Winter storm cuts power in Texas; Total accelerates US solar push

Our pick of the latest solar news you need to know.

Related Articles

Millions of Texans without power after cold snap cuts supplies

Over 5 million US customers were without power February 16 - including over 4 million in Texas - after a freak winter storm sliced generating capacity and drove up power demand.

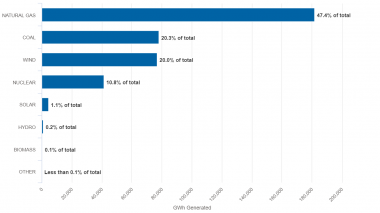

By February 15, some 34 GW of power generation was offline in Texas - around 40% of expected capacity - as prolonged cold weather cut wind, gas, coal and nuclear generation.

Coordinated blackouts were implemented and customers were urged to limit power usage to prevent system-wide outages. Day-ahead power prices in the ERCOT North hub hit a record high of $8,800/MWh on February 16. Some spot power prices had risen above $10,000/MWh, the grid operator said. Summer heat waves frequently drive up power prices in Texas but winter price spikes are less common.

Texas is the fastest-growing solar market and will reach 10 GW of capacity by the end of 2021. Extreme weather events are becoming more common, hiking solar insurance costs.

Texas power generation by fuel (2019)

(Click image to enlarge)

Source: ERCOT

The neighbouring Southwest Power Pool (SPP) declared a level 3 emergency for its entire 14-state network on February 16 and warned of controlled power cuts. Generating capacity had dropped below loads due to low temperatures and cuts to gas supplies, SPP said.

"Individuals in the SPP service territory should take steps to conserve energy use and follow their local utilities’ instructions regarding conservation, local conditions and the potential for outages to their homes and businesses," it said.

Total buys another 2.2 GW of solar projects in Texas

Oil group Total has acquired 2.2 GW of solar projects and 600 MW of storage in Texas, from developer SunChase Power and investment firm MAP RE/ES, Total announced February 5.

The deal follows Total's entrance into US utility-scale solar last month through a joint venture with Hanwha subsidiary 174 Power Global. Total and 174 Power will develop 1.6 GW of solar and storage capacity in Texas, Nevada, Oregon, Wyoming and Virginia, they said.

Total will use 1 GW of the solar capacity to supply its entire US industrial operations, including its refining and petrochemicals activities in Port Arthur and La Porte, Texas and its petrochemicals site in Carville, Louisiana, it said.

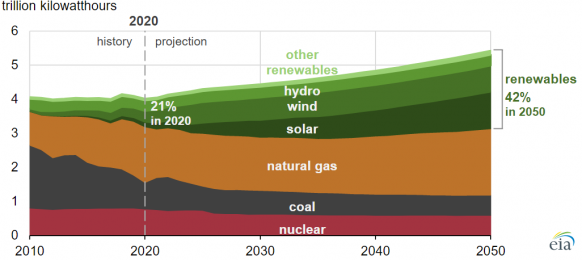

Forecast US power generation by source

(Click image to enlarge)

Source: Energy Information Administration (EIA), February 2021

Globally, Total has 7 GW of contracted renewable energy capacity and aims to increase this to 35 GW by 2025. The group has committed to reach net zero carbon emissions by 2050.

In January, Total acquired a 20% stake in India's Adani Green Energy Limited (AGEL) from industrial conglomerate Adani Group for $2.5 billion. The acquisition represented Total's largest investment yet in renewable energy.

AGEL has 14.6 GW of renewable energy under contract and aims to reach 25 GW by 2025. The group currently has 3 GW of projects under construction and 8.6 GW under development.

Renewables will account for around 20% of Total's net investments in 2021, the company said in financial results published February 9. The group plans to invest between $13 billion and $16 billion annually in 2022-2025.

Shell to invest up to $3 billion/year in clean power

Oil group Shell plans to invest $2 to $3 billion per year in renewables and energy solutions in the coming years and has tightened its 2050 net zero carbon target to include third-party products marketed by the group.

In the "near-term," Shell will spend up to $6 billion annually on marketing, renewables and energy solutions, $9 billion on "transition" fuels such as integrated gas, chemicals and refining, and $8 billion on oil and gas, the company said in a strategy update February 11.

Shell failed to set out any targets for renewable energy capacity. The group has been gradually ramping up investments in offshore wind power but has invested relatively low amounts in onshore wind and solar.

Shell has identified downstream green power services as a key growth area as it shifts away from fossil fuels. By 2030, Shell aims to double power sales to 560 TWh/year, serving more than 15 million retail and business customers, it said.

Consortium targets 95 GW solar-to-hydrogen by 2030

A group of 30 energy companies in Europe has launched a project to install 95 GW of solar and 67 GW of electrolysis capacity for green hydrogen by 2030.

The "HyDeal Ambition" initiative aims to achieve cost-competitive green hydrogen at 1.5 euros/kg by 2030 and will start with 10 GW of solar-to-hydrogen projects in Spain this year, the partners said.

Around 96% of Europe's hydrogen supply is produced from natural gas, generating up to 100 million tonnes of carbon emissions per year. Electrolysers use electricity to split water into hydrogen and oxygen, avoiding carbon emissions, but costs must fall to compete with gas-based methods.

The HyDeal objectives exceed green hydrogen targets set out by the European Commission (EC) last year. The EC published a plan to build 6 GW of electrolysis capacity by 2024, rising to 40 GW by 2030. The largest electrolyser installed in Europe to date has a capacity of 10 MW, but a growing number of energy companies are investing in larger projects.

The HyDeal plan sets outs a "complete industrial ecosystem spanning the whole green hydrogen value chain (upstream, midstream, downstream, finance)" and follows two years of research, feasibility studies and contract preparations, the partners said.

Under the plan, green hydrogen would be supplied to energy, industry and transport sectors via gas transmission and storage infrastructure. The first deliveries would be to Spain and south-west France, followed by extensions towards the east of France and Germany.

Members of the consortium include solar developers DH2/Dhamma Energy, Falck Renewables and Qair, electrolyser supplier McPhy Energy, gas grid operators in Spain, France, Germany and Italy, and infrastructure funds.

Reuters Events