DuPont predicts closer ties with solar operators

Durability and maintenance efficiency are key drivers in Dupont's bifacial module R&D and materials groups will work more closely with solar operators going forward, Ethan Simon, Global R&D Director for Photovoltaics and Advanced Materials at DuPont, told the Reuters Events PV Operations and Financial Strategies 2020 conference.

Related Articles

As the solar market matures, greater collaboration between different parts of the industry will be key to maximising asset returns.

Capital costs are continuing to fall on technology advances and design improvements, increasing the competitiveness of solar and boosting growth outlooks. Modules are becoming larger and more efficient and new bifacial models that offer higher output are claiming a growing share of the market.

The levelised cost of new US solar plants fell by 9% over the last year and are now between $31/MWh and $42/MWh, depending on local factors, Lazard consultancy said in a report last month.

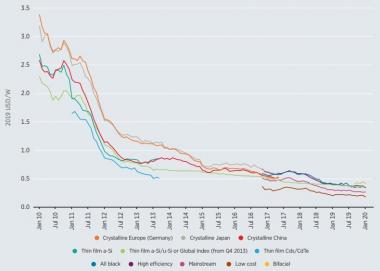

PV module prices by technology, supplier country

(Click image to enlarge)

Source: IRENA's 'Renewable Power Generation Costs 2019' report.

Global PV prices will continue to fall at learning rates of over 23% in the coming years, due to improvements in wafer and cell performance, advances in bifacial cells and improved layouts, according to the latest annual Photovoltaic Roadmap (ITRPV) by German engineering industry group VDMA. This implies selling prices will fall by over 23% for every doubling in cumulative PV shipments.

To maximise revenues, solar owners are predicting longer lifespans and expanding their knowledge of technology and operations and maintenance (O&M) practices. This is driving new relationships along the value chain.

"As we move through this rapid growth phase of the PV industry, I think we will see increased collaboration between people who have knowledge about material science design and the people who have knowledge about operating and maintaining plants," Simon told the conference on November 12.

"We are materials scientists...Over the past few years, though, in part pooled by our experience in doing field studies and having conversations with people downstream, we find we are beginning to think more and more like O&M people," he said.

Longer view

A recent survey by the Lawrence Berkeley National Laboratory (Berkeley Lab) showed that the average life expectancy of US utility-scale PV projects rose to 32.5 years in 2019, compared with 21.5 years in 2007.

Module manufacturers now typically offer warranties of 25 or 30 years. Many plant owners expect lifespans over 35 years, while very few anticipate lifespans below 30 years, the survey showed.

The longer estimates come despite little operational data on long-term performance, particularly for newer technology such as bifacial modules.

"While cutting-edge module technology is stress-tested to estimate design life we don't have empirical data on how they actually perform after 30 years in the field,” Joachim Seel, Senior Scientific Engineering Associate at Berkeley Lab, told Reuters Events earlier this year.

Amid rapid shifts in technologies, suppliers are finding ways to demonstrate durability and increase investor confidence.

DuPont factored in the hunger for longer lifespans in its bifacial materials research, Simon told the conference.

The group developed a clear film module back sheet, based on a polymer back face that has been used in conventional monofacial modules for decades. This allowed the use of existing module structures and manufacturing processes, and the use of proven field data. The clear material also benefited from 20 years of field performance data in an older building integrated PV application.

Field data was combined with accelerated ageing tests.

"[The test] predictions correlate well with decades of existing field data. So what we are able to do is look at that set of field data, correlate the test and then, with confidence, we can move forward to make predictions about future performance," Simon said.

Asset lifespans of 35 years are possible, provided the project uses good quality materials and testing processes and best practices in installation and O&M, he said.

Lasting thoughts

DuPont's clear film avoids the use of a second glass layer in the bifacial module, reducing the weight of the system. This makes them easier to transport and install and also allows the use of a fully-tempered front glass layer with a width of 3.2 mm, rather than the thinner glass widths used in glass-glass modules.

"Untempered glass is prone to breakage... Those materials don't not hold up as well to impact tests or thermal shock tests, which means they will not do as well with hailstorms or hotspots. We see....early [field] evidence bearing up that hypothesis," Simon said.

DuPont has also found that the film allows more infrared heat to dissipate, increasing output by around 1 to 2%, depending on the site conditions. Early field studies also show the lower surface energy on the clear film layer means they retain less dirt than glass back panels and makes them easier to clean, Simon noted.

"This should drive lower maintenance costs," he said.

US solar O&M costs by category (2018)

Source: National Renewable Energy Laboratory (NREL).

Many larger fleet operators are switching to advanced remote or automated cleaning mechanisms to reduce labor costs. However, bifacial modules introduce a new range of variables that impact performance. Many of the first bifacial plants are being built in desert conditions and operational learnings will shape cleaning strategies in the coming years.

Material gains

Suppliers like DuPont are now putting greater focus on the end systems, rather than just the performance of their product, seeking feedback from operators.

At the same time, these groups are helping to diagnose asset underperformance.

"Essentially we are finding we are acting as consultants, using our materials science knowledge to help field owners assess the health of installations, trace issues back to materials, to design, to methods of operation, and propose solutions," Simon said.

"As the industry matures and as fields age, I predict there will be an increased amount of these sorts of partnerships between materials science experts and field operators, as together we keep learning what makes PV fields work well," he said.

Robin Sayles