US solar, storage builders dash west in major test for grids

Grid connection applications are soaring in Western U.S., buoyed by the Inflation Reduction Act and strong demand fundamentals, posing a resource challenge for the region's grid operators.

Related Articles

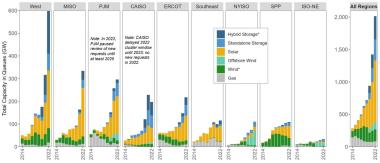

The latest U.S. grid connection (interconnection) data highlights the soaring demand for renewable energy projects as federal and state authorities race towards decarbonisation goals.

Annual grid connection applications hiked by 40% in 2022 to over 700 GW as demand for solar and storage projects soared, the Lawrence Berkeley National Laboratory (Berkeley Lab) said in its annual grid connection report.

In an emerging trend, the West region outside California’s CAISO network saw the fastest growth as project applications jumped 306 GW to leave 597 GW of capacity in the queue. The MISO market in Central U.S. now has the second-largest queue, at 334 GW, surpassing California's CAISO grid and the PJM network in the East.

The rise in applications in the West and MISO outweighed a drop in new applications in CAISO and PJM after the grid operators shelved new applications to tackle a backlog of projects.

Power capacity in U.S. grid connection queues

(Click image to enlarge)

Source: Berkeley Lab, April 2023

The Biden administration's Inflation Reduction Act has boosted the economics of renewable energy nationwide, offering tax credits for solar and wind projects and for the first time, stand-alone energy storage.

Some developers have turned their attention to the West while CAISO and PJM reduce their backlogs, but the West also offers strong solar and wind resources along with good land availability and growing power demand is combining with rising renewable energy targets as states and utilities look to decarbonise their power networks.

California, Oregon, Washington, Nevada, Colorado and New Mexico have raised state renewable portfolio standards (RPS) or set out 100% clean energy targets over the last few years, Aaron Vander Vorst, Head of Growth Strategy and transmission at operator Enel North America, told Reuters Events. A large international developer, Enel is developing solar, wind and storage projects across the West.

Utilities such as Bonneville Power Administration (BPA), Arizona Public Service (APS) and PacifiCorp have set decarbonization targets and are issuing requests for proposals for renewable energy that are driving demand, Joseph Rand, Energy Policy Researcher at Lawrence Berkeley Lab, said. These targets will continue to support demand going forward, he said.

The regional utilities manage grid connections in the non-ISO West and the surge in applications will severely test their ability to process applications efficiently and avoid withdrawals that disrupt other projects in the queue.

Nationwide, grid connection delays are growing, Berkeley Lab warned in its report. Much of the capacity will not be built and a growing number of developers are withdrawing applications at a later stage, it said.

Power needs

Across the U.S., 350 GW of solar projects and 202 GW of storage entered grid connection queues last year, the data from Berkeley Lab shows.

Rising solar and wind penetration increases the demand for storage and most new solar applications include batteries. Combined, solar and storage accounted for over 80% of new applications.

In some regions, rising population levels and growing economic activity is supporting demand for renewable energy. In the Salt River Project (SRP) service area in central Arizona, rising power demand combined with a push to reduce carbon emissions is driving up grid connection applications, SRP Director of Resource Planning Grant Smedley told Reuters Events.

SRP predicts peak electricity demand will grow by 1.2 GW between 2023 and 2025, a rise of 16%, due to population growth around the city of Phoenix. SRP is a not-for-profit organization that provides power to 2 million people.

Some of the new projects in the West lie on federal land, where the Biden administration is looking to accelerate deployment. The Interior Department aims to permit 25 GW of renewable energy on federal lands by 2025 and by March 2023 it had approved 8.2 GW of projects, mostly solar.

Developers may also be attracted by lower deposit requirements from some of the utility-owned transmission operators, Vander Vorst said.

"Any transmission company still following [the Federal Energy Regulatory Commission’s] original tariff rules will have lower deposit requirements than regions which have reformed their rules to discourage high volumes of [grid connection] requests," he noted.

California's power demand is set to hike on the back of ambitious climate objectives. Some developers are looking to export into CAISO but transmission capacity is now largely occupied and there are additional regulatory barriers to cross networks, Vander Vorst said.

Enel is among a group of stakeholders advocating a regional transmission operator (RTO) that spans the whole of the West, including California.

A Western RTO would “reduce barriers to effectively sharing power across the region” and encourage more proactive and cost-effective expansion of the transmission system, Vander Vorst said. A reform bill to create a regional RTO has been tabled in the California legislature but it requires approval by lawmakers and it will take years for any reforms to be fully implemented.

Growing queues

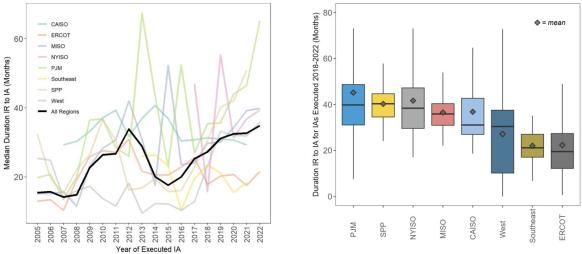

As applications surge across the U.S., the average time from connection request to plant operations rose to around five years in 2022, Berkeley Lab said.

The time from connection request to connection approval varied widely across the non-ISO West, but the average was in line with the national average at around three years, the data showed.

U.S. grid connection approval times, by market

(Click image to enlarge)

IR = Interconnection Request

IA = Interconnection Approval

Source: Berkeley Lab, April 2023

Longer timelines increase project costs. Grid connection costs and project withdrawals are highest in congested grids such as the expansive PJM network, where costs for active projects in the queue have grown eightfold since 2019, Berkeley Lab said in a separate study published in January.

Reforms to application processing are critical to reduce queues going forward. Southwest Power Pool (SPP) is leading efforts to reduce approval times by assessing projects in groups, and this could soon be rolled out by other network operators under new rules proposed by the FERC.

Developers need access to grid connection data to assess project risks and FERC is also considering imposing a two-tier process to filter out speculative requests. Developers would gain access to preliminary data before filing a formal grid connection request.

Arizona’s SRP has already found that the ‘first come, first served’ grid connection process has led to a "multitude of speculative [grid connection] requests," lengthening the timeline required to conduct grid connection studies, Smedley said.

This is creating a feedback loop where developers often submit speculative grid connection requests to get prospective projects in the queue in an attempt to meet potential future timelines, he said.

Reporting by Neil Ford

Editing by Robin Sayles