UK offshore bids prompt warning of higher costs; US resumes Vineyard Wind permitting

Our pick of the latest wind power news you need to know.

Related Articles

UK offshore bidding prompts cost warning from industry

Bullish bidding in the UK's latest offshore wind leasing round has prompted criticism of the leasing rules by the wider wind industry.

The UK Crown Estate allocated six offshore wind leases in England and Wales to four different groups - including the first UK project for oil major BP - for a total capacity of 8 GW. The UK aims to quadruple offshore wind capacity to 40 GW by 2030 and developers require the leases to pursue permitting and bid in UK contract for difference (CfD) auctions.

BP and German utility EnBW bid 154,000 pounds/MW/year ($211,400/MW/yr) for each of two 1.5 GW leases, some 65% higher than the next successful bidder. Offshore Wind Limited, a venture of Spain's Cobra Instalaciones y Servicios and Flotation Energy, bid 93,233 pounds/MW/yr for a 480 MW site, Germany's RWE Renewables bid 88,900 pounds/MW/yr and 76,203 pounds/MW/yr to secure two 1.5 GW leases while Macquarie's Green Investment Group gained a 1.5 GW site for 83,049 pounds/MW/yr.

"These are highly advanced assets…it's location, location, location,” BP's low carbon energy chief Dev Sanyal told Reuters.

The shallow water of BP's lease site 30 km from the coast would allow lower transmission costs and reduce the environmental impact, he said.

The leasing round was the first in Europe based on bids for upfront option fees, which the developer must pay until it gains final planning permission. The previous three rounds in the UK had set fixed annual option fees.

Sanyal expected BP and EnBW would take a final investment decision (FID) on their windfarms in 2025, which implies the companies will each pay around 1 billion pounds in fees before then.

The new leasing process risks raising the costs of offshore wind projects, industry group WindEurope warned in a statement.

The capacity available was four times lower than in the UK's last leasing round 10 years ago and there are now more developers chasing projects, Giles Dickson, CEO of WindEurope, said.

"It’s unclear when the next auction will take place. So there’s a price frenzy in the bidding – that’ll just get passed on to energy bills,” he said.

Offshore wind financing soars in Europe

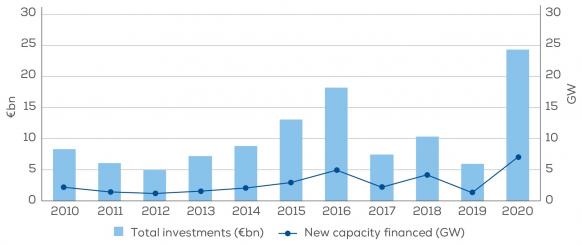

Offshore wind financing in Europe hiked four-fold in 2020 as developers committed a record 26.3 billion euros ($31.7 billion) to 7.1 GW of new projects, industry group WindEurope said.

Despite COVID, offshore wind developers clinched deals, met construction deadlines and prepared for multiple tenders this year, leading developers told the Reuters Events Offshore and Floating Wind Europe Virtual Conference in September.

Annual offshore wind financing in Europe

(Click image to enlarge)

Source: WindEurope

Europe installed 2.9 GW of new offshore wind capacity in 2020 and construction will have to ramp up sharply to meet the region's green energy objectives. The European Union aims to install almost 50 GW of new offshore wind capacity by 2030 while the UK plans to build a further 30 GW, raising total capacity in Europe to around 100 GW.

European governments are increasingly using contract for difference (CfD) mechanisms that guarantee offshore wind project revenues for developers. The UK, Denmark, Poland, France, Ireland, and Lithuania all use CfDs.

"[CfDs are] cheap for governments: they pay out and get paid back depending on market prices. And it significantly reduces financing costs which means lower bills for energy consumers," Giles Dickson, CEO of WindEurope, said.

US resumes permitting process for first major offshore project

The U.S. Bureau of Ocean Energy Management (BOEM) has resumed its environmental review of Vineyard Wind, the US' first large-scale offshore wind project, following an Executive Order from President Biden to accelerate the permitting of renewable energy projects on public lands and waters.

The 800 MW Vineyard Wind project in Massachusetts is a joint venture of Iberdrola subsidiary Avangrid and Copenhagen Infrastructure Partners (CIP) and would be built in two 400 MW phases.

In December, Vineyard Wind temporarily withdrew its Construction and Operations Plan (COP) from the BOEM permitting process after it switched from MHI Vestas to GE Renewable Energy as preferred turbine supplier.

On January 25, Vineyard Wind asked BOEM to resume the process after it found no need to update the project plans. Two days later, President Biden issued an Executive Order to the Interior Department to identify steps to fast-track renewable energy development on public territory.

Following the order, BOEM said it would resume the environmental review of Vineyard Wind and proceed with the development of a Final Environmental Impact Statement (FEIS).

“BOEM is committed to conducting a robust and timely review of the proposed project,” BOEM Director Amanda Lefton said.

Vineyard Wind welcomed the announcement and maintained its objective of financial close in the second half of 2021 and first delivery of power by 2023.

The federal approval process for Vineyard Wind is being closely watched by the offshore wind industry.

BOEM issued an initial draft environmental impact statement (EIS) on Vineyard Wind in December 2018. Following feedback from regional stakeholders, BOEM expanded this into a Supplement to the Environmental Impact Statement (SEIS), delaying the project schedule.

The SEIS introduced previously unavailable fishing data, a new transit lane alternative, larger turbine considerations and cumulative risks from multiple offshore wind projects.

US annual wind installs hike 85% on tax credit rush

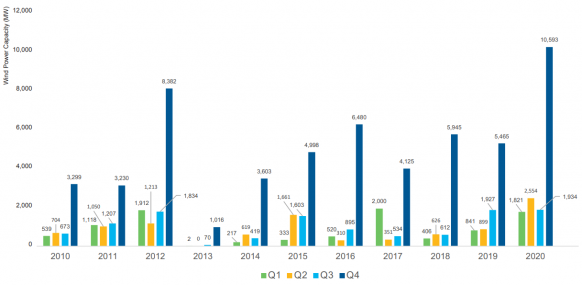

US wind installations rose by 85% in 2020 to 16.9 GW as developers raced to meet end of year tax credit deadlines and renewable energy demand continued to swell, industry group American Clean Power said in a report.

Wind installations in the fourth quarter soared by 94% on a year ago to 10.6 GW as developers looked to secure production tax credits (PTCs) that decline each year. In late December, Congress extended the tax credit deadline by a year as part of a COVID-19 relief package.

Around a quarter of new wind installations last year - some 4.2 GW - were in Texas. Iowa, Wyoming, Illinois and Missouri all installed over 1 GW.

US quarterly wind power additions

(Click image to enlarge)

Source: American Clean Power

US renewables share set to double under existing legislation

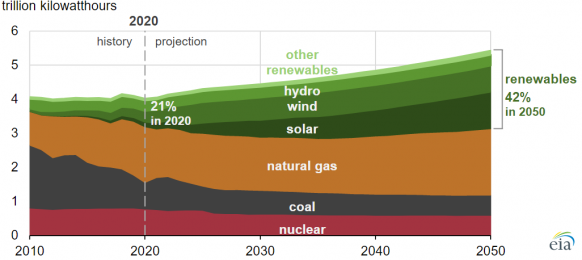

The share of renewable energy in the US power generation mix is forecast to double to 42% by 2050 under current policy and regulation, the US Energy Information Administration (EIA) said in its latest Annual Energy Outlook.

The outlook is a reference case scenario and would change considerably if the Biden administration implements pro-renewables policies as pledged. President Biden wants to achieve net zero carbon emissions in the power sector by 2035 and spend $2 trillion on clean energy and sustainable infrastructure in his first four-year term.

Even without these measures, renewable energy will surpass gas as the largest source of power generation by 2030, EIA said. By 2040, solar will surpass wind as the largest source of renewable energy, it said.

Forecast US power generation by source

(Click image to enlarge)

Source: Energy Information Administration (EIA), February 2021

Wind power will be responsible for most of the growth in renewable energy generation until 2024, when wind production tax credits (PTCs) are expected to be phased out, EIA said.

Between 2024 and 2050, solar power will account for 80% of the increase in renewable energy generation, it said. This assumes PV plants will receive a 30% investment tax credit (ITC) until 2023 and receive a 10% credit from 2024 through 2050.

Reuters Events