US needs vessels, faster permits to hit offshore wind targets

The U.S. must step up investments in supply chain and port infrastructure to meet national offshore wind targets as global demand soars, industry experts said.

Related Articles

A recent report by U.S. researchers highlighted the efforts needed to meet President Biden's target of 30 GW of offshore wind by 2030.

Around 2,100 turbines and foundations, 6,800 miles of cable, 58 crew transfer vessels and four to six turbine installation vessels are required to meet the target, the National Renewable Energy Laboratory (NREL) said.

The first U.S. projects will source components from European suppliers but international manufacturers will not have sufficient capacity to supply all of the components needed, the report concluded. Global offshore wind demand is set to rocket as the UK and the European Union aim to install over 100 GW by 2030.

The Biden administration's 2022 Inflation Reduction Act will accelerate investments in U.S. manufacturing by making domestic components more competitive, but supply chain investments must be made soon to achieve the 30 GW goal, Matt Shields, Senior Offshore Wind Analyst at NREL, told Reuters Events.

A lack of U.S. wind turbine installation vessels remains a significant risk for developers and the permitting of new port and manufacturing facilities must be accelerated to avoid delaying projects, industry experts said.

Missing vessels

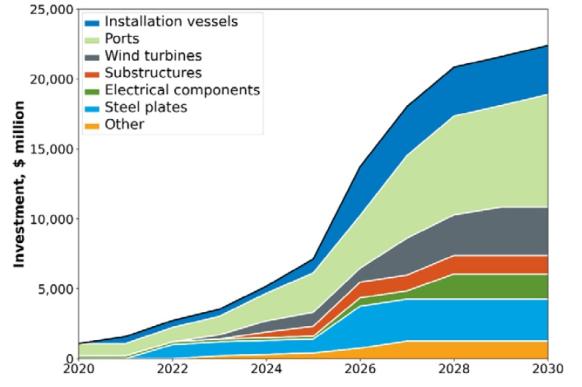

A U.S. supply chain that can supply 4 to 6 GW of projects per year would require investment of at least $22 billion in ports, large installation vessels and manufacturing facilities alone, NREL said.

The first major manufacturing facilities include the country’s first monopile production mill by EEW Group at the Paulsboro Marine Terminal in New Jersey and the first U.S. offshore wind turbine blade factory, pledged by Siemens Gamesa in Virginia.

Investments needed to build a U.S. offshore wind supply chain

(Click image to enlarge)

Source: NREL's Offshore wind Supply Chain Road Map, January 2023.

A shortage of U.S. turbine installation vessels could be the biggest risk to deployment, Shields said. The construction of U.S. vessels is lagging far behind offshore deployment plans as investors wait for a clear and consistent pipeline of projects.

Dominion Energy's order for the new 472-foot Charybdis vessel remains the only firm commitment for a U.S.-built WTIV and up to five more vessels will be required to meet the President's targets, exposing early projects to international vessel markets.

To encourage U.S. vessel construction, the federal government could introduce a backstop mechanism that provides support during contracting gaps, Fred Zalcman, Director of New York Offshore Wind Alliance, told Reuters Events.

This would “help vessel owners meet their debt obligation in the event of project delay or gaps in demand for their services," he said.

New offshore wind regulations set out by the Biden administration in January should provide more clarity on timelines. The new rules streamline survey requirements and the government also plans to release five-year leasing roadmaps.

Support gaps

The inflation act is a major boost for offshore wind developers, offering a 30% tax credit for offshore wind projects that start construction before 2026 and bonus credits for domestic content.

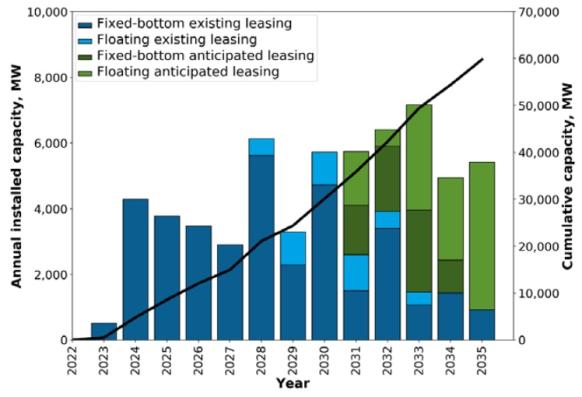

Forecast U.S. offshore wind installations

(Click image to enlarge)

Source: Department of Energy report on U.S. offshore wind supply chain, June 2022

NREL warned however that some components will require significant efforts to supply domestically, including steel plates to be rolled into monopiles or towers, mooring chains and electrical systems for offshore substations.

In addition, the domestic content credits offered in the inflation act do not apply to cables, which can represent around 9% of project costs, based on figures from UK offshore wind research centre ORE Catapult.

Another issue is that the incentives do not apply to manufacturers wishing to diversify from other sectors, such as oil and gas and shipbuilding, Shields noted.

Oil and gas firms can offer equipment manufacturing and vessel supply networks, gained from decades of experience in working in U.S. waters.

State support

The expansion of U.S. ports is critical for the siting of coastal offshore wind manufacturing facilities and assembly zones. Coastal states are driving early investments through domestic content incentives in state procurement plans.

For example, New York state has a target of 9 GW of offshore wind by 2035 and developers are required to make in-state supply chain commitments.

New York has pledged to spend $700 million on regional supply chain development and has already allocated $200 million towards a new offshore wind staging facility and operations and maintenance (O&M) hub at the South Brooklyn Marine Terminal, plus wider manufacturing initiatives.

The remaining $500 million will support new local manufacturing facilities in support of its third offshore wind tender which closed last month, a spokesperson for the New York State Energy Research and Development Authority (NYSERDA) told Reuters Events.

The aim is to "attract and catalyze additional private funding from supply chain partners, port operators and offshore wind developers,” the spokesperson said.

To attract investors, stakeholders will need to minimise the risk of permitting delays that can derail projects. The streamlining of offshore wind regulations will help clarify timelines but manufacturers will also need swift permit approvals.

“State and federal agencies should continue to focus on accelerating the permitting timelines," the NYSERDA spokesperson said.

Reporting by Neil Ford

Editing by Robin Sayles