US community solar growth hinges on faster public messaging

Developers are diving into the community solar market as state and federal support improves but the public needs to be better informed of the savings, experts said.

Related Articles

US community solar activity is ramping up as the federal government widens its support measures and large developers expand into the sector.

Last month, the U.S. Department of Energy (DOE) launched credit support and technical assistance programs for community solar projects as it looks to install over 25 GW of community solar by 2025, five times the current level.

Community solar can provide low-cost renewable energy to customers unable to source it, such as those living in an apartment complex where rooftop solar is not an option. Solar costs have fallen significantly in recent years, allowing developers to lower offtake prices.

The DOE will provide free technical assistance to developers, on areas such as policy and regulation, financial analysis and community engagement, it said. The department also aims to connect developers of “credit-ready” community solar developers with lenders and has set up a new collaboration hub between federal and state authorities to share technical assistance and best practices at policy and project level.

In response, a group of 80 community solar developers pledged to build 20 GW of community solar by 2025, providing certain "critical" measures are put in place.

Three quarters of US community solar projects have been installed in just four states and support programs must be expanded and applied in more regions, the Coalition for Community Solar Access (CCSA) said.

The Biden administration should also aim to pass tax incentives for community solar in its Build Back Better act and promote integrated grid planning and other measures to reduce cost barriers, the CCSA said.

Community solar projects may be smaller than utility-scale facilities but they face similar risks as well as additional challenges from a larger number of stakeholders, experts told Reuters Events.

Project partners must increase public awareness of the benefits of community solar in order to secure sufficient offtakers and minimise risks, they said.

“Community solar shifts benefits and ownership to the community and individual households and businesses," Nicole Steele, Workforce and Equitable Access Program Manager at the DOE’s Solar Energy Technologies Office, said.

"Today we see an average bill reduction for community solar subscriptions at 10%, with the new DOE target increasing it to 20% by 2025,” Steele said.

Growth markets

In December, utility giant AES acquired developer Community Energy and its 10 GW pipeline of projects. Last month, developer Invenergy and impact investor Lafayette Square launched a new investment platform for community solar and other recent deals include the acquisition of Dimension Renewable Energy by Partners Group which included 180 community solar projects.

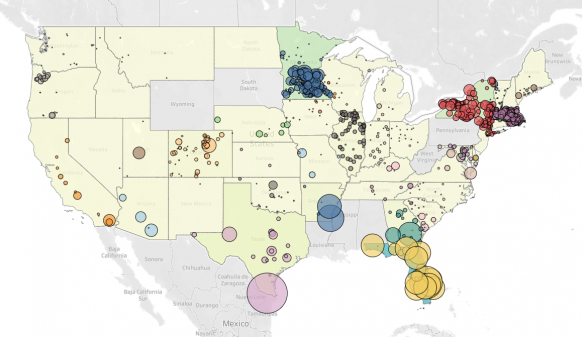

The largest community solar state is Florida with an installed capacity of 1.6 GW, followed by Massachusetts (674 MW), Minnesota (834 MW) and New York (731 MW), but new markets are emerging. Florida Power & Light (FPL) has the nation's largest community solar program and has installed most of state's capacity within the last two years. Activity is also growing in New York, where state authorities aim to install 6 GW of community and distributed solar by 2025 and 10 GW by 2030.

US community solar installations at end of 2021

(Click image to enlarge)

Source: U.S. Department of Energy, January 2022.

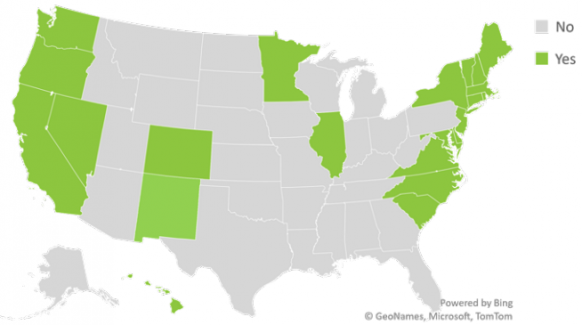

Some 22 states have introduced policy support for community solar and this is enabling new developers to break into the sector, Jenny Heeter, Senior Energy Analyst at the National Renewable Energy Laboratory (NREL), told Reuters Events.

State support ranges from mandates on community solar capacity to revenue support mechanisms and the authorisation of pilot projects.

States with community solar policies

Source: National Renewable Energy Laboratory (NREL), July 2021

Activity is ramping up in some states without community solar mandates, Heeter said.

“Most recently we had the launch of the Florida Power & Light Solar Together program, which is not mandated, but was negotiated between multiple parties in the state," she said. "In Texas, Green Mountain Energy is offering the Go Local Solar program.”

Wood Mackenzie recently increased its community solar forecast for New Jersey, New York, Illinois, and Colorado due to expanded state programs and clean energy commitments. New state legislation in New Mexico, Delaware, Pennsylvania, Wisconsin, Michigan and Ohio would accelerate growth in the coming years, it said.

Like larger projects, grid connection is a significant challenge for community solar developers and could hamper growth, Wood Mackenzie noted. A lack of grid capacity and slow approval processes are delaying solar and wind projects across the US.

Investor needs

Community solar programs differ between states and investors must be familiar with each market, Bret Turner, Market Manager, Project Finance at Silicon Valley Bank (SVB), told Reuters Events.

Finance providers like SVB would typically look for an ambitious renewable portfolio standard (RPS), a low solar penetration rate, supportive market conditions for community solar credits, long-term eligibility of projects, an ability to secure commercial and residential subscribers, and cooperation from utilities, Turner said.

Community solar projects are typically between 0.5 MW and 5 MW in size. Developers face many similar risks to large utility-scale projects, such as permitting, interconnection capacity, and community acceptance, but they must also secure a large number of residential customers, often alongside commercial clients, Woody Rubin, Chief Development Officer at AES Clean Energy, said.

“Financing terms typically charge a modest premium compared to larger [utility-scale] projects,” Rubin said. This is mostly due to the large volume and range of customers and community solar projects are "significantly less expensive" for developers than behind the meter or other distributed resources, he said.

“Financing terms and rates are driven by the creditworthiness of the subscribers and owners,” Steele said.

Power subscriptions

Developers need to engage community members and organizations to subscribe to their projects. Cash flows are usually balanced between long-term PPAs with anchor tenants and a revolving pool of shorter-term subscription agreements with individual households.

“The typical advantage will be structured as a discount, either fixed or floating, to the retail tariff," Rubin said. The customer savings will depend on the "volume of production from the community solar [project] that is attributed to the customer,” he said.

US monthly wholesale power prices by market

(Click image to enlarge)

Source: U.S. Energy Information Administration (EIA)

Customer contracts can vary from just one year up to longer term power purchase agreements (PPAs) of around 10 years and developers typically employ a subscription manager to engage, acquire and manage subscriptions.

To take one example, Pivot Energy and Nautilus Solar recently completed a 13 MW community solar portfolio in Colorado, using seven projects to supply power to 1,700 households and 12 commercial subscribers. Subscriptions are managed through Pivot Energy’s SunCentral platform, with the entire portfolio now owned by Nautilus.

Developers must also mitigate exposure to wholesale price swings.

“If there is lower retail or wholesale energy pricing in the future than modelled, this will reduce the expected revenue thus leading to potentially lower valuations," Turner said.

Customer push

At this early stage in the market, the acquisition of community solar customers remains a key challenge.

Measures required to improve public awareness include using government-branded education material that is translated into multiple languages, working with community-based group to improve messaging, and creating standardised messages on the benefits, project partners said.

“Our analysis shows that more than 80% of projects across the country have a positive net present value (savings) to customers,“ Heeter said.

All customers need to be made aware that, regardless of their credit score, they "can have clean energy for a discount to their electricity bill without putting panels on their rooftop," Turner said.

Reporting by Neil Ford

Editing by Robin Sayles