Largest ever turbine installation tests floating wind potential

Principle Power has started installing 8 MW turbines on Continental Europe's first floating wind project and predicts costs could compete with fixed-bottom plants.

Related Articles

Last month, the Windplus consortium began attaching the turbines for WindFloat Atlantic (WFA), the first floating wind farm in continental Europe.

The 25 MW project comprises three 8 MW MHI Vestas offshore wind turbines, the largest ever used for a floating wind farm, attached to Principle Power's semi-submersible floating wind base.

The Windplus consortium is owned by Portugal's EDPR (54.4%), France's Engie (25%), Spain's Repsol (19.4%) and US group Principle Power (1.2%). The WFA project has also received almost 100 million euros of loans from the European Investment Bank, the European Commission’s NER300 Programme and the government of Portugal.

WFA will be installed 20 kilometers off the coast of Viana do Castelo, Portugal. Final assembly is being performed at Ferrol harbor in north-west Spain and the first turbine unit will be towed to the project site in September. The remaining two turbine units will be installed at the site before the end of the year.

The project represents a significant scaling up of Principle Power's floating wind design and a key step towards wider commercial deployment. Larger, higher efficiency turbines are driving down costs and floating wind structures will need to accommodate growing turbine dimensions to become competitive.

The 8 MW turbines on WFA will have a hub height of 100m and a maximum blade tip height of 190m. An earlier prototype commissioned in 2011 featured a single 2 MW turbine with a hub height of 70m and a maximum blade tip height of 110m.

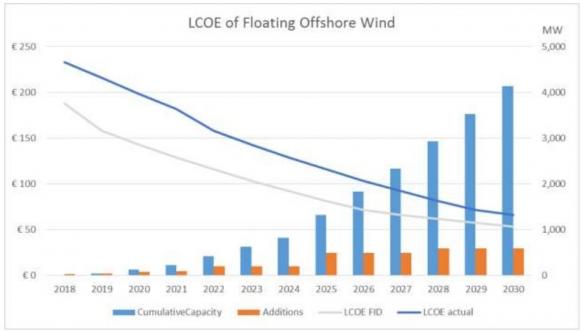

Floating wind costs are set to plummet in the coming years as developers move from pilot projects to wider commercial deployment. Rapid growth in the fixed-bottom offshore sector has shown how technology improvements, installation learnings and economies of scale can slice costs and stoke demand.

Europe floating wind cost forecast

(Click image to enlarge)

Source: WindEurope's Floating Offshore Wind Energy: a Policy Blueprint for Europe (October 2018)

Principle Power is currently developing a range of pre-commercial projects to boost the competitiveness of its design, including the 24 MW Les Eoliennes Flottantes du Golfe du Lion (LEFGL) on France's Mediterranean coast, due to be commissioned in 2021, and the 49 MW Kincardine project in the UK, scheduled online in 2020.

A key frontrunner in floating wind technology, Principle Power accounts for 22.21% of capital expenditure in the floating wind industry to date, according to a report published by the Quest consultancy in June. The U.S. group's commercial projects include the proposed 100 to 150 MW Redwood Coast facility in Northern California.

Floating wind can become competitive with fixed bottom plants as onshore assembly advantages reduce project risks and cut the cost of equipment and labor, Kevin Banister, Head of Development at Principle Power, told New Energy Update.

Project learnings

Fixed-bottom offshore wind costs have plummeted but floating wind developers are chasing the much larger deepwater market. An estimated 80% of offshore wind resource, some 4 TW of capacity, is in water depths of over 60 meters, where fixed bottom designs are not suitable, according to industry group WindEurope.

Floating wind developers are maximizing siting flexibility in their designs to accommodate different seabed types and water depths.

Principle Power’s WFA platform will be installed in water depths of 85 to 100m.

Once assembled, WFA will be towed some 200 nautical miles to the site, where it will be attached to pre-installed mooring systems.

The design uses catenary anchor lines with conventional drag embedment anchors that can accommodate different seabed materials.

“Drag embedment anchors permit installation in various soil conditions, including mud, clay, sand and layered soils,” the company said in a statement.

Principle’s semi-submersible architecture is designed to be inherently stable without requiring mooring to balance the system.

The structures can be deployed in water depths of over 1,000 m, according to the company.

For WFA, existing port side and vessel facilities were used to minimise costs. The use of tug boats and anchor handling tug supply vessels removes the need for specialist offshore installation vessels.

The simple transportability of the design is an important factor for the Redwood Coast project in California, Matthew Marshall, Executive director of Redwood Coast Energy Authority (RCEA), consortium member, told New Energy Update last year.

“One of the key reasons Principle Power’s WindFloat technology is a great fit is that we can bring components into the harbor, do fabrication and assembly in the harbor, and then tow the units out with conventional tugboats for final deployment,” Marshall said.

Commercial hubs

Pre-commercial floating wind projects installed in the coming years will help to accelerate cost reductions and boost investor confidence in the sector.

Principle Power expects pre-commercial testing to demonstrate “significant” savings on the levelized cost of energy (LCOE) compared with earlier models, the company said. Pre-commercial testing will include "quick disconnect" operations and maintenance (O&M), in which the facility is towed to shore to perform maintenance, avoiding the high cost of heavy lift vessels.

The first commercial arrays will rely on fabrication sites in multiple locations for the procurement of the main subsystems, Banister said. As project pipelines grow and developers seek greater efficiency, the fabrication and assembly network could evolve into regional supply hubs, he said.

“In the future the supply chain might be more organized with centralized fabrication facilities," Banister said.

These facilities could cover large market areas such as the North Sea, the Mediterranean or the U.S. western seaboard, he said.

By Neil Ford