Solar cost drop spurs scaling up of services

Buyouts show how solar operations and maintenance groups are chasing scale to serve a growing focus on asset performance.

Related Articles

Growing installed PV capacity and increasing cost pressure is spurring consolidation in the operations and maintenance (O&M) sector. O&M suppliers are expanding their businesses to secure a share of the growing O&M market. Annual global solar O&M costs will double from around $4.5 billion in 2019 to $9.4 billion in 2024, as installed PV capacity grows and components age, Wood Mackenzie Power and Renewables said in a report published in October 2019.

Last month, NovaSource, the new O&M subsidiary of private equity group Clairvest, announced it would buy First Solar's North American O&M business. Clairvest created NovaSource in May when it acquired SunPower's O&M business through a management buyout.

NovaSource did not state the size of First Solar's North American O&M business. Globally, First Solar has an O&M portfolio of around 12 GW and reported revenues from O&M services of $107.7 million in 2019. The portfolio NovaSource acquired from SunPower comprises 3 GW of commercial and utility-scale assets across nine countries.

“NovaSource can capitalise on our industry’s tail winds and the expected growth of installed solar assets over the next ten to fifteen years," Jack Bennett, CEO of NovaSource, said in a statement. "...with Clairvest, we will continue to invest in our platform to further enhance our capabilities, reach, and service levels," he said.

Other deals this year include Pearce Services' acquisition of O&M companies MaxGen Energy Services and World Wind & Solar, through a partnership with private equity group New Mountain Capital.

"Over the past few years there’s been a heavy competition within [O&M] outsourcing,” David Feldman, a senior financial analyst at the US National Renewable Energy Laboratory (NREL), told Reuters Events.

“There are a lot of companies trying to streamline their operations and business models, and outsourcing operations can often lead to a more strategic and efficient use of your available capital,” he said.

Race for scale

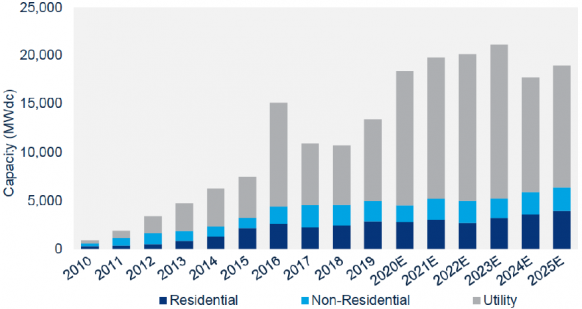

US solar installations are forecast to hit a record 18 GW in 2020 as strong demand for utility-scale projects outweigh the impact of COVID-19 lockdowns, according to the latest quarterly market report by the Solar Energy Industry Association (SEIA) and Wood Mackenzie, published earlier this month.

Strong demand for utility-scale projects is set to continue in the coming years as falling costs for PV and energy storage combine with rising renewable energy targets from corporates and utilities.

Forecast US solar installations by segment

(Click image to enlarge)

Source: SEIA, Wood Mackenzie (September 2020)

Larger O&M suppliers can optimise labour deployment across multiple projects and gain greater economies of scale from data analytics and automation technologies. Many fleet operators use centralised control centres and some have invested in spare parts distribution facilities and shared spare parts networks to minimise delivery delays.

Pearce's acquisition of MaxGen and WWS will bring large "strategic value to the combined platform, including scale for technology and analytics investments, service density to continue driving industry leading response times, and complementary cultures focused on safety and quality,” it said.

Many larger solar developers are also expanding their O&M divisions to manage growing fleets and gain a share of the third-party service market.

Developer Invenergy plans to expand its solar operations portfolio by around 3 GW within the "next few years," Brad Purtell, Director, Services Business Development at Invenergy, told Reuters Events in October 2019.

Invenergy has developed in-house analytics to accelerate growth in solar services and predicts more complex roles and wider technology knowledge within maintenance teams, Purtell said. Service groups will need to keep up-to-date with new controls and hardware, such as bilateral panels and energy storage.

Larger O&M groups like NovaSource can also capitalise on the global spread of PV capacity. By 2022, some 19 countries are forecast to install between 1 GW and 5 GW of solar power per year, compared with just seven countries in 2018, Wood Mackenzie said last year. International growth presents revenue opportunities and additional data that can be fed back into performance analysis.

Asset care

Until recently, solar owners have typically minimised O&M spending, but falling capex costs have increased the importance of O&M efficiency.

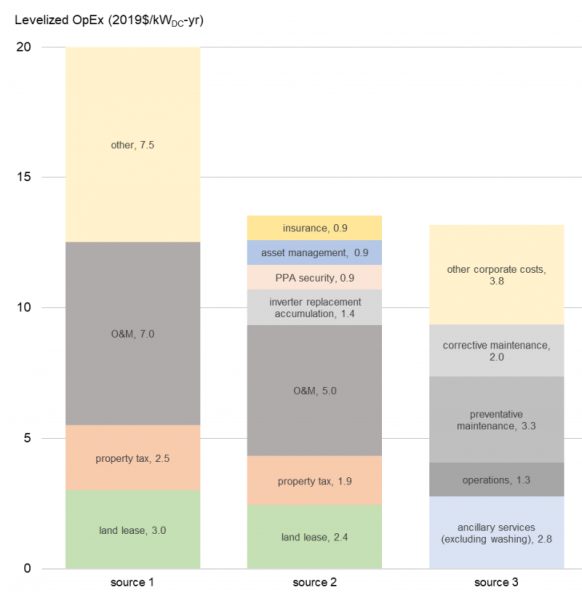

Competition has slashed O&M prices. US O&M costs were between $5,000 and $8,000/MW/year in 2019, according to a survey of industry professionals by the Lawrence Berkeley Lab. Most contracts are currently being signed at between $3,000 and $5,000/MW/year, Daniel Liu, Wood Mackenzie Principal Analyst, said. Many of these lower cost O&M contracts do not include proactive activities that can significantly impact performance, such as vegetation management and module cleaning.

US solar opex estimates in 2019

(Click image to enlarge)

Source: Berkeley Lab's 'Benchmarking Utility-Scale PV Operational Expenses and Project Lifetimes' report (June 2020).

"Over the past few years there’s been heavy competition and a lot of outsourcing...some people are saying that prices are too low, and something’s got to give,” Feldman said.

“After a period of declining prices for O&M services, we believe the market has found equilibrium," Bennett told Reuters Events in a Q&A session in June. O&M operators are "finding efficiencies to deliver competitive pricing and quality service" and customers are starting to differentiate and select higher quality operators, he said.

Aligning goals

To optimise performance, developers must align incentives in O&M contracts with their own interests and owners are increasingly inserting performance incentives in contracts.

"You need to make sure the O&M company is really doing its job, as the developer’s name will still be on the project, a project that could be experiencing low productivity,” Feldman said.

More comprehensive contracts provide greater scope for performance-linked guarantees, but many operators may choose to limit third-party services to day-to-day repairs and cleaning, and perform more significant or strategic maintenance activities in-house, Feldman said.

Many utilities and larger solar owners have chosen to perform O&M in-house to expand their expertise of the technology and gain greater control over operational strategies.

“For example, if it’s a bifacial module, it's designed in a specific way, for a specific place, and the way the developers or owners want to operate it might be different to how the O&M [provider] sees the operation,” Feldman said.

As fleet sizes grow and technologies evolve, the US is set to see much larger O&M businesses, whether owner-operators or third-party groups.

Reporting by Ed Pearcey

Editing by Robin Sayles