Texas solar boom turns to battery dash as grid pain looms

Texas solar developers are adding storage as federal tax benefits increase profit margins but a lack of transmission could delay projects and keep huge solar resources in the west beyond reach.

Related Articles

Texas will continue to lead U.S. solar growth in the coming years as tax incentives in President Biden's Inflation Reduction Act accelerate activity nationwide.

The U.S. Energy Information Administration predicts Texas will install 7.7 GW of solar this year, a quarter of all U.S. installations. Some 36 GW in new capacity is expected in Texas in the next five years, according to the U.S. Solar Energy Industry Association (SEIA).

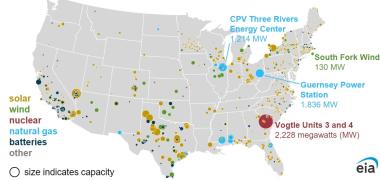

Planned U.S. power plant installations in 2023

(Click image to enlarge)

Source: U.S. Energy Information Administration (EIA), February 2023

Most developers are expected to pair solar facilities with one to four-hour lithium-ion battery storage systems. This represents a dramatic change in just a couple of years.

At the start of 2022, only 27% of all solar projects in the Texas grid connection queue were coupled with storage and by the end of the year this had risen to 42%, according to preliminary data from Lawrence Berkeley National Laboratory (Berkeley lab). In California, where solar penetration is higher, the figure was around 97%.

Energy storage allows solar operators to dispatch during times of higher prices or avoid curtailment. Increasing solar penetration improves the business case for storage, either coupled with solar or stand-alone, and the Texas power authorities are also looking to strengthen dispatchable power capacity following major outages during the devastating Winter Storm Uri in 2021.

Demand for solar and storage in Texas is soaring but many developers are also building separate storage facilities in Texas to take advantage of new tax credits for stand-alone storage in the inflation reduction act. Total planned storage capacity is estimated at 28.5 GW, twice as large as California, S&P Global Market Intelligence said last month.

“With the [inflation act] our approach has shifted from focusing on solar plus energy storage to both,” said Sabah Bayatli, VP for Project Development at OCI Solar Power. “We now have a pipeline of standalone energy storage systems. We see momentum in both scenarios.”

Supply shift

Annual U.S. solar installations must rise rapidly to meet President Biden's renewable energy goals but developers continue to face supply chain challenges that are delaying deliveries and inflating prices.

Customs delays, tariff uncertainty and soaring global demand have hiked solar costs as the U.S. weans itself off Chinese dependence.

The inflation act was signed into law in August 2022 and includes tax incentives for renewable energy deployment as well as domestic manufacturing. These benefits should eclipse current inflationary pressures in the next couple of years and drive further growth, industry sources said.

In one example, South Korea's Hanwha Q Cells said it plans to invest $2.5 billion to increase its U.S. solar panel production capacity to 8.4-gigawatt by 2024 and said it would build a new battery manufacturing facility with LG Energy Solution.

“In the past six months, we've seen more investment in the U.S. solar supply chain than in the past 10 years,” Scott Moskowitz, Head of Market Strategy and Public Affairs at Q Cells, told Reuters Events.

Grid challenge

With demand soaring, a lack of grid capacity in Texas could lead to project delays. Across the U.S., solar and wind developers have faced interconnection delays as grid operators grapple with dwindling capacity and a huge increase in renewable energy applications.

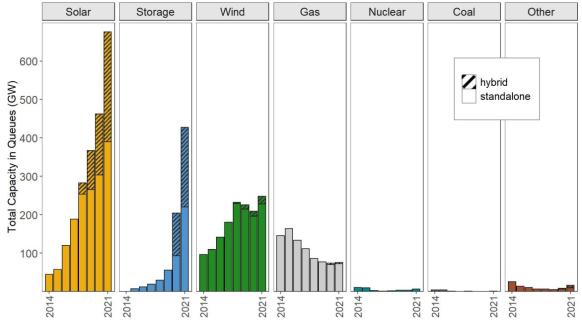

U.S. power capacity in interconnection queues

(Click image to enlarge)

Note: Hybrid solar typically means coupled with storage.

Source: Berkeley Lab

Texas developers have benefited from a more streamlined grid approval process than other markets, with waiting times lower than the national average at around two years, but rising activity is increasing the pressure on power authorities.

Around 110 GW of solar and storage capacity was in the interconnection queue at the end of 2021 and initial data shows this rose by over 50% last year, according to the Berkeley Lab.

Not all this capacity will be built but the figures clearly indicate an "almost exponential growth" in solar and battery activity in Texas, said Joe Rand, Senior Scientific Engineering Associate in the Electricity Markets and Policy Group at the Berkeley Lab.

New territory

Grid access is also becoming more challenging as developers expand into rural areas with large expanses of affordable land as prime connection points near cities such as Austin and San Antonio reach capacity.

Developers want grid operator ERCOT to invest more in the grid in West Texas, where solar and wind resources are highest, to unlock further opportunities.

“I'd like to see a giant project like the CREZ line to bring those additional solar resources from the West to the East side of the state but that could take a decade,” Bayatli said, referring to the $7 billion CREZ transmission system that carries wind power from West Texas.

To avoid connection delays and congestion risks, some developers are focusing on direct supply to industrial clients.

The power demands of oil and gas groups in the Delaware Basin in West Texas represent a significant opportunity for renewable energy developers, as does the nascent green hydrogen sector, said Wade Gungoll, CEO of Industrial Sun, which specializes in net-metered solar for the industrial sector and has a capacity pipeline of several gigawatts. Last month, Industrial Sun secured $90 million in investments from infrastructure fund EIG and clean energy developer Modern Energy.

The inflation act provides new tax credits for green hydrogen projects and in December Air Products and AES Corporation announced plans for a $4 billion green hydrogen facility in northern Texas that would require 1 GW of clean electricity.

“The passing of the [inflation act] has accelerated the growth of the hydrogen industry and Texas is set to become the epicenter of that industry,” Gungoll said.

Reporting by Eduardo Garcia

Editing by Robin Sayles