U.S. grid data needed for faster solar, wind build

Developers want local and operational grid data to help reduce grid connection delays and more upfront investments by transmission operators to reduce cost burdens.

Related Articles

An anticipated surge in solar and wind installations following President Biden's historic climate bill has increased the urgency of grid interconnection reforms.

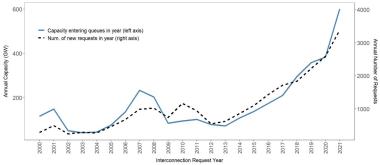

A lack of grid capacity and long interconnection queues are delaying solar, wind and storage projects across the U.S. Over 1.4 TW of new power generation and storage projects were queueing for grid connection at the end of 2021, triple the amount in 2016. Projects take an average of more than three years to secure interconnection and in the large PJM network the number of projects in the interconnection queue surged to 2,500, prompting the grid operator to take action.

U.S. annual grid connection requests

(Click image to enlarge)

Source: Berkeley Lab, April 2022

Developers are assigned costs for transmission connections and wider grid upgrades, which pushes up project costs and can delay studies or derail projects entirely. Complicated impact assessments and a lack of staff to approve the rising number of renewable energy projects are causing further delays.

In the coming years, new rulemaking proposed by FERC could help reduce timing uncertainties while the Department of Energy (DOE) recently launched the Interconnection Innovation e-Xchange (i2X) initiative to share data and develop a roadmap to speed up the interconnection process.

Developers want deeper reforms on interconnection costs and are calling for power authorities to urgently provide more data on interconnection processes to help accelerate deployment.

A lack of data means developers may not know connection timelines and costs until years into the process. Greater visibility could push developers towards zones with lower costs and spare capacity.

Urgent reforms are needed in data sharing, timelines and costs, Adam Stern, manager of regulatory affairs at developer Enel North America, told Reuters Events.

More certainty would remove the need for resubmission of studies and reduce the number of speculative projects that are later withdrawn from the process, Stern said.

As a result, they “would expect to see queue volumes go down... and faster timelines overall," he said.

Data gaps

In a positive move, the U.S. Energy Information Administration (EIA) said it will collect more interconnection data in its regular Electric Power and Renewable Electricity Surveys (EPRES). EPRES consists of nine surveys, including annual, monthly and daily surveys, collecting data from across the industry.

The Solar Energy Industries Association (SEIA) wants data on interconnection queues, costs and timelines, grid operations and constraints, and local network outages.

“Understanding the likely processing and study timelines is very important to help firms plan for construction and arrange financing,” Dave Gahl, executive director of the Solar and Storage Industries Institute (SI2), an SEIA body, told Reuters Events.

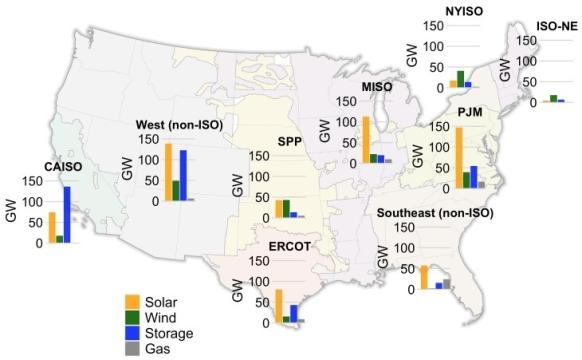

Capacity in U.S. interconnection queues at end of 2021

(Click image to enlarge)

Source: Berkeley Lab, April 2022

Transmission service operators should be required to share more information upfront and provide regular updates, allowing developers to plan and adapt, Gahl said. TSOs would need to allocate more staff to the process.

The most important metrics for developers include the number and capacity of projects queueing in the local network zone, completion times for interconnection service agreements and tracking of abandoned versus active projects, he said.

Developers need access to monthly data on existing transmission lines and substations and operational data that enables technology groups to design solutions that avoid injecting power during times of congestion, Gahl said.

“They can only do that if they have more information about how the line operates and its constraints," he said.

Federal reforms

A Notice of Proposed Rulemaking issued by FERC in June aims to provide greater certainty over interconnection processes and prevent undue discrimination against new generation.

The new rules would require TSOs to prioritise projects which demonstrate sufficient readiness, rather than review all projects in order of submission. PJM is already implementing similar measures to reduce the backlog, prioritising projects with financial and technical requirements in place and fast-tracking projects that do not require grid upgrades or facility studies.

The new FERC rules also require TSOs to perform cluster studies for numerous proposed generating facilities rather than separate studies for each and require TSOs to incorporate energy storage and other technology advancements in interconnection modelling. Most U.S. large-scale solar projects now include battery storage and FERC wants developers to apply for one interconnection for both technologies. The commission will collect initial comments on the proposals until October before it makes a decision on a final rule and compliance schedule.

Despite calls from industry, FERC is not proposing reforms to how costs are allocated.

FERC should require transmission operators to plan for future grid needs in more detail and invest in larger transmission lines upfront, Stern said.

"This will help ensure generators in the interconnection process pay for 'driveways' instead of 'highways',” he said.

In addition, the cost of transmission upgrades for new generation projects should be allocated "in a manner that better reflects the broader benefits those upgrades provide to all users of the grid," Stern said.

Reporting by Neil Ford

Editing by Robin Sayles