Texas' largest power cooperative files for bankruptcy; EDPR to install 50 GW renewables by 2030

Our pick of the latest wind power news you need to know.

Related Articles

Big freeze pushes Texas cooperative Brazos Electric into bankruptcy

Texas' largest power cooperative Brazos Electric filed for bankruptcy March 1 following huge charges incurred in last month's winter storm.

Over 4 million Texans were left without power and dozens of people died after a rare cold snap fell upon the South.

By February 15, some 34 GW of power generation was offline in Texas - around 40% of expected capacity - as extreme low temperatures and ice cut wind, gas, coal and nuclear generation. Texas is a deregulated power market and is more used to supply shortages in the summer, when hot weather drives up power demand.

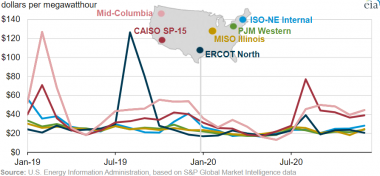

Amid freezing temperatures, coordinated blackouts were implemented across the Electric Reliability Council of Texas (ERCOT) power grid and customers were urged to limit power usage to prevent system-wide outages. Power prices in the ERCOT market hit the maximum cap of $9,000/MWh.

US monthly average wholesale power prices

(Click image to enlarge)

After the storm passed, ERCOT directors and the chair of the Public Utility Commission of Texas resigned, Texas Governor Greg Abbott pledged to overhaul the grid operator, and generators and suppliers were left reeling from the financial impact.

Brazos, a generation and transmission cooperative, filed for Chapter 11 bankruptcy relief after receiving a $2.1 billion bill for power purchased during the storm, the group announced March 1.

"As a cooperative whose costs are passed through to its members, and which are ultimately borne by Texas retail consumers served by its Member cooperatives, Brazos Electric determined that it cannot and will not foist this catastrophic financial event on its members and those consumers," it said.

Brazos would continue to deliver "affordable and reliable electric service" to its member cooperatives, it said.

Ratings group Fitch warned the financial fallout from the storm could impact credit ratings across the Texas power market.

"Power generators with firm supply obligations that were unable to produce power may experience significant losses. Retail Electric Providers (REPs) forced to purchase power at elevated wholesale prices to meet surge in customer demand face significant losses, in addition to potential bad debts and delayed payments from end customers facing astronomical electricity bills," Fitch said.

Vistra Corp, an integrated power group, said the winter storm had a negative impact of $900 million to $1.3 billion on the company, according to preliminary estimates. During the storm, Vistra increased its share of power generation in Texas from 18% to between 25 and 30%, but it also had to buy power in the ERCOT market at or near the maximum price cap levels in order to meet supply obligations, it said.

"The final amount of the estimated loss is subject to a variety of factors including, but not limited to, outstanding pricing, load, and settlement data from ERCOT, potential state corrective action, or the outcome of potential litigation arising from this event," it said.

Algonquin Power & Utilities Corp warned of an expected impact on adjusted core earnings of $45 million to $55 million after the cold weather stopped production at its wind facilities.

Innergex estimated a negative impact of around $80 million after its wind farms were halted or disrupted by the storm.

DeAnn Walker, chairwoman of the Public Utility Commission of Texas, resigned March 1 after testifying to the Senate and House on February 25.

In her resignation letter, Walker said the failure of the grid was "not caused by any one individual or group."

Power generators, transmission and distribution utilities, electric cooperatives, municipality-owned utilities, ERCOT, the Railroad commission and government representatives all failed to take the necessary steps over the last 10 years that could have averted the issues, Walker said.

EDP Renewables to install 50 GW by 2030

EDP Renewables (EDPR) plans to install 4 GW of wind and solar capacity per year through 2025 and install 50 GW of renewables by 2030 in an accelerated growth plan.

EDPR is controlled by Portuguese utility EDP and has 20 GW of installed renewable energy capacity, including 12 GW of wind. EDP plans to spend 24 billion euros ($28.9 billion) in the next five years, of which 80% on renewables and 15% on grid infrastructure, and become carbon neutral by 2030, the utility said in a strategic update February 25.

Renewables currently make up 79% of EDP's global portfolio and will represent 100% by 2030, it said.

Annual investments will rise from 2.9 billion euros in 2019-2020 to 4.8 billion euros in 2021-2025, EDP said.

Some 40% of this will be invested in Europe, 40% in North America, 15% in Brazil and Latin America and 5% in the rest of the world, it said.

EDPR has long since been active in onshore wind and is expanding its offshore wind operations, pushing ahead with US offshore wind and floating wind projects.

EDPR is considering raising between 1.5 and 2 billion euros from institutional investors, EDP said.

EDP currently owns 82.6% of EDPR and would maintain a stake of more than 70% in the company, it said.

Iberdrola to invest 150 billion euros by 2030

Spanish power group Iberdrola plans to invest 150 billion euros ($180.7 billion) by 2030 and triple its installed renewable energy capacity to 95 GW, the company said in annual results published February 24.

Last year, Iberdrola announced it would spend 75 billion euros by 2025, of which half on renewables, doubling its installed capacity to 60 GW. By 2025, Iberdrola aims to achieve 26 GW of installed onshore wind capacity, 4 GW of offshore wind, 16 GW of solar and 14 GW of hydro, the company said.

Iberdrola invested 9.2 billion euros in 2020, of which 91% was on renewables and power grids, the group said. Net profit rose 4.2% to 3.6 billion euros and underlying operating profit (EBITDA) climbed 8% to 10.7 billion euros, excluding the impact of COVID-19 and exchange rates.

Iberdrola's acquisition spree last year included the buyout of US utility PNM Resources through its US subsidiary Avangrid. The deal expands Avangrid's regulated asset base to 10 regulated companies across six states and makes it the third-largest renewable energy company in the US.

Italy's Enel also recently hiked its renewable energy outlook, setting a target of 120 GW of installed capacity by 2030.

Reuters Events