UK Celtic Sea surveys set to quicken floating wind at scale

Early access to survey data will reduce project risks and help developers shape their large arrays as they battle for seabed rights this year.

Related Articles

The UK Crown Estate's decision to invest in offshore wind surveys in the Celtic Sea is set to help the UK floating wind sector make the important step up to commercial arrays.

In December, the Crown Estate issued contracts for the first metocean surveys off the southwest coast of England and Wales. Work on them will begin this spring, with some datasets made available to participants ahead of seabed lease auctions scheduled for mid-2023.

The leases will accommodate large floating wind arrays of several hundred megawatts capacity, allowing developers to apply economies of scale to pilot project learnings. ACS Group’s 50 MW Kincardine array in Scotland is currently the largest floating windfarm in operation.

The provision of survey data in the Celtic Sea will cut the cost of bidding into the lease auctions and reduce the number of additional surveys required later in the development process, shortening project timelines and reducing costs.

Recent UK lease auctions have shown how intense competition in the offshore wind market is driving up bid prices. Oil groups Equinor and Total are among a number of companies developing Celtic Sea sites.

The UK is looking to install 4 GW of floating wind in the Celtic Sea by 2035, but last year Scotland expanded the leases available in its Scotwind auction and capped prices after being inundated with bids. The auction allocated 25 GW of leases, including 15 GW of floating wind projects, far more than the 10 GW initially targeted.

The significant interest in Celtic Sea development means “we can expect some large sums to be bid for these sites," Nicola Simpson, Technical Director for the Marine Consenting and Environment team at consultants RPS, told Reuters Events.

Bespoke bids

The full survey programme will analyse seabed geophysical and geotechnical properties, including wind, wave and current patterns, as well as marine wildlife.

UK Celtic Sea: Refined search areas for offshore wind

(Click image to enlarge)

The surveys should help developers refine the layouts of arrays and anchor designs, key factors in the scaling up of floating wind projects, Tom Hill, program manager at Marine Energy Wales and chair of the Celtic Sea Developer Alliance, said.

The Crown Estate “has taken a very open, collaborative approach” towards engaging with prospective developers and stakeholders, he said.

Developers will need to demonstrate that they have the financial and technical capability to deliver projects at scale, a spokesperson for The Crown Estate said.

Early access to the data will offer “substantial” cost savings for developers, avoiding the need to recruit internal survey teams, Simpson said.

Developers will be two to three years ahead of where they would have been in metocean and foundation understanding, while access to key bird and mammal data will reduce consenting risks, she said.

In a further boost for developers, The Crown Estate will run the Habitats Regulation Assessment (HRA) process before the auction, Simpson noted. By comparison, the HRA for leases issued in Round 4 auctions in early 2021 was only completed recently, finally allowing the seabed rights to be awarded in January.

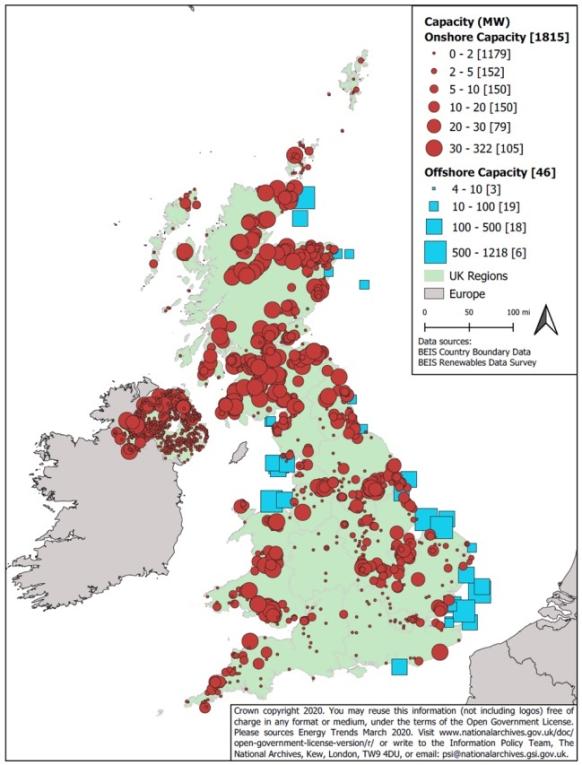

UK onshore, offshore wind capacity in 2020

(Click image to enlarge)

Source: UK Department for Business, Energy and Industrial Strategy (BEIS)

In workshops, developers requested further information in the surveys on potential export cable routes, in line with plans for grid expansions under the U.K.'s Holistic Network Design (HND) 2 review. Led by National Grid ESO, the HND 2 review is due for completion later this year.

Urgent spending

Investments in local authorities, power grids and supply infrastructure will be required to ensure Celtic Sea projects are delivered on schedule. Across the UK, local authorities are under-resourced to handle the surge in renewable energy applications expected in the coming years.

Consenting is a major hurdle in Wales as the consenting authority, Natural Resources Wales, “is not currently adequately resourced to handle the volume of applications expected in the coming months," said Hill.

In addition, grid capacity in Wales needs major investment or “there is a danger developers will choose to go elsewhere”, he said. Proposed grid reinforcements will be set out in the HND 2 review.

An estimated 1 billion pounds ($1.2 billion) of investments in port infrastructure will also be required to assemble and launch floating wind turbines, according to Marine Energy Wales

No single port in Wales has sufficient water depth, quayside access, assembly and lay-down space, Hill said. Many developers support a multi-port network as sites such as Port Talbot in South Wales are more suitable for construction and assembly, while others, such as the Port of Milford Haven, are more suitable for operations and maintenance (O&M). The ports will likely need to be within 200-250 nautical miles of project sites, according to the Crown Estate.

For the first time, developers will be required to make early commitments to infrastructure. Project partners must provide an investment plan in their lease bids that supports "an internationally competitive supply chain," the Crown Estate spokesperson said.

This will determine whether participants can proceed to the final stage of the tender, the spokesperson said.

Reporting by Neil Ford

Editing by Robin Sayles