U.S. to consider tariffs on panels from Southeast Asia; UK set to hike solar target in energy security push

The solar news you need to know.

Related Articles

U.S. to study tariffs on solar panels from largest exporters in Southeast Asia

The U.S. Department of Commerce has launched an investigation that could increase the cost of solar panels from the four largest supplier countries in Southeast Asia.

The department will investigate imports from Malaysia, Thailand, Vietnam and Cambodia after U.S. manufacturer Auxin claimed Chinese manufacturers shifted production to these countries to avoid paying U.S. anti-dumping duties on imports from China.

Most U.S. solar projects use imported modules and anti-dumping duties on the Southeast Asian countries could "more than double the cost," research group Wood Mackenzie warned in a recent report.

The Southeast Asian countries supplied the bulk of the 26 GW of solar panels imported into the U.S. in 2021, data from the U.S. National Renewable Energy Laboratory (NREL) shows. China, which has been subject to anti-dumping duties for over a decade, supplied just 177 MW. U.S. manufacturing capacity is around 5 GW.

The U.S. Solar Energy Industry Association (SEIA) warned the investigation alone would scare developers and curb solar growth that is critical to achieving President Biden's target of a decarbonised power grid by 2035.

“Contrary to the Biden Administration’s goal of growing clean energy in the U.S., the Department of Commerce has decided to consider up to 50%-250% tariffs on the solar industry in the United States," the SEIA said. "This misstep will have a devastating impact on the U.S. solar market at a time when solar prices are climbing, and project delays and cancellations are adding up."

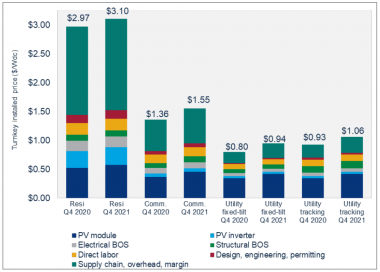

U.S. modelled solar system costs in Q4

(Click image to enlarge)

Source: Wood Mackenzie/SEIA US Solar Market Insight, March 2022.

Auxin claimed Chinese companies merely assemble equipment in Southeast Asian nations using components manufactured in China. A similar request was filed by an anonymous group of U.S. manufacturers last year but the commerce department said it could not investigate the issue properly without the companies identifying themselves.

Auxin has provided information indicating some exporters from the four Southeast Asian countries are subsidiaries of large Chinese producers, the department said.

In February, the Biden administration extended separate Section 201 tariffs on imported crystalline silicon solar panels for another four years but exempted bifacial panels.

The majority of utility-scale developers are opting for bifacial panels due to the higher yields from using both sides. Bifacial panels are relatively new to the market but prices have fallen significantly and narrowed the gap with more established monofacial designs.

UK energy minister aims to quadruple solar capacity by 2030

UK energy minister Kwasi Kwarteng has proposed an almost four-fold increase in solar power to 50 GW by 2030 as part of the Conservative government's delayed white paper on energy security, the Financial Times reported March 29.

Kwarteng also ordered a review into a fracking ban in England as the government looks to rein in soaring gas prices and cut its fuel ties with Russia following its invasion of Ukraine.

The energy ministry also proposed to double onshore wind capacity to 30 GW by 2030 and increase the UK's offshore wind target by a further 10 GW to 50 GW, the FT said, citing people close to the process.

Some Conservative MPs are against the widespread deployment of large-scale onshore wind and solar. Last year, the government opened up contract for difference (CFD) subsidies to solar and onshore wind for the first time since 2015. The previous Conservative government of David Cameron implemented a moratorium on onshore wind and solar subsidies to appease anti-wind groups and reduce state spending.

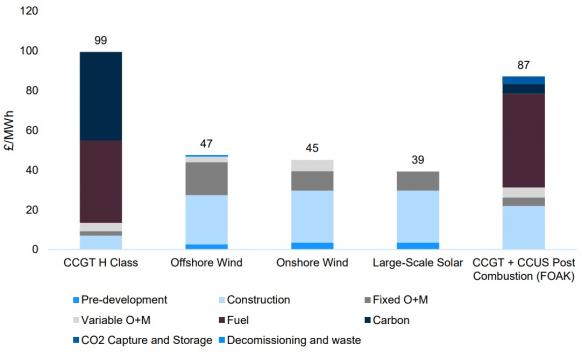

Forecast UK power generation costs in 2030

(Click image to enlarge)

Source: UK government, August 2020

The government's energy security white paper has been delayed by several weeks due to concerns from the Treasury over the cost of approving six or more new nuclear power stations proposed in the strategy, the FT reported.

Under the plan, nuclear capacity would increase from 7 GW to 16 GW by 2030, it said.

Portugal hikes renewable energy target to 80% by 2026

Portugal will accelerate solar and wind build to achieve 80% of electricity from renewable energy by 2026, four years earlier than previously planned, the government announced April 1.

Portugal already gets 60% of its power from renewables but European Union (EU) members are accelerating solar and wind build to mitigate increasing energy supply risks following Russia's invasion of Ukraine.

The European Union (EU) plans to cut its dependence on Russian gas supplies by two thirds by the end of the year and cease supplies entirely in the coming years and will study new climate policies that accelerate renewable energy deployment, the European Commission (EC) said last month. Germany has pledged to fast-track the implementation of new energy laws that accelerate solar and wind deployment and Portugal's neighbour Spain has approved an accelerated permitting procedure for solar projects of up to 150 MW in a suite of energy transition measures, according to media reports.

"Portugal has already taken very significant measures in the energy transition, but the evolution and duration of the war in Ukraine must necessarily imply new measures," Portuguese Cabinet Minister Mariana Vieira da Silva told a news conference.

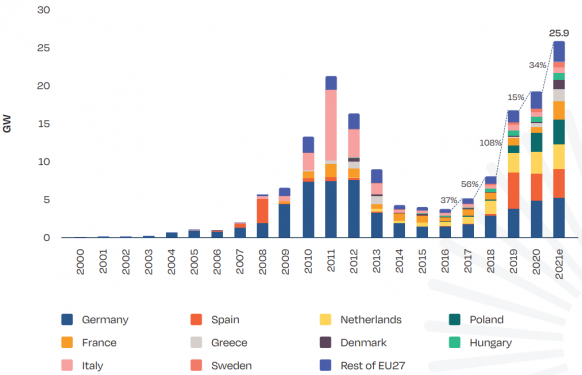

Annual solar installations in European Union

(Click image to enlarge)

Source: SolarPower Europe, December 2021

Portugal has 7.3 GW of hydroelectric capacity, 5.6 GW of onshore wind and plans to rapidly expand its solar fleet from its current level of 2 GW.

Portugal recently launched Europe's largest auction of floating solar capacity. The government will allocate 263 MW of capacity at seven hydroelectric dams, Reuters reported. Portugal will tender for 100 MW at the 518 MW Alqueva hydroelectric dam operated by EDP in southern Portugal as well as 50 MW at the Castelo de Bode dam and smaller capacities at other sites.

Portugal also plans to allocate 3 to 4 GW of floating wind projects this summer in its first commercial-scale auction, Environment and Energy Transition minister Joao Matos Fernandes told Reuters last month.

The projects will be due online around 2026, Matos Fernandes said in an interview.

Reuters Events