Iberdrola buys US utility PNM in growth push; EDF snaps up 4.5 GW of US solar projects

Our pick of the latest solar news you need to know.

Related Articles

Iberdrola subsidiary Avangrid buys US utility PNM

Spain's Iberdrola is to acquire US utility PNM Resources through its US subsidiary Avangrid, expanding its regulated asset base and becoming the third-largest renewable energy company in the US, Iberdrola announced October 21.

Approved by PNM's Board of Directors, the deal values PNM at $8.3 billion, for which Iberdrola will pay $4.3 billion in cash and assume a net debt plus other adjustments of around $4 billion.

PNM is the power utility for New Mexico and Texas and owns 2.8 GW of generation capacity. The group sources around half of its power from zero carbon sources.

Texas annual solar installations

(Click image to enlarge)

Source: Solar Energy Industry Association (SEIA)

The deal will expand Avangrid's regulated asset base to 10 regulated companies across six states. Avangrid already owns 8.1 GW of power generation capacity and has operations in 24 states. As of October 20, the company had a market value of $16.8 billion and an enterprise value of $25.7 billion.

The transaction must be approved by shareholders and state and federal regulators and is expected to be completed in 2021.

Iberdrola plans to spend 10 billion euros ($11.8 billion) in 2020 and is rapidly expanding its renewable energy capacity.

The PNM buyout is Iberdrola's eighth corporate acquisition since the start of the COVID-19 pandemic. Previous acquisitions were in France, Scotland, Sweden, Australia, Japan and Brazil. By the end of September, the group had spent 6.6 billion euros, a rise of 23% on a year ago. Net profit in January-September climbed by 4.7% to 2.7 billion euros.

In 2019, Iberdrola installed 5.5 GW of new global power capacity, five times its annual average over the previous few years, the Spanish utility said in February.

EDF acquires 4.5 GW of solar projects in PJM market

EDF Renewables North America has acquired 4.5 GW of solar projects from developer Geenex in order to accelerate its growth in the PJM wholesale electricity market area, the company announced October 16.

The PJM wholesale network spans numerous states in Eastern U.S. The project portfolio includes over 20 solar projects at various stages of development that are scheduled to come online from 2023 onwards, EDF said.

Controlled by the French state, EDF aims to double its global renewable energy capacity to 50 GW by 2030.

Geenex holds the largest solar development pipeline in the PJM area and had sold over 1.9 GW of projects prior to the EDF purchase.

Geenex has completed over 300 MW of projects and has a further 340 MW under construction, according to the company's website. Projects under development include the giant 577 MW Fox Squirrel project in Madison County, Ohio.

US solar costs drop 9% in a year: Lazard

The levelised cost of new US solar plants fell by 9% over the last year and are now between $31/MWh and $42/MWh, depending on local factors, Lazard consultancy said in its latest annual levelised cost of energy (LCOE) report.

In contrast, the cost of US onshore wind fell by just 2%, compared with 4% in the previous year, highlighting the slowdown in cost reductions following years of declines, Lazard said. Wind power costs are now estimated at between $26/MWh and $54/MWh.

Including subsidies, the average cost of new build solar is now around $31/MWh, compared with $26/MWh for wind projects.

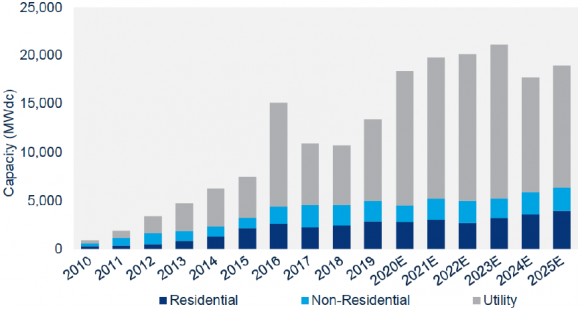

The US remains on track to install a record 18 GW of solar power capacity in 2020 due to strong activity in utility-scale projects, the Solar Energy Industry Association (SEIA) and Wood Mackenzie said in their latest joint quarterly market report.

US solar installation forecast by sector

(Click image to enlarge)

Source: 'Solar Market Insight Report,' SEIA and Wood Mackenzie, September 2020.

Lithium ion battery storage costs continue to fall, mainly driven by falling battery costs rather than savings in balance of system or operations and maintenance (O&M), Lazard said.

“As the costs of utility-scale wind and solar continue to decline and compete with the marginal cost of conventional energy generation, the focus remains on tackling the challenge of intermittency,” George Bilicic, Vice Chairman and Global Head of Lazard’s Power, Energy & Infrastructure Group, said.

Australia accelerates giant green hydrogen project

The Australian government has awarded "major project status" for a giant 26 GW solar and wind project in Western Australia to produce green hydrogen and green ammonia.

The $36-billion Asian Renewable Energy Hub (AREH) project would be built on a site spanning 6,500 square kilometres in the Pibara region. Project partners include green hydrogen developer InterContinental Energy, renewables developer CWP Energy Asia, wind turbine supplier Vestas and investment group Macquarie.

The major project status recognises the national economic significance of the project and enables the government to fast-track project approvals.

Under the plan, the capacity would be built in phases and 23 GW would be used to produce green hydrogen and green ammonia, for export and domestic markets. The remainder of the capacity would be used to power local businesses.

Earlier this month, AREH received environmental approval from the Western Australian government for a first stage comprising 10 GW of wind capacity and 5 GW of solar.

The project partners plan to make a final investment decision by 2025.

Scatec buys hydroelectric group with eye on floating solar

Norway's Scatec Solar has agreed to buy hydroelectric plant developer SN Power from the Norwegian Investment Fund (Norfund) for $1.1 billion.

The deal diversifies Scatec's renewable energy portfolio and opens up new project opportunities such as floating solar plants at hydroelectric facilities, the company said October 16.

The combined company will have 3.3 GW of solar, wind, energy storage and hydroelectric capacity in operation or under construction. By end of 2021, Scatec aims to reach 4.5 GW.

"With this transaction we see great potential in broader project origination and geographical expansion into growth markets in South East Asia and Sub-Sahara Africa," Raymond Carlsen, CEO of Scatec Solar, said.

The transaction is subject to regulatory approval.

Reuters Events