Solar builders race to claim grid access at closing coal plants

US coal and nuclear plant closures are freeing up valuable interconnection capacity for solar developers as grid challenges grow.

Related Articles

US solar capacity is surging and developers are increasingly looking to build on closed coal and nuclear sites to bypass grid connection challenges and save costs. Solar capacity is forecast to quadruple to 419 GW by 2030 and a swathe of coal and nuclear plants will be shut down in the coming years.

NextEra Energy plans to build a 690 MW solar plant at its recently closed Duane Arnold nuclear plant in Iowa, Reuters reported last month. The proposed $700-million project would be operational by the end of 2023, rapidly expanding Iowa's solar capacity. Elsewhere, Navajo Power and SPower are co-developing 200 MW of solar capacity and a potential further 750 MW at the decommissioned 2.3 GW Navajo coal plant in Arizona. Developer Akon Lighting recently partnered with fund manager Growmore to build its Black Sunrise Fund that will focus on the decommissioning of US coal plants and replacing them with renewable energy through workforce programs for black minorities and underserved communities.

In a slightly different tack, developer Photosol US is developing a 598 MW solar plant with 300 MW of battery storage on land next to the San Juan coal power station in New Mexico. The solar plant will connect to the San Juan plant 345 kV switchyard and is scheduled to come online in 2022, when the coal plant is decommissioned.

“Developing near coal plants is one of our main strategies," Josh Case, CEO of Photosol US, told Reuters Events. "As well as siting near planned new infrastructure or planned upgrades to existing infrastructure."

“Access to [the] transmission system and adaptive reuse of existing electrical system infrastructure, such as step-up transformers and switchgear can [offer] very substantial savings," Andy Walker, Senior Research Fellow at National Renewable Energy Laboratory (NREL), said.

On some sites, the savings could equate to a quarter of project costs, he said.

Grid gaps

Years of underinvestment in US grid infrastructure have led to growing queues for solar and wind connections, delaying projects and raising costs. Local opposition can even block rights-of-way permits and derail projects.

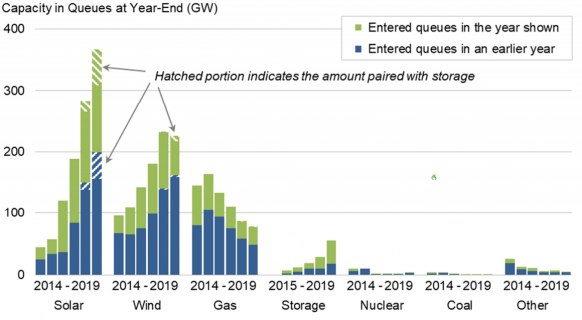

US generation capacity in interconnection queues

(Click image to enlarge)

Source: Lawrence Berkeley National Laboratory (Berkeley Lab), August 2020

Meanwhile, the closure of coal plants is set to accelerate following President Joe Biden's pledge to decarbonise the power sector by 2035. This year, nuclear station closures will dominate US plant retirements, but more coal closures are coming as utilities pivot to solar and wind capacity.

For its San Juan project, Photosol has signed a 400 MW interconnection agreement and a power purchase agreement (PPA) with the Public Service of New Mexico (PNM), owner of the existing coal plant. The PPA covers 200 MW of power and 100 MW/4 hour duration battery storage. Photosol has also signed a 30 MW PPA with power group Uniper.

NextEra's Duane Arnold solar project is in an earlier stage of development. The giant solar facility would span beyond the power plant site and NextEra is currently in talks with local landowners, the company told Reuters Events.

It completed, the plant would dwarf others in the area. By the end of 2020, Iowa had only 288 MW of installed solar capacity and was forecast to install just 342 MW over the next five years, according to data from the Solar Energy Industry Association (SEIA). In comparison, Iowa has 11 GW of installed wind capacity and wind farms generated 58% of the state's power in 2020, data from the U.S. Energy Information Administration (EIA) shows. Coal-fired plants generated 24% and gas-fired units supplied 12%, while the Duane Arnold plant supplied 5%.

Primed for PV

Decommissioned coal and nuclear sites offer solar developers a large land area, allowing them to maximise economies of scale. Other benefits include existing access roads and water supply for panel cleaning and fire protection, and buildings that can store equipment or accommodate operations and maintenance (O&M) staff.

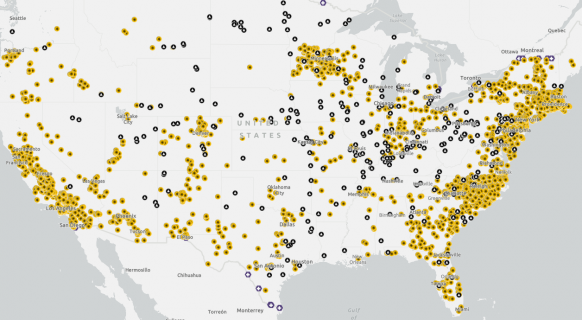

Map of US coal, solar plants

(Click image to enlarge)

Coal plants are indicated in black. Solar plants in yellow.

Source: US Energy Information Administration (EIA), 2020

The deep environmental footprint of conventional plants also means these sites may be of little use for other industries. Solar developers have already shown that plants can be developed over ash landfills and lands with subsurface contamination. There are "perhaps dozens" of PV systems installed on closed US ash landfills and ash ponds at retired coal-fired power plants, including a 2.3 MW facility installed at the Rock River Generating Station in Beloit Wisconsin, Walker said.

Hundreds of similar US sites could host PV plants, he said, if specific risks can be managed.

“There might be a lot of subsurface foundation, piping, and other objects which would complicate typical pile foundations and require expensive survey work to map out,” Walker said.

Developers must also be aware of potential site contamination and regulatory requirements during development and operations, or equipment that is in poor condition or obsolete, he said.

Photosol clearly sees major potential in developing adjacent to closing coal plants and claiming valuable interconnection capacity. The group is looking to build 650 MW of solar capacity with 325 MW of battery storage near Nebraska's 1,365 MW coal-fired Gerald Gentleman station, as well as two 125 MW arrays near the Holcomb plant in Kansas.

These projects are expected to come online in 2024-2025 and the group is "negotiating multiple other interconnection agreements” in other US States, Case said.

Reporting by Beatrice Bedeschi

Editing by Robin Sayles