US vessel builders seek urgent orders to catch offshore wind wave

Orders for US installation vessels are needed to secure limited shipyard capacity and meet a looming hike in offshore wind construction, vessel partners told Reuters Events.

Related Articles

A new fixed-rate investment tax credit (ITC) for offshore wind farms agreed by Congress in December has boosted the outlook for US offshore wind build over the next decade.

The new 30% ITC and 10-year construction deadline gives developers greater financial certainty and will support a wide range of investments in supply chain and port infrastructure in the coming months and years.

Vessel construction is a key priority for developers as there are currently no Wind Turbine Installation Vessels (WTIVs) made in the US.

The US wind industry has set a target of 30 GW of offshore wind capacity by 2035 and orders for new US-made vessels are needed to fill a looming supply shortage. Under the US federal Jones Act, only US-flagged vessels can be used to ferry components to and from ports, ruling out purpose-built foreign installation vessels for transporting components.

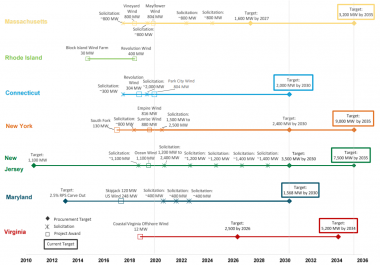

US offshore wind procurement timelines by state

(Click image to enlarge)

Source: National Renewable Energy Laboratory (NREL), October 2020

In December, shipbuilder Keppel announced it would build the US' first WTIV for developer Dominion Energy at its shipyard in Brownsville, Texas. Scheduled for delivery in 2023, the 'Charybdis' vessel will be used on Dominion's 2.6 GW Virginia Coastal Offshore Wind (VCOW) project and available for up to 5 GW of U.S. East Coast projects through 2027.

Orders for additional vessels are urgently required for shipbuilders to commit financing and secure the limited amount of US shipyard capacity that is equipped for the job, vessel partners told Reuters Events.

A WTIV can install 70 to 100 turbines a year, so three to five vessels will be needed to install 30 GW by 2035, Jan-Mark Meeuwisse, Commercial Director Renewables at GustoMSC, the Dutch group that designed the Charybdis, said.

Only two or three US shipyards may be able to perform the work, due to large width requirements and high tensile steel and plating needs, Meeuwisse warned.

"The number of shipyards is limited and they are predominantly located in the Gulf [of Mexico]," he said.

Vessel pressures

The Charybdis will be one of the largest WTIVs ever built and the engineering, procurement and construction (EPC) contract is valued at $600 million.

The construction of large WTIVs is complex and technically challenging and requires a shipyard with “physical size, capacity, knowhow and experience," Blair Ainslie, CEO of UK-based vessel owner Seajacks, said.

Seajacks owns a fleet of jack-up vessels and is advising Dominion on the design and delivery of the Charybdis. The company will also provide further assistance during the installation and operations and maintenance (O&M) phases.

The Charybdis will have a length 472 feet, a width of 184 feet, and feature a crane with capacity 2,200 tons and boom length 426 feet.

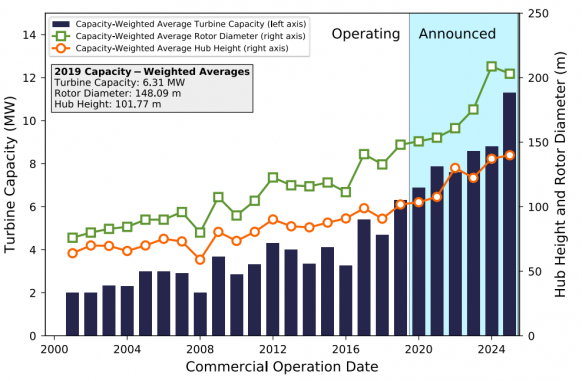

The large dimensions and lifting capabilities highlight how rising turbine capacities are impacting the supply chain. The Charybdis will be capable of installing turbines of capacity in excess of 12 MW, Keppler said. Some developers are already planning to install 13 MW turbines in the coming years and larger capacities are expected going forward.

Average turbine dimensions on new offshore wind farms

(Click image to enlarge)

Source: NREL, October 2020

Feeder vessels with "heave compensation" will also be required to lift off delicate turbine components but these can be built in East Coast shipyards due to their smaller widths, Meeuwisse said.

Global risks

The first large US projects may be forced to rely on European installation vessels due to time constraints.

Under this approach, the developer relies on US-flagged tugs and barges to transport components to site. Demand for the installation vessels in European and Asian offshore wind markets would increase project risk, Meeuwisse said. The UK alone plans to build 30 GW of new offshore wind capacity in the next 10 years while the European Union aims to install almost 50 GW.

The installation vessels would also be required to perform certain maintenance work, like the replacement of blades, Meeuwisse noted.

Vineyard Wind, developer of the US' first large offshore wind project in Massachusetts, plans to reach financial close in the second half of this year and deliver power by 2023. Vineyard Wind is co-owned by Iberdrola subsidiary Avangrid and Copenhagen Infrastructure Partners and may provide more details of its vessel strategy in the coming weeks, a spokesperson for the group said.

US offshore wind construction will ramp up significantly from around 2025 and vessel builders urgently require long-term orders to commit finances and meet wind industry objectives.

Shipbuilders require around 12 months to identify and tender for shipyard capacity and construction can take at least three years, Ainslie said.

“If you want a Jones Act compliant WTIV ready to install components in 2025 then you had better start tomorrow,” he said.

Reporting by Neil Ford

Editing by Robin Sayles