US offshore pricing stand-off raises vessel sourcing risks

The US needs shipyard upgrades and vessel commitments from developers to ensure it meets President Biden's 2030 offshore wind target, experts told Reuters Events.

Related Articles

As construction starts on the US’ first large-scale offshore wind farm, developers risk exposure to global vessel markets in the coming years unless commitments are made for new US wind turbine installation (WTIV) vessels.

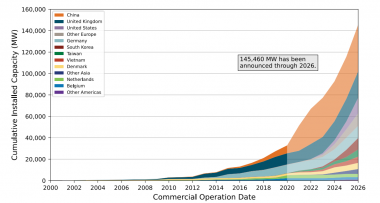

US developers are planning to install as much as 9.1 GW of offshore wind by 2026 and President Biden has set a target of 30 GW by 2030.

Meanwhile, global demand for WTIVs will surge. Europe is aiming to install around 100 GW by 2030 and development is also taking off in Asia.

Forecast offshore wind capacity by country

(Click image to enlarge)

Source: US Department of Energy's Offshore Wind Market Report (2021)

The US shipbuilding industry needs to advance and keep up with Europe and Asia to meet the demand, Karl Humberson, Director of Project Construction at utility Dominion Energy, said.

Last December, Dominion secured the first order for a US-built WTIV from Texas-based shipbuilder Keppel. Estimated to cost around $500 million, the Charybdis will be completed by late 2023 and one of the largest WTIVs ever built, capable of installing the largest turbines on the market. Dominion is developing the 2.6 GW Virginia Coastal Offshore Wind (VCOW) project and aims to start construction in 2023-2024.

Since Charybdis, no binding commitments for new US vessels have been made. As many as six vessels may be required to meet President Biden's 30 GW target, according to the American Bureau of Shipping (ABS).

“We are aware of ongoing conversations for additional WTIVs to be built over the next two years in the US, but they have [not] yet been contracted,” Matt Tremblay, Vice President, Global Offshore at ABS, said.

“We are beginning to bump up against the edge of the timeline. We could be in a situation in 2023 where we are playing catch up [for turbines scheduled to be installed by 2030]," Tremblay said.

“More investment is needed to prevent a vessels shortage,” Claire Richer, Director, Federal Affairs at the American Clean Power association (ACP), said.

Indeed, rising US demand could lead to a global shortage of WTIVs and heavy lift ships by the middle of the decade, consultancy Rystad Energy said in a report last year.

Shipyard gap

Under the US federal Jones Act, only US-flagged vessels can be used to ferry components to and from ports, requiring the use of extra US feeder ships when using foreign WTIV vessels. A US-made WTIV reduces the risks of transferring materials and huge components between vessels and gives greater access to local US crews, providing flexibility during installation phases that can be impacted by weather, Greg Lennon, Vice President, Offshore Wind, Global Offshore at ABS, told Reuters Events.

On the flipside, US vessel construction costs are higher than in other low-cost regions like Asia.

The US shipbuilding sector must invest in more modern facilities to boost efficiency and match the capabilities in Europe and Asia, Humberson said. This includes processes such as panel line construction.

"Investment has been in a lull because there hasn’t been the certainty of demand for new ships, he said. "Well, the demand led by offshore wind is coming and we need to advance...Every US shipyard is getting calls about building new vessels such as WTIVs to install turbines offshore, Service Operating Vessels [SOVs] to help with maintenance and feeder barges.”

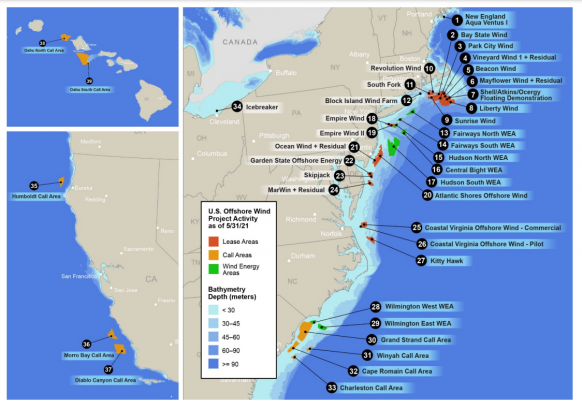

US offshore wind development activity, lease call areas

(Click image to enlarge)

Source: US Department of Energy's Offshore Wind Market Report (2021)

Dominion chose the Keppel AmFELS' shipyard in Brownsville for the Charybdis partly due to its on-site facilities that include a floating crane and drydock.

Currently, only two or three US shipyards may be able to build WTIVs, due to large width requirements and high tensile steel and plating needs, Mark Meeuwisse, Commercial Director Renewables at GustoMSC, the Dutch group that designed the Charybdis, told Reuters Events earlier this year.

"The number of shipyards is limited, and they are predominantly located in the Gulf [of Mexico]," he said.

Cost challenge

Norway's Havfram has opted to build a WTIV that will serve the US market but will not be Jones Act compliant, due to higher costs in the US, Even Larsen, Executive Vice President/Director of Offshore Wind at Havfram, said.

Vessel construction costs are perhaps 50% higher in the US than in low-cost regions and construction can take around a year longer to complete, Larsen said.

US shipbuilders are faced with higher labour costs, a lack of experience in building WTIVs and a less developed supply chain. In an older study, the Douglas Westwood research group estimated costs in Asia could be 60%-200% lower.

US port infrastructure must also be expanded to accommodate the large dimensions and deepwater requirements of WTIVs. Only a limited number of East Coast ports currently offer the space and expansions in several ports are underway through a combination of private and public finance.

Pricing talks

Charter pricing negotiations may be delaying US vessel orders, Tremblay said. Offshore wind developers are under pressure to minimise costs, and many are several years away from gaining environmental approval and starting installation.

“If you are going to put up $500 million to build an WTIV you want to have the assurance that you have a charter and contracts in place before construction,” Tremblay said. “I think the contracts will come but there are a lot of people looking at each other and wondering who is going to pull the trigger. It’s a chicken and egg situation.”

Dominion aims to use the Charybdis for its VCOW project but has also signed charter deals with Orsted and Eversource for their joint Revolution Wind and Sunrise Wind projects.

“Even if it doesn’t work out for our offshore wind project there is a large pipeline of projects coming ahead of us," Humberson said. "We also intend to use it on international projects...Our vessel will be utilised for the next five to 10 years.”

"Dominion is a regulated utility...so there is an opportunity for them to make that type of investment," Lennon said.

"First movers will hold the advantage," he said. "The market has demonstrated that WTIVs will be contracted. There is an opportunity here. It’s just somebody has to take that risk profile.”

Reporting by David Craik

Editing by Robin Sayles