Europe unveils plan to hike green growth; Lithium-ion battery costs to hit $100/kWh by 2023

Our pick of the latest solar news you need to know.

Related Articles

European Commission unveils plan to accelerate renewables growth

The European Commission unveiled September 17 how it plans to reduce EU greenhouse gas emissions by at least 55% by 2030, compared with 40% under current policy measures.

One of the measures will be to increase the target for renewable energy in 2030 from 32% to 38-40%, the EC said.

The EC has tabled an amendment to the European Climate Law to include the 55% emissions target and the commission will publish detailed legislative proposals on how to achieve this by June 2021. Based on current National Energy and Climate Plans filed by EU member states, renewable energy could reach 34% of power generation by 2030, it said. The commission has pledged to reform the EU Emissions Trading System, which could significantly benefit renewable energy developers.

"The lack of carbon pricing in the building and the transport sector was a missing link of Europe’s climate strategy, to encourage electrification and increase the use of solar electricity in these sectors," Aurelie Beauvais, Policy Director of industry group SolarPower Europe, said in a response statement. "The European Commission confirmed that it will address this gap and review the EU ETS regulations and Energy Taxation Directive to establish a level playing field between renewables and fossil fuels," Beauvais said.

The new targets will help to boost Europe's economic recovery from the COVID-19 pandemic, the EC said.

"Member States can draw on the 750 billion-euro [$873.9 billion] NextGenerationEU recovery fund and the EU's next long-term budget to make these investments in the green transition. To support the necessary investments, the Commission has also adopted today the rules for a new EU Renewable Energy Financing Mechanism, to make it easier for Member States to work together to finance and deploy renewable energy projects," it said.

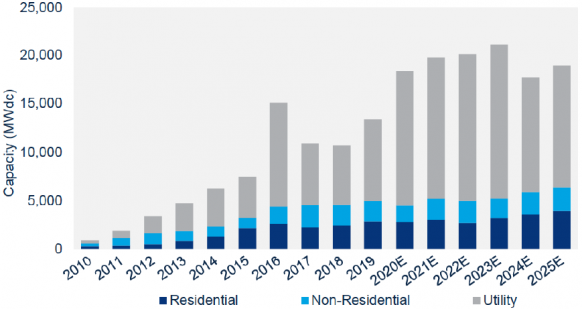

US utility-scale PV hits record activity but funding risks loom

The US remains on track to install a record 18 GW of solar power capacity in 2020 after strong utility-scale activity in Q2 2020 outweighed the impact of COVID-19 lockdowns on the distributed solar segment, the Solar Energy Industry Association (SEIA) and Wood Mackenzie said in their latest joint quarterly market report.

US developers installed 3.5 GW of solar power in the second quarter, up by 52% on a year ago, due to a record 2.5 GW of new utility-scale capacity.

Strong demand for utility-scale projects is set to continue in the coming years as falling costs for PV and energy storage combine with rising renewable energy targets from corporates and utilities. A further 8.7 GW of new solar power purchase agreements (PPAs) were signed in the second quarter, expanding the total contracted capacity to a record 62.2 GW.

US solar installation forecast by sector

(Click image to enlarge)

Source: 'Solar Market Insight Report,' SEIA and Wood Mackenzie, September 2020.

The pandemic has thus far caused few procurement delays for utility-scale projects but the availability of tax equity and other financing is a concern, SEIA said.

"With increasing frequency, banks and investors are showing signs of insufficient tax equity investment for all projects in development," the industry group said.

"In addition to the tightness of tax equity markets, the cost of debt has also crept up a few basis points as debt providers have become wary of non-traditional investments," it said.

Some developers are also concerned there is not enough engineering procurement construction (EPC) capacity to supply the record number of projects currently under development, SEIA warned.

US FERC approves wholesale distributed energy trading

The US Federal Energy Regulatory Commission (FERC) approved September 17 a new ruling which enables aggregators of distributed energy resource (DER) to participate in wholesale power markets.

Order 2222 will allow the aggregation of small-scale power generation, energy storage, electric vehicles and demand response resources connected to the distribution grid or behind the meter. Regional grid operators will be required to adjust tariff mechanisms accordingly. The aggregated portfolios could have a significant impact on supply-demand balances and future generation needs.

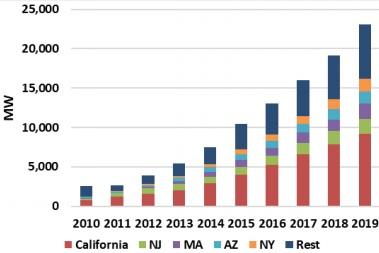

In states such as California, net metering programs have incentivised new DER projects. Net metering allows customers with on-site generation to sell power back to the grid. Total US DER capacity using net metering rose by 4 GW in 2019 to 23 GW, data from the Energy Information Administration (EIA) shows.

US cumulative net metered capacity

Source: FERC's 'State of the Markets' report, March 2020.

Data source: EIA

Since 2018, energy storage assets have been eligible to participate in wholesale markets under FERC Order 841. In July, the Court of Appeals for the District of Columbia Circuit (D.C. Circuit Court) upheld Order 841 following appeals from the National Association of Regulatory Utility Commissioners and the American Public Power Association, amongst others, to opt out.

“Today FERC broke new ground towards creating the grid of the future by knocking down barriers to entry for emerging technologies,” FERC Chairman Neil Chatterjee said September 17.

“With this final rule on DERs, we build on the significant progress already made through Order 841 and expand our ability to harness the full potential of these flexible resources. By relying on simple market principles and unleashing the power of innovation, this order will allow us to build a smarter, more dynamic grid that can help America keep pace with our ever-evolving energy demands," Chatterjee said.

The US Solar Energy Industry Association (SEIA) welcomed the ruling.

"This rule embraces the trend of increasing use of distributed resources and provides much-needed clarity to grid operators on how to harness the energy and ancillary services they provide," Katherine Gensler, vice president of regulatory affairs at SEIA, said.

Lithium-ion battery costs to drop below $100/kWh in 2023

The average cost of lithium-ion battery cells will fall below $100/kWh in 2023 as larger factories reduce manufacturing costs, research group IHS Markit said in a note September 23.

By 2030, average battery cell costs will fall to $73/kWh on greater economies of scale and lower material costs due to more efficient designs and improvements in energy density, the research group said. Back in 2013, costs were around $680/kWh.

The cost of Iron Phosphate (LFP) cells has already fallen below $100/kWh and will continue to remain the lowest cost option, IHS Markit said. The other two major types of lithium-ion battery cells, Nickel Manganese Cobalt (NMC) and Nickel Cobalt Aluminum (NCA), will retain a majority share of the automotive and transport sector due to higher energy density, it said.

"Technology advances and competition between the different types of lithium-ion batteries is driving prices down," Youmin Rong, senior analyst, clean energy technology at IHS Markit, said. "Ultimately, the two major growth markets - transportation and electric grid storage - depend upon lower costs to make batteries more competitive with the internal combustion engine and fossil fuel power generation,” he noted.

An increasing number of solar developers are including battery storage in their projects to gain higher revenues during peak demand.

By 2025, one-fifth of new US utility-scale PV plants will be paired with energy storage, the Solar Energy Industry Association (SEIA) and Wood Mackenzie said in their latest joint quarterly market report.

Reuters Events