First US all-in offshore O&M deal forms basis for vessel build

Siemens Gamesa's partnership with marine specialist Acteon in Virginia will help to reduce the cost of labour and logistics but vessel solutions are needed to support larger arrays.

Related Articles

Last month, turbine supplier Siemens Gamesa partnered with marine solutions company Acteon to create a full scope offshore wind operations and maintenance (O&M) package for Dominion Energy's 12 MW Coastal Virginia Offshore Wind (CVOW) pilot project.

Built under contract by Denmark's Orsted, the CVOW pilot project is the second US offshore wind project after Block Island and the first owned by a US utility. Located 27 miles off the coast of Virginia Beach, the project comprises two 6 MW Siemens Gamesa turbines and will soon be online following the completion of construction and testing last month.

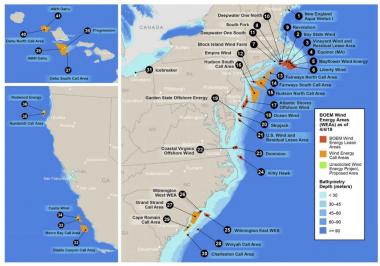

US offshore wind development activity

(Click image to enlarge)

Source: US DOE's Wind Technologies Market 2018 report

Siemens Gamesa and Acteon will work together to optimize the wind turbine service and balance of plant O&M work scopes. Siemens Gamesa will perform above water balance of plant inspections while Acteon will inspect subsea components, using its range of subsea technologies.

The partnership will allow the companies to optimise logistics, sharing assets such as vessels during fine weather windows, Michael Hughes, Head of Offshore Americas Operations at Siemens Gamesa, told Reuters Events.

Siemens Gamesa will become the first turbine supplier to offer a full-scope O&M package in the US offshore wind market, avoiding the need for Dominion to coordinate a number of different work packages.

This would create “synergies with technicians and more importantly, reduce the amount of downtime for each wind turbine,” Hughes said.

Technicians could perform multiple types of work above water and Siemens Gamesa will gain "seamless access to subsea corrosion, structural integrity and geotechnical expertise should any issues be identified," he said.

The O&M package will act as a model for much larger projects Dominion plans in the region in the coming years.

Dominion plans to leap from the pilot project to three adjacent 800 MW arrays, expanding its offshore wind capacity to 2.6 GW by 2026. These large arrays will use much bigger turbines, creating additional challenges which must be overcome to maximise the economies of scale.

Larger loads

The multi-phase 2.6 GW CVOW project would be built within a 112,800-acre lease area, alongside the 12 MW pilot. Dominion filed its proposal for the project to the PJM grid operator in September 2019. The company is on track to submit its permitting application for the project to the BOEM towards the end of 2020, Bob Blue, President and CEO of Dominion, said in an earnings call November 5.

In June, Dominion selected Siemens Gamesa's giant 14 MW turbine for the project.

The turbine has a rotor diameter of 222 metres and blade length of 108 metres. Siemens Gamesa will decide next year whether to build its first US blade manufacturing facility on the east coast.

The larger size of the turbines and arrays will significantly increase the construction and O&M challenges. The arrays will include hundreds of turbines and associated foundation structures, and far longer lengths of cabling.

"That will be our focus going forward - on how to integrate these scopes using the existing vessels on a larger scale wind project," Hughes said.

Rhode Island-based Atlantic Wind Transfers is currently constructing a crew transfer vessel (CTV) for all planned O&M work, including the underwater surveys.

"The larger project will require a Service Operations Vessel (SOV) so we foresee a new vessel will be required to be built," Hughes said.

European offshore operators have used large vessels like SOVs as floating O&M hubs, in conjunction with port-side centers, to optimize growing project portfolios.

For CVOW, O&M work will be co-ordinated from a logistics hub near Virginia Beach.

Vessel learnings

US offshore operators can build on learnings on vessel use from European projects, Ian Baylis, Managing Director of Seacat Services, told Reuters Events. For example, vessels built to industry certification standards "de-risks vessel construction as well as the overall operation of the vessel throughout its lifetime, as it guarantees supervision and quality checks,” he said.

US sea conditions can also be more extreme than in Europe.

"The latest US vessels have been designed to provide optimum seakeeping and efficiency even in greater wave swells, through advanced hull form optimisation," Andy Page, Managing Director of Chartwell Marine, a naval design specialist, said.

Project partners must also ensure vessels meet US regulations, such as powertrain requirements to comply with EPA Tier 4 emissions regulations, which are more stringent than European equivalents, Page noted.

"A popular configuration for US flagged CTVs is to use 4 smaller engines instead of two larger ones, ensuring compliance with EPA Tier 4 while maintaining the power necessary for offshore operations," he said.

Machine monitoring

Dominion and its supply partners will use the latest technology innovations to minimise labour and logistics costs.

Acteon will use remotely operated vessels (ROVs) to perform underwater surveys of export and array cables.

“Remotely operated vehicles will provide significant savings over the deployment of divers to conduct subsea inspections," Jeremy Slayton, spokesperson for Dominion, said.

"We will also evaluate the future use of drone technology to conduct other asset inspections, such as tower and blade inspections,” he said.

Siemens Gamesa and Acteon have devised alternative methods of deploying the ROVs without requiring additional vessels, Hughes noted.

“This allows for more efficient vessel use as well as lower [maintenance] costs," he said.

Reporting by Neil Ford

Editing by Robin Sayles