Texas solar owners face price risks after building boom

Texas solar developers are building huge plants to drive down costs but price risks loom in a hotly-contested and volatile power market.

Related Articles

As US solar construction surges, Texas is racing ahead. Some 28% of US solar plant installations in 2021 will be in Texas, hiking solar capacity in the state to 10 GW, the US Energy Information Administration (EIA) said last month.

Developers are using Texas' vast land areas to build giant projects at lower cost.

Larger solar arrays offer lower per-unit construction costs and operations and maintenance (O&M) efficiencies, Stephen Pike, Senior Vice President, Project Execution Leader at Enel Green Power North America, told Reuters Events. Enel recently completed its 497 MW Roadrunner solar plant on a 2,770-acre site in Upton County, West Texas.

Economies of scale can be found in "facilities, personnel, transmission, construction contracts and generating equipment," Pike noted.

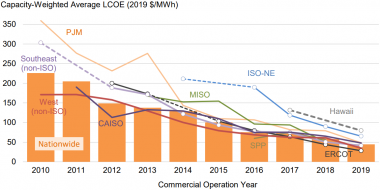

Levelised cost of US utility-scale PV by market

(Click image to enlarge)

ERCOT=Texas

Source: Berkeley Lab, November 2020

Invenergy is currently building the largest solar plant in the US across three counties in north-east Texas. The 1.3 GW Samson Solar plant will cost $1.6 billion and be built in five phases by 2023.

While size brings savings, the building boom in Texas has brought some skills shortages and could increase price risks in Texas' deregulated power market going forward. Blackouts and price spikes during this week's winter storm highlight the sensitivity of Texas' wholesale market and as solar and wind capacity grows, operators will need to mitigate the impact on long-term prices.

Summer payoff

Developers of large solar projects typically secure long-term power purchase agreements (PPAs) for part of the capacity and sell the remainder on the wholesale market.

Growing demand from smaller offtakers has shortened the tenor of PPAs and offtakers are looking to place more risk on the operator.

PPA contract tenors are now typically around 10 years, Manan Ahuja, Manager, North America Power Analytics at S&P Global Platts, told Reuters Events. Solar projects are now expected to operate for over 30 years, leaving much of the plant's offtake exposed to price swings.

In the Texas ERCOT market, liquidity on the power forward curve is low, "which makes it challenging to hedge exposure," Ahuja said.

Wholesale power prices in Texas rise sharply during the summer, when hot weather drives up demand from cooling appliances. However, increasing renewable energy capacity softens these price spikes, as shown in California and Europe.

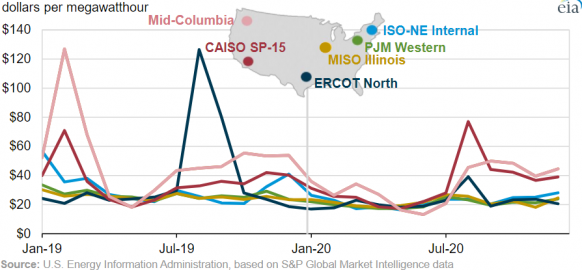

Average wholesale prices in the ERCOT market fell by 45% last year to $22/MWh, EIA said last month. COVID-19 lockdowns and milder summer temperatures depressed demand, but rising wind capacity also reduced summer price spikes, EIA noted. Texas wind capacity rose by 4.2 GW in 2020 to 33.1 GW, according to industry group American Clean Power.

US monthly average wholesale power prices

(Click image to enlarge)

PPA contracts are competitively bid and offer credit-worthy offtakers. Despite the risks, average spot power prices in Texas remain "significantly above [PPA] contract prices and are forecast to stay that way for the long term,” Kevin Christy Chief Operating Officer, North America Lightsource BP, told Reuters Events.

Last month, BP closed the financing of its 163 MW Elm Branch and 153 MW Briar Creek solar projects in Texas, securing PPAs with L3Harris Technologies and Allianz.

Platts Analytics predicts excess solar capacity will become a more significant issue in the wider Texas market towards the end of the decade, when solar capacity reaches 20 GW and curtailments are possible, Ahuja said. High solar penetration in other markets has increased the demand for energy storage and many solar developers are now coupling plants with batteries.

Another key long-term risk driver for operators will be state-wide electricity demand and the impact of electric cars and energy efficiency programs.

Skills squeeze

The rapid deployment of solar on Texas's vast land area presents challenges for construction groups and maintenance teams.

The availability of skilled construction workers can be an issue, Scott Canada, Senior Vice President of Renewable Energy & Storage at McCarthy, a major construction group, said.

"It is usually more difficult to fill the roles of pile drivers, surveyors, and electricians," he said.

McCarthy’s current contracts in Texas include BP's Elm Branch and Briar Creek projects.

"By focusing our training on efficiency, quality and safety, we’ve established best practices that are replicated on each project," Canada said.

Large distances between power plants, O&M facilities and distribution hubs can also create skills shortages in the operations phase, Trent Mostaert, Vice President, General Manager at construction group Solar Mortenson, told Reuters Events.

Mostaert noted "some competition for talent" in inverter and substation maintenance, among other areas.

Outage risks

Downtime of solar equipment is a "heightened concern" in ERCOT, Christy said. Settlement periods are more frequent than in many other markets and Texas solar operators also face greater risks from extreme weather. Operators may also be obliged to cover curtailments.

"We see offtake contracts not making allowance for forced outages or curtailment, coupled with high thresholds of energy guarantees,” Christy said.

To mitigate this risk, Lightsource BP is developing a spares program that reduces lead times for equipment with low probability of failure but high impact, such as expensive high voltage equipment, he said.

For these risks, larger solar operators are better positioned as they can implement fleet monitoring and data analytics and pool supplies of higher cost spares.

Reporting by Neil Ford

Editing by Robin Sayles