Losses mount at turbine makers; U.S. wind installs dive on supply chain woes

The wind power news you need to know.

Related Articles

Siemens Gamesa misses target as losses mount at turbine suppliers

Wind turbine supplier Siemens Gamesa missed its full year target in the year ending September as revenues declined, mostly due to project delays and supply chain challenges.

Core earnings margin was minus 5.9%, below the company's forecast in August of minus 5.5%, it said November 10.

Leading wind turbine suppliers have cut profit forecasts as soaring materials costs and logistical challenges following the pandemic and Russia's invasion of Ukraine have impacted margins. Supplier margins were already squeezed by several years of intense market competition and the gradual removal of renewable energy subsidies.

Siemens Gamesa, the world's largest supplier of offshore wind turbines, posted a net loss of 940 million euros ($943.48 million) for the full year, citing higher-than-expected materials cost inflation, component failures and an onshore order intake dented by protracted contract negotiations and market delays.

A week earlier, leading onshore turbine supplier Vestas posted a net loss of 1.0 billion euros ($1.0 billion) in the first nine months of 2022 and cut its 2022 profit margin outlook to minus 5% from between minus 5% and 0%.

Last month, U.S. turbine supplier GE predicted losses of about $2 billion in its renewable energy division this year.

All three companies have announced job cuts - GE plans to reduce global headcount at its onshore wind business by around 20% over the next 12 months, GE's CEO Larry Culp said.

Turbine suppliers have started to increase their prices and predict better results within a few years as more consumers turn to renewable energy and governments accelerate decarbonisation plans.

U.S. quarterly wind installs dive on supply delays, PTC phase-down

U.S. quarterly wind installs slumped by 78% on a year ago to just 356 MW in July-September, due to inflation and logistics challenges, grid connection delays and the phasing down of earlier U.S. production tax credits (PTCs), the American Clean Power (ACP) association said in its latest quarterly report.

U.S. solar installations in the third quarter fell by 23% on a year ago to 1.9 GW as developers continued to face delivery delays due to supply chain challenges and slow import approvals by U.S. Customs and Border Protection. Storage installations hiked by 227% to 1.2 GW as the battery market heats up.

Wind, solar and storage installations are expected to soar in the coming years following sweeping tax incentives in President Biden's Inflation Reduction Act (IRA). The IRA extends tax credits for wind and solar for the next ten years and allows stand-alone energy storage projects to qualify for the first time. The bill also includes tax credits for manufacturing to boost domestic supply.

The IRA could lead to an additional $160 billion of investments in onshore wind, doubling installed capacity over the next decade to 280 GW, compared with an earlier growth forecast of 38%, Rystad Energy consultancy said.

The tax incentives could lead to larger wind farms and more projects near former coal mining communities, as well as more wind farms coupled with battery storage, experts told Reuters Events.

There is currently around 22.5 GW of U.S. onshore wind capacity either under construction or in advanced stages of development. Some 6.3 GW of this capacity is in Texas, followed by 3 GW in Wyoming and 2.3 GW in Illinois, while 12 states have more than 500 MW in development.

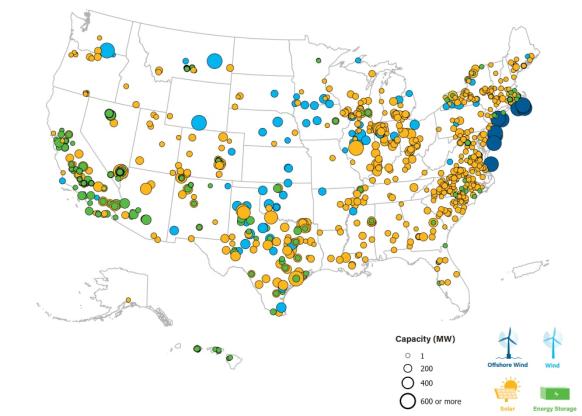

U.S. clean power projects under development in Q3

(Click image to enlarge)

Source: American Clean Power association, November 2022

Around 14 GW of offshore wind capacity is currently in advanced stages of development, spread across New York, New Jersey, Massachusetts and Virginia, ACP said. The Biden administration has set a target of 30 GW of offshore wind by 2030.

Canada to provide 30% tax credits to renewable energy

Canada will introduce investment tax credits (ITCs) of up to 30% for renewable energy technologies as it looks to close the competitive gap with U.S. companies, finance minister Chrystia Freeland announced in the government's Fall Economic Statement.

The move follows the passage of President Joe Biden's U.S. Inflation Reduction Act (IRA) that extends tax credits for wind and solar for the next 10 years and allows developers of stand-alone energy storage to access the credits for the first time. The bill also includes tax credits for manufacturing to boost domestic supply.

Canada's tax credits will also be available to energy storage, small-scale hydro and small modular nuclear reactor (SMR) technologies.

Companies will need to meet domestic labour requirements to gain the full 30% tax credit and others will be eligible for a 20% credit.

The credits will be available from 2023 and will be phased out from 2032.

Canada will also launch later this year a new growth fund, first outlined in April, to attract "billions of dollars" of private sector investments in low carbon solutions, Freeland said.

"We will make it more attractive for businesses to invest in Canada to produce the energy that will power a net-zero global economy," the minister said.

Reuters Events