U.S. Treasury clarifies local content bonus; California grid agrees $7.3 billion of new power lines

The wind power news you need to know.

Related Articles

U.S. Treasury issues guidance for inflation act domestic content

The U.S. Treasury Department has issued guidelines for the domestic content requirements needed to qualify for tax incentives in the Inflation Reduction Act (IRA), providing developers with much-needed clarity.

Passed last year, President Biden’s inflation act offers a 30% investment tax credit (ITC) or a production tax credit of $27.5/MWh if labor conditions are met, plus an additional bonus of 10% if the project meets domestic content thresholds. Further bonuses are available to projects in low-income communities or areas impacted by coal plant closures.

Renewable energy investors have called for more clarity on how companies qualify for domestic content criteria.

On May 12, the Treasury said that to qualify for the content bonus, all steel and iron manufacturing processes must take place in the U.S. For wind facilities, both inland and offshore, this requirement applies to towers and foundations.

The guidance also sets a threshold for the minimum amount of “manufactured products” and components that need to be “mined, produced, or manufactured” in America.

For offshore wind, 20% of the “manufactured products” that go into turbines, monopiles, substations, and inter-array cables have to be made in the U.S. ― the number will rise to 55% if construction starts after 2027.

For onshore wind farms, the minimum is 40% for facilities starting construction before 2025 and 55% after 2026.

The American Council on Renewable Energy (ACORE) said the update provides “helpful clarity” and is in line with recommendations from the industry.

The Treasury still has to issue guidance regarding other aspects of the inflation act, “including transferability, direct pay, and the clean hydrogen production tax credit,” the trade group noted.

California grid operator signs off on $7.3 billion of power lines

The California Independent System Operator (CAISO) plans to spend $7.3 billion to build 45 new power transmission projects that will support the construction of more than 40 GW of new clean energy capacity.

CAISO's 2022-2023 Transmission Plan will allow the state to add more than 17 GW of solar resources, 8 GW of wind generation (including 4.5 GW from Idaho, Wyoming, and New Mexico), and 1 GW of geothermal development, as well as battery storage projects, the grid operator said on May 18.

The plan aims to "better synchronize power and transmission planning, interconnection queuing and resource procurement," CAISO said. Last year, CAISO shelved new applications for grid connections to tackle a backlog of projects.

The grid operator will prioritize interconnection requests in areas with high solar and wind resources, and those coming from stand-alone storage projects located closer to major load centers in the LA Basin, greater Bay Area, and San Diego, it said.

The investments would also allow CAISO to better cope with "increasing levels of net load forecast uncertainty between day-ahead and real-time markets," as the state sometimes relies on regional power transfers at times of peak demand or when solar output drops.

CAISO expects next year's transmission plan to identify the need for 70 GW of new capacity by 2033, to meet increased demand from the transportation and building sectors, and a total of 120 GW by 2045 to reach the state's clean energy goals.

Long Beach, California plans $4.7 billion offshore wind port

The Port of Long Beach in California has unveiled plans for a $4.7 billion facility to manufacture and assemble floating wind turbines, a linchpin project that could help lower development costs.

The Pier Wind seaport will be designed to build and deploy huge 20 MW turbines, far larger than current models. Developers continue to seek larger turbines to gain economies of scale and the largest deployed to date is 15 MW.

Construction of the Pier Wind facility could potentially start in January 2027. The 400-acre facility would go on stream gradually between 2031 and 2035.

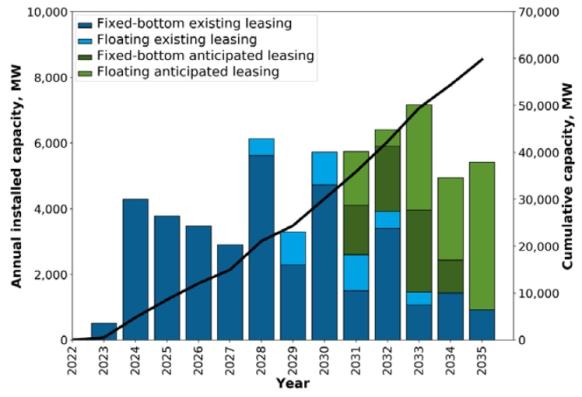

Forecast U.S. offshore wind installations

(Click image to enlarge)

Source: Department of Energy report on U.S. offshore wind supply chain, June 2022

The Port of Long Beach features one of the deepest channels in the U.S., direct access to the open ocean, and no air height restrictions.

“No other location has the space to achieve the economies of scale needed to drive down the cost of energy for these huge turbines,” said Port of Long Beach Executive Director Mario Cordero.

Long Beach could potentially be the second offshore wind port in the state. The California Energy Commission last year approved $10.5 million in funding to upgrade the Port of Humboldt Bay so that it can support the development of up to 1.6 GW of offshore wind in northern California. The funds will go toward preliminary engineering and design work, as well as environmental impact assessments.

The federal government wants to build 15 GW of floating offshore wind by 2035 and has set a cost target of $45/MWh, which will require huge investments in domestic manufacturing to achieve high production volumes, industry experts told Reuters Events last year.

Construction on the first U.S. pilot floating wind project off the coast of Maine is slated to start this year and the government auctioned off five leases for floating offshore wind farms along California's north and central coast in December.

The winners were mainly divisions of European energy companies that are already investing in offshore wind on the East Coast, including Equinor, Copenhagen Infrastructure Partners, RWE, and Ocean Winds (a joint venture between Engie and EDP Renewables); as well as U.S. developer Invenergy.

Ireland allocates first offshore wind contracts

Ireland has awarded state-backed power contracts to four offshore wind projects with a combined capacity of 3.1 GW in its first auction of offshore wind capacity.

The winning bids were the North Irish Sea Array (Statkraft, 500 MW), Dublin Array (RWE and Saorgus Energy, 824 MW), Codling Wind Park (EDF and Fred Olsen, 1,300 MW), and Sceirde Rocks (Corio Generation, 450 MW). The first three projects are on the East Coast and the fourth is on the West Coast.

The government secured an average price of 86.05 euros/MWh ($93.0/MWh), which compares to an average wholesale electricity price of over 200 euros/MWh over the past 12 months, a period in which prices soared following Russia's invasion of Ukraine.

The auction represents a key step towards Ireland’s target of producing 80% of electricity from renewables by 2030. The facilities will be able to produce about a quarter of total electricity consumption, enough to power 2.5 million homes.

Reuters Events