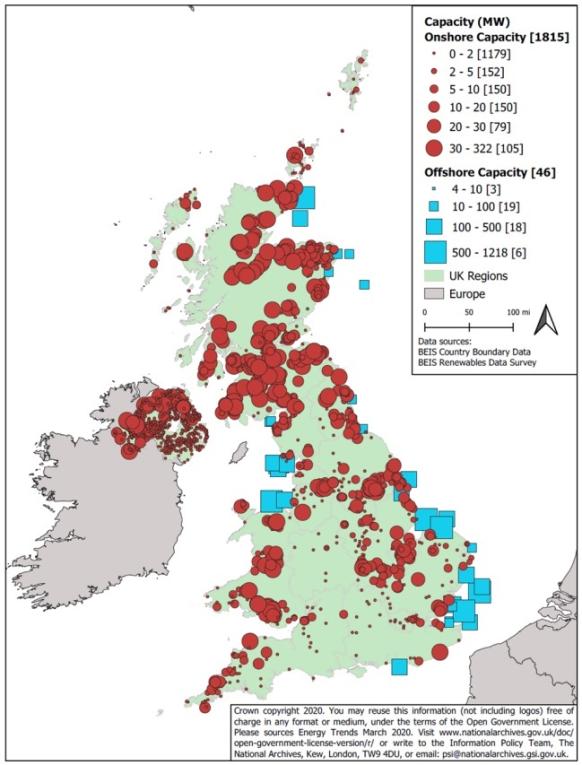

Wider UK market reforms are also required to speed up development, Matthieu Hue, CEO of EDF Renewables UK & Ireland, told Reuters Events.

UK onshore, offshore wind capacity in 2020

(Click image to enlarge)

Source: UK Department for Business, Energy and Industrial Strategy (BEIS)

Changes to Scotland's planning framework set out in November show positive progress and the UK government should heed recommendations in the UK Net Zero Review published in January, Hue said.

The Net Zero Review recommends the creation of a national net zero fund for renewable energy investments and reforms to planning and grid connection to shorten project timelines.

Existing UK renewable energy policies are not sufficient to keep the country competitive, Hue said.

“A strong response is needed to policy abroad," he said, noting that "investors are attracted by subsidies and certainty."

Reporting by Neil Ford

Editing by Robin Sayles