New York to award 2 GW of offshore projects; Bullish gas hurts US power buyers

The wind power news you need to know.

Related Articles

New York to procure 2 GW offshore wind, spend $500 million on ports

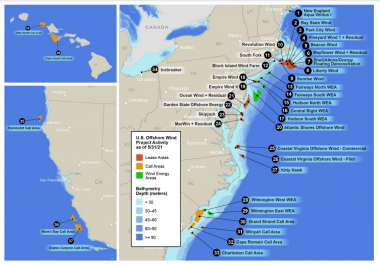

New York will launch the procurement of 2 GW of new offshore wind capacity this year and invest an additional $500 million in offshore wind ports and supply chain infrastructure, New York Governor Kathy Hochul announced in her 2022 State of the State address January 5.

"This investment will ensure that New York has the strongest offshore wind energy market along the Eastern Seaboard, enabling us to be the offshore wind supply chain hub for other projects up and down the coast," the Governor's office said in a statement.

New York has already agreed to 4.3 GW of new offshore wind capacity and is investing $200 million in port infrastructure, alongside commitments from developers.

US offshore wind development, lease areas

(Click image to enlarge)

Source: US Department of Energy's Offshore Wind Market Report (2021)

By 2035, New York aims to install 9 GW of offshore wind and state agencies will launch a study into potential offshore wind transmission corridors that will deliver at least 6 GW of offshore wind capacity directly into New York City, the Governor's office said.

The study will identify strategic offshore cable corridors and key points of interconnection to the grid, it said.

Governor Hochul will also launch a new master plan for the deployment of floating wind technologies in deeper waters.

In October, the Governor backed two giant onshore power transmission and renewable energy projects and expanded the state target for distributed solar power to 10 GW by 2030.

New York is on track to achieve its target of 6 GW of distributed solar power by 2025 and the new 10 GW target should see the state "exceed" its goal to supply 70% of power from renewable sources by 2030, the Governor's office said.

US power prices hiked in 2021 as bullish gas impacts all markets

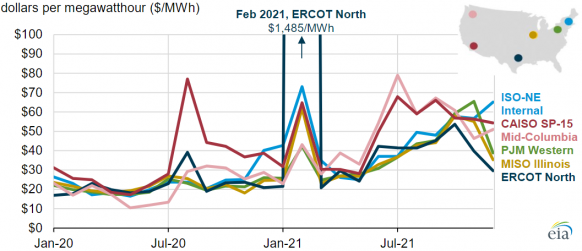

Wholesale power prices soared in all US regions in 2021 as gas prices climbed and an extreme cold snap in February cut generation capacity in Texas.

The price of gas delivered to power plants rose from $3.19/MMBtu in January 2021 to an estimated $5.04/MMBtu in the fourth quarter, data from the U.S. Energy Information Administration (EIA) showed.

Average power prices at the Illinois Midcontinent ISO (MISO) hub in the second half of 2021 doubled to $45/MWh while prices at the SP15 hub in California's CAISO market rose 37% to $61/MWh.

US monthly average power prices by market

(Click image to enlarge)

Source: U.S. Energy Information Administration (EIA). Data S&P Global Market Intelligence

Last February's winter storm cut the supply of wind, gas, coal and nuclear power in Texas and prices rocketed in the regional ERCOT wholesale market.

Between February 14 and February 19, hourly power prices at the ERCOT North trading hub exceeded $6,000/MWh for 70% of the time, EIA said. For the whole month of February, the average power price in Texas was $1,485/MWh.

The cold weather in February also lifted gas and power prices nationwide. The average power price in the ISO-New England market in February was $73/MWh, more than three times the price in February 2020.

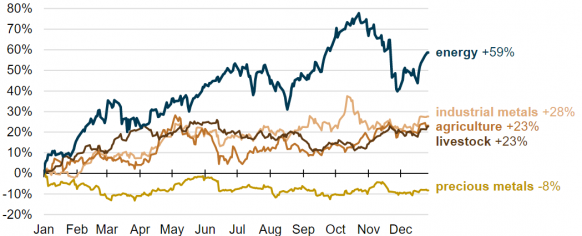

Energy prices rose 59% in 2021, far more than other commodities, according to the S&P Goldman Sachs Commodity Index (GSCI). The energy index is based on a basket of gas, crude oil and oil products and prices rose due to weather disruptions, higher demand for gasoline and diesel and rising demand for gas and crude oil which outstripped production increases.

Commodity price index by industry

(Click image to enlarge)

Source: EIA. Data: S&P Dow Jones and Bloomberg. S&P Goldman Sachs Commodity Index (GSCI)

Soaring gas prices continue to have a major impact in Europe, hiking wholesale power prices and pushing more households into fuel poverty.

Japan awards Mitsubishi three offshore wind projects

Consortiums led by Mitsubishi Corp have been awarded three offshore wind projects in Akita prefecture in northern Japan, and Chiba, near Tokyo.

Mitsubishi Corp and partners Mitsubishi Corporation Energy Solutions and C-Tech Corp, a Chubu Electric subsidiary, were awarded a 479 MW project off the coast of Noshiro City and Oga City in Akita and a 391 MW project off the coast of Choshi City, Chiba.

A consortium of the same companies as well as renewable energy firm Venti Japan were awarded an 819 MW project off the coast of Yurihonjo City project in Akita.

The projects will be the first fixed-bottom offshore wind farms in Japan's common sea area following a competitive tender held last year, Mitsubishi Corp said. The projects are scheduled to start operations between September 2028 and December 2030.

Japan aims to install 10 GW of offshore wind power by 2030 and 30 to 45 GW by 2040. Japan's deep waters hold huge potential for floating wind capacity and a number of international developers are looking to gain a foothold in this emerging market.

Reuters Events