Texas Senate approves reversal of storm fees; First large US offshore project clears key hurdle

Our pick of the latest wind power news you need to know.

Related Articles

Texas Senate approves reversal of excess storm power fees

The Texas state Senate approved a bill March 15 that would cut around $5.1 billion in disputed electricity fees imposed by the grid operator on power market operators during last month's winter storm.

The bill, which must be approved by the Texas House of Representatives and Governor Greg Abbott, directs the Texas Public Utility Commission and grid operator Electric Reliability Commission of Texas (ERCOT) to correct 32 hours of emergency prices and service fees.

The power authorities have been under mounting pressure to reduce the giant power market charges imposed by ERCOT as severe winter weather cut supplies. Over 4 million Texans were left without power and dozens of people died after the rare cold snap fell upon the South.

Power suppliers and weather-hit generators were left reeling from the costs. On March 15, power supplier Griddy Energy became the third power company to file for Chapter 11 bankruptcy since the storm.

As the storm set in, extreme low temperatures and ice cut wind, gas, coal and nuclear generation. By February 15, some 34 GW of power generation was offline in Texas- around 40% of expected capacity. Texas is a deregulated power market and is more used to supply shortages in the summer, when hot weather hikes air-conditioning demand.

Amid freezing temperatures, coordinated blackouts were implemented across the ERCOT power grid and customers were urged to limit power usage to prevent system-wide outages. ERCOT raised power prices to $9,000/MWh to encourage power generators to stay online. After the event, ERCOT was criticised for maintaining prices at high levels for too long a period. The Texas Public Utility Commission ruled the grid operator did not have to compensate market participants for the error.

US monthly average wholesale power prices

(Click image to enlarge)

After the storm passed, ERCOT directors and the chair of the Texas Public Utility Commission resigned, Texas Governor Greg Abbott pledged to overhaul the grid operator, and generators and suppliers were left reeling from the financial impact. The grid operator then fired its CEO Bill Magness after the fallout of the pricing error became clearer.

Brazos, Texas' largest power cooperative, filed for Chapter 11 bankruptcy relief on March 1 after receiving a $2.1 billion bill for power purchased during the storm.

"As a cooperative whose costs are passed through to its members, and which are ultimately borne by Texas retail consumers served by its Member cooperatives, Brazos Electric determined that it cannot and will not foist this catastrophic financial event on its members and those consumers," it said.

Brazos would continue to deliver "affordable and reliable electric service" to its member cooperatives, it said. A week later, Just Energy became the second supplier to file for bankruptcy.

Ratings agency Moody’s downgraded ERCOT by one notch to A1 from Aa3 on March 5 and revised the grid operator’s credit outlook to “negative.”

Fitch warned the financial fallout from the storm could impact credit ratings across the Texas power market.

"Power generators with firm supply obligations that were unable to produce power may experience significant losses. Retail Electric Providers (REPs) forced to purchase power at elevated wholesale prices to meet surge in customer demand face significant losses, in addition to potential bad debts and delayed payments from end customers facing astronomical electricity bills," Fitch said.

By March 16, wind farm operator RWE had recorded 400 million euros ($477 million) in losses from the weather event, the German company said in financial results. As a result, RWE's annual operating profit (EBITDA) is expected to fall by as much as 17% in 2021 to between 2.65 billion and 3.05 billion euros ($3.16-$3.64 billion), it said.

Vistra Corp, an integrated power group, said the winter storm had a negative impact of $900 million to $1.3 billion on the company, according to preliminary estimates. During the storm, Vistra increased its share of power generation in Texas from 18% to between 25 and 30%, but it also had to buy power in the ERCOT market at or near the maximum price cap levels in order to meet supply obligations, it said.

"The final amount of the estimated loss is subject to a variety of factors including, but not limited to, outstanding pricing, load, and settlement data from ERCOT, potential state corrective action, or the outcome of potential litigation arising from this event," it said.

Algonquin Power & Utilities Corp warned of an expected impact on adjusted core earnings of $45 million to $55 million after the cold weather stopped production at its wind facilities.

Innergex estimated a negative impact of around $80 million after its wind farms were halted or disrupted by the storm.

DeAnn Walker, chairwoman of the Texas Public Utility Commission, resigned March 1 after testifying to the Senate and House on February 25.

In her resignation letter, Walker said the failure of the grid was "not caused by any one individual or group."

Power generators, transmission and distribution utilities, electric cooperatives, municipality-owned utilities, ERCOT, the Railroad Commission and government representatives all failed to take the necessary steps over the last 10 years that could have averted the issues, Walker said.

BOEM completes environmental review of Vineyard Wind

The U.S. Bureau of Ocean Energy Management (BOEM) has completed its final environmental impact statement (EIS) for Vineyard Wind, the US' first large-scale offshore wind project, the Department of Interior (DOI) announced March 8.

The BOEM will decide whether to approve the 800 MW project following a 30-day public consultation period, it said.

The completion of the Final EIS is a major milestone for Vineyard Wind and follows a three-year review process. Located 15 miles from Massachusetts, the project is a joint venture of Iberdrola subsidiary Avangrid and Copenhagen Infrastructure Partners (CIP).

Vineyard Wind welcomed the DOI's announcement and maintained its objective of financial close in the second half of 2021 and first delivery of power by 2023.

US offshore wind development activity is soaring and the BOEM is facing a growing backlog of offshore wind proposals. The bureau is currently assessing the Construction and Operations Plans (COPs) for the South Fork project and is processing 11 other COPs in the pre-review phase.

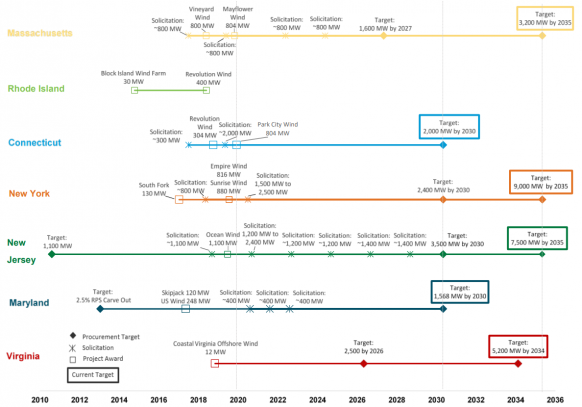

US offshore wind procurement timelines by state

(Click image to enlarge)

Source: National Renewable Energy Laboratory (NREL), October 2020

In January, President Biden issued an Executive Order to the DOI to identify steps to fast-track renewable energy development on public territory.

The BOEM expects to start to formally review more projects later this year, a spokesperson told Reuters Events last month, but developers fear delays.

Reviews of the first projects are taking longer than planned, more leases are on the way, and offshore partners want more resources directed at the process.

GE to open offshore turbine blade factory in England

GE Renewable Energy is to open a new offshore wind turbine blade manufacturing facility in Teeside, north-east England, the company announced March 10.

The factory will be built at Teesworks, the UK's largest industrial site and a newly-designated low-tax zone, and will be operated by GE's blade subsidiary LM Windpower. Due online by 2023, the plant will supply blades to the 3.6 GW Dogger Bank project being developed by SSE Renewables, Equinor and Eni in the UK North Sea.

"This new plant will contribute to the development of an industrial cluster dedicated to offshore wind in the North East of England," Jerome Pecresse, President and CEO of GE Renewable Energy, said.

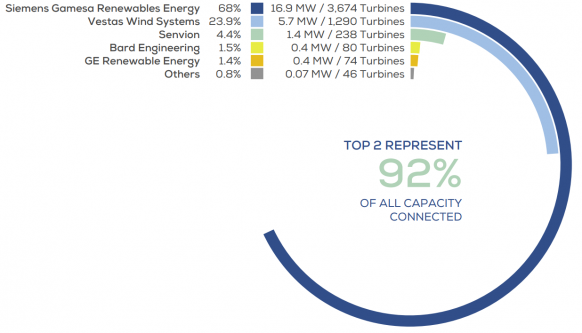

Turbine suppliers' share of offshore wind market - Europe

(Click image to enlarge)

Source: WindEurope, February 2021

The UK government is tightening local content rules for offshore wind farms and GE's announcement came as the UK government committed 20 million pounds ($27.8 million) of further funding for offshore wind manufacturing in Teesworks and 75 million pounds for the Able Marine Energy Park in the Humber region.

The two industrial sites will support the development of up to 9 GW of offshore wind projects per year, hosting up to seven manufacturers and creating 6,000 jobs, the government said.

The UK is the world's leading offshore wind market and aims to quadruple installed capacity to 40 GW by 2030.

Reuters Events