Total, Naturgy enter US solar market; Total buys into India's Adani Green for $2.5 billion

Our pick of the latest solar news you need to know.

Related Articles

Total enters US utility-scale solar market

Oil group Total has formed a joint venture with Hanwha subsidiary 174 Power Global to develop 1.6 GW of US solar and storage capacity, Total announced January 14.

The deal marks Total's entrance into US utility-scale solar development and forms part of its pledge to increase its global renewable energy capacity to 35 GW by 2025, up from a current level of around 7 GW.

The 50/50 partnership with 174 Power Global covers 12 utility-scale solar and storage projects in Texas, Nevada, Oregon, Wyoming and Virginia that are due online in 2020-2024.

"I am confident that this will pave the way to more opportunities in the US renewables and storage market,” Julien Pouget, renewables director at Total, said.

Total buys 20% stake in India's Adani Green Energy

Oil group Total is to acquire a 20% stake in India's Adani Green Energy Limited (AGEL) from industrial conglomerate Adani Group for $2.5 billion, the companies announced January 18.

The acquisition represents Total's largest investment yet in renewable energy. In February 2020, Total acquired a 50% stake in AGEL's solar business which included 2.4 GW of operational solar assets. Total had already partnered with Adani in the gas sector, acquiring joint control of utility Adani Gas in 2019.

AGEL has 14.6 GW of renewable energy under contract and aims to reach 25 GW by 2025. The group currently has 3 GW of projects under construction and 8.6 GW under development. In June 2020, India awarded AGEL 8 GW of new solar projects that will come online over the next five years.

Total had around 7 GW of contracted renewable energy capacity at the end of 2020 and aims to hit 35 GW by 2025.

India had 81 GW of renewable energy online in 2019 and Prime Minister Narendra Modi wants to reach 175 GW by 2022 and 450 GW by 2030.

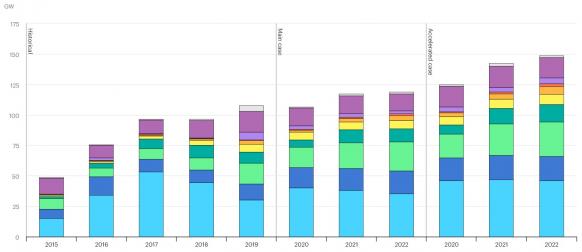

Global PV installation forecast

(Click image to enlarge)

Source: International Energy Agency (IEA), November 2020

"Given the size of the market, India is the right place to put into action our energy transition strategy based on two pillars: renewables and natural gas," Patrick Pouyanne, Chairman and CEO of Total, said.

Spanish energy group Naturgy enters US solar market

Spanish power and gas group Naturgy has entered the US market through the acquisition of Hamel Renewables and aims to install 1.9 GW of solar power by 2025, the company announced January 15.

Formerly named Gas Natural Fenosa, Naturgy is the largest integrated power and gas group in Spain and a major energy supplier in Latin America. The group will invest $1.8 billion in the US over the next five years and will acquire Hamel's portfolio of 8 GW of solar projects and 4.6 GW of energy storage projects spanning nine US states.

Some 3.2 GW of these solar projects and 2 GW of storage could be operational before 2026, Naturgy noted.

As part of the deal, Naturgy has entered into a five-year agreement with Candela Renewables for the exclusive development of solar and storage projects. Candela was created by former directors at First Solar.

"We incorporate a portfolio of excellent projects in different stages of maturity, as well as a first-class team with a proven track record in the development of projects,” Francisco Reynes, executive chairman of Naturgy, said.

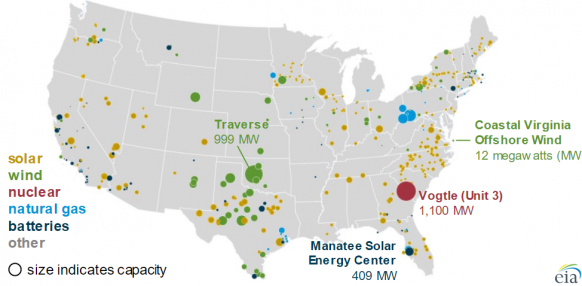

US utility-scale solar installs to hike 30% this year

US annual utility-scale solar installations are forecast to rise by almost 30% this year to 15.4 GW, the US Energy Information Administration (EIA) said in a note published January 11.

Some 4.3 GW of utility-scale battery capacity is expected online this year, quadrupling installed storage capacity, EIA said.

Solar projects will represent 39% of new capacity in 2021 while wind projects will make up 31%, natural gas 16%, batteries 11% and nuclear power 3%.

The forecasts from EIA are based on summer capacity reporting by operators and monthly surveys of new generation projects.

More than half of the new solar capacity will come online in four states, most notably in Texas, which will host 28% of new additions, EIA said. A further 4.1 GW of small-scale solar PV capacity is expected online this year, it said.

Battery storage systems are increasingly being paired with renewables and mainly with solar projects.

New battery projects online this year include Florida Power & Light's (FPL) 409 MW Manatee Solar Energy Center, the world's largest solar-powered battery. FPL is owned by NextEra energy, the largest renewable energy developer by capacity.

US power generation additions in 2021

(Click image to enlarge)

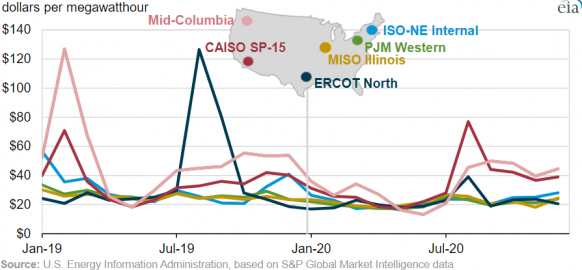

US power prices fell in 2020 as pandemic sliced demand

US electricity prices fell across most markets in 2020 as gas prices slumped and COVID-19 restrictions cut electricity demand, the US Energy Information Administration (EIA) said in a note published January 8.

The largest fall was seen in the Texas ERCOT market, where average wholesale electricity prices fell by 45% year-on-year to $22/MWh. Milder summer temperatures and increasing wind capacity helped to reduce the number of price spikes, EIA said.

US monthly average wholesale power prices

(Click image to enlarge)

In California's CAISO market, prices fell by just 5% over the whole year due to a surge in prices in August as heat waves prompted supply shortages.

In the Midcontinent Independent Service Operator (MISO) and PJM markets, average wholesale prices fell by 14% and by 22%, respectively.

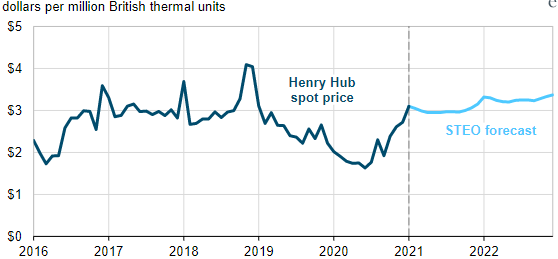

Rising gas prices and increasing renewable energy penetration will reduce gas consumption in the power sector in 2021 and 2022, EIA said.

The EIA predicts natural gas prices will climb above $3 per million British thermal units (MMBTu) in 2021 and 2022. Gas prices have been recovering since falling below $2/MMBTu in the first half of 2020.

Forecast monthly Henry Hub gas price

Source: EIA, January 2020

US extends solar tax credits in COVID-19 recovery package

US lawmakers agreed to extend the investment tax credit (ITC) for solar projects by two years in bipartisan COVID-19 recovery legislation agreed by Congress December 20.

The solar ITC will now remain at 26% for projects that start construction in 2021-2022 and fall to 22% in 2023 and 10% in 2024. The recovery package also extended the production tax credit (PTC) for onshore wind projects by a year and implemented a 30% ITC for offshore wind projects that start construction between 2017 and 2025.

COVID-19 restrictions have hampered some solar projects but total installations still hiked in 2020 due to strong demand going into the pandemic. Installations are forecast to hit new records this year and President-elect Joe Biden is expected to implement wide-ranging climate policies that will further accelerate deployment following his inauguration on January 20.

“Over the next few years, we have an opportunity to build a stronger, more reliable, and more equitable American energy economy, and the action Congress is taking today is a helpful down payment," the Solar Energy Industries Association (SEIA) said in December.

"As we enter the new year, stable policy support will help ensure that wind and solar can continue providing the backbone of our country’s electricity growth," the American Clean Power Association (ACP) said.

Reuters Events