US builds solar on coal plants as community funding flows

Extra tax incentives and ready-made grid connections are boosting the business case for solar on coal plant and fossil fuel sites, developers said.

Related Articles

A sharp reduction in solar costs and dwindling availability of land with good grid connections has seen some developers turn to brownfield developments on energy production and industrial sites.

U.S. solar installations must triple to 60 GW/year by the middle of the decade to meet President Biden’s zero-carbon power goals but developers of greenfield sites are facing years of grid connection delays.

Grid expansion initiatives in the 2021 Bipartisan Infrastructure Law will take years to take effect and a number of developers are developing on closing coal plant sites to utilise existing grid access. Around 12 GW of coal plant capacity was retired in 2022 and a further 40 GW of closures are expected by 2029, according to EIA data.

Coal plant sites can offer solar developers a large land area to maximise economies of scale, as well as transport and utility infrastructure. Cleco Power and D.E. Shaw Renewable Investments announced in August they would build a 240 MW solar project on the site of the recently retired Dolet Hills coal-fired plant in Louisiana. Elsewhere, the Minnesota Public Utilities Commission approved Xcel Energy’s plans for a 460 MW solar project next to the 1,780 MW coal-fired Sherco plant, which is being retired in phases this decade.

Including tax credits, the average cost of developing a solar plant in coal communities is $24/MWh, around one-third lower than the cost of running an existing coal plant, analysts at the Energy Innovation group said in a recent report.

The Biden administration's inflation reduction act provides a 30% tax credit to solar projects and additional tax credits to projects located on closing energy production sites. The act also provides loan guarantees to re-purpose energy production sites and funding for factory transformations and worker re-training in coal and oil and gas communities that are impacted by closures.

"More attention and funds are being directed to coal plant closures and affected communities,” Gail Mosey, Project Lead at National Renewable Energy Laboratory (NREL), said.

Converting coal

The pace of coal plant closures will depend on plant efficiency and environmental regulations that differ between states. The four states of Michigan, Texas, Indiana and Tennessee account for 42% of notified closures in 2023-2029, EIA said.

Strong solar activity is also expected in the Appalachian coal mining region in eastern U.S., where power plants have been fed by local mines and developers have access to the large PJM power market, Erich Miarka, Development Director for renewable energy group Savion, told Reuters Events.

Tax credits in the inflation act are "extremely beneficial" to projects located within designated energy communities, Miarka said.

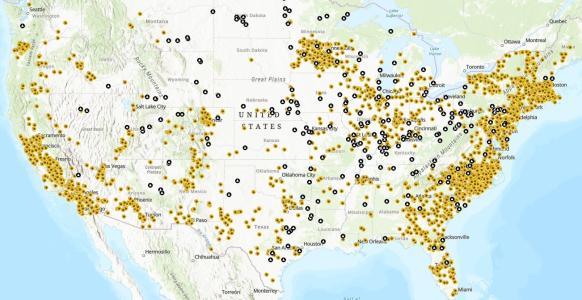

U.S. coal, solar power plants

(Click image to enlarge)

Coal-fired plants are indicated in black. Solar plants in yellow.

Source: U.S. Energy Information Administration (EIA), 2022

Solar development on closed coal mining sites is also "gaining a lot of momentum," boosted by federal support initiatives in the 2021 infrastructure law, Mosey said. Later this year, the Department of Energy (DOE) will allocate $500 million to up to five clean energy projects on coal mine sites in 2022-2026. The DOE wants its investments to encourage private sector investment going forward.

The U.S. hosts around 17,750 mining sites, offering a potential 89 GW of clean energy capacity. Currently, over 540 former mine sites could host utility-scale PV projects of more than 5 MW capacity, according to a recent report by the Environmental Protection Agency (EPA).

Solar projects already in operation include a 35 MW project by Avalon Solar on abandoned mining land in Arizona, Chevron’s 1.2 MW Questa project on a former mineral project in New Mexico and Greenwood Energy’s 7 MW array on the Elizabeth former copper mine in Vermont.

Land costs on mining sites are typically lower than for greenfield solar projects but overall costs are higher. Land ownership can be complex and developers face technical challenges depending on the quality of the subsurface. Technology solutions and economies of scale will be required to secure attractive returns.

Oil & Gas openings

Solar activity on oil and gas sites is also growing as companies look to benefit from long-term reductions in solar costs and tax credits in the inflation act.

In November, OYA Renewables announced a joint venture with an oil & gas company, Oil Well Shares, to develop 3 GW of solar, wind and energy storage capacity in Pennsylvania, Ohio and West Virginia, with the first projects to be completed by 2030. OYA has already developed 1,440 MW of utility-scale and distributed solar projects and has a pipeline of a further 9 GW, including some on oil & fields. The company is working with operators on future production sites as well as existing facilities.

Dual land use can reduce costs and minimise the risk of local opposition and some sites benefit from nearby transmission lines, OYA Chairman Manish Nayar told Reuters Events.

Developers could benefit from funds set aside in the inflation act for modifying generation and transmission facilities and wider grid expansions, Nayar noted. Transmission projects funded through the 2021 infrastructure law should open up further opportunities for developers.

Meanwhile, there is growing political support for renewable energy in fossil fuel producing states, Nayar said.

“We are seeing more programs in states and regions traditionally reliant on fossil fuel generation... For example, in Ohio there is currently a draft bill, HB450, that aims to incentivize development on brownfield sites which would be geared towards current and former oil and gas sites,” he said.

Reporting by Neil Ford

Editing by Robin Sayles