New US clean energy jobs plummet; First Solar sells O&M division to NovaSource

Our pick of the latest solar news you need to know.

Related Articles

New US clean energy jobs drop to 3,200 in July

New clean energy jobs fell to 3,200 in July, from 106,000 in June, showing support is needed from Congress to stimulate job recovery, renewable industry groups said in a statement August 12.

Clean energy includes renewable energy, energy efficiency, grid modernization, clean vehicles and fuels. In May, the US Solar Energy Industry Association (SEIA) warned COVID-19 had cut 65,000 solar jobs and cancelled the creation of around 50,000 expected new roles.

Research by BW Research for E2, E4TheFuture, and the American Council on Renewable Energy (ACORE) showed that just one out of every six clean energy jobs lost since March has been recovered.

More than half a million clean energy workers remain jobless, representing 15% of the workforce, the report said. Between 2015 and 2019, clean energy jobs grew 70% faster than the overall economy.

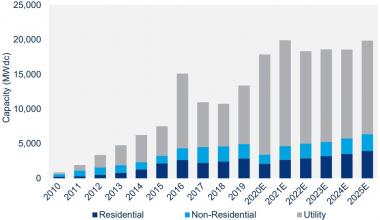

Forecast US solar installations by segment

(Click image to enlarge)

Source: Wood Mackenzie, SEIA (June 2020)

"As federal Paycheck Protection Program (PPP) funds are exhausted and businesses are forced to close or scale back due to COVID-19’s resurgence, more layoffs could be imminent without congressional action," the industry groups said.

"What is needed most right now is temporary refundability of renewable tax credits so projects can continue to move forward despite an increasingly constrained tax equity market, and a delay in the scheduled phasedown of existing tax credits," Gregory Wetstone, President and CEO of ACORE, said.

First Solar sells O&M division to growing NovaSource group

US module manufacturer First Solar is to sell its North American operations and maintenance (O&M) business to NovaSource, the new O&M subsidiary of Toronto-based private equity firm Clairvest Group, as it shifts to a third-party project development model, First Solar announced in its Q2 results on August 6.

NovaSource was created in May, when Clairvest acquired SunPower's 3 GW O&M business through a management buyout.

Competition in O&M is intensifying as project owners seek lower costs.

"Further business optimisation would require increased scale, product offerings, capital," First Solar said in its Q2 earnings presentation.

In October, First Solar said it would close its engineering procurement construction (EPC) business to concentrate on its core businesses of module manufacturing and project development.

Under a third-party EPC model, First Solar will "leverage a much broader external ecosystem of knowledge and expertise," Mark Widmar, CEO of First Solar, said.

First Solar's EPC shift comes as intense price competition impacts margins across the sector. Solar projects are also becoming more complex, using innovative layouts and new technologies like energy storage to increase market value.

First Solar recorded net sales of $642 million in the second quarter, some $110 million higher than in Q1, primarily due to the sale of its 128 MW American Kings project in California.

The group maintained its 2020 module production outlook at 5.9 GW and capital spending forecast at $450 to $550 million.

“We remain pleased with our operational performance with strong metrics across the board,” Widmar said.

While First Solar's financial results have not been "materially impacted" by COVID-19, the group will continue to provide limited guidance due to significant uncertainty over the severity and duration of the pandemic, it said.

Vistra gains permit for potential 1.5 GW battery in California

Texan energy group Vistra has been granted a permit to expand its Moss Landing energy storage facility in Monterey, California, to 1.5 GW/6 GWh, S&P Global reported.

Vistra is already building 300 MW of battery capacity at the Moss Landing power plant site and intends to add a further 100 MW by 2021. An expansion to 1.5 GW would make it the largest battery facility in the US.

The Moss Landing site hosts a 1.0 GW operational gas-fired plant and several decommissioned fossil fuel units and offers extensive space for battery development.

Vistra would expand the storage project “should market and economic conditions support it,” Curtis Morgan, CEO of Vistra reportedly told S&P Global.

“With this new permit in place, Vistra is working on the related infrastructure upgrades so that we will be able to move quickly when opportunities to add additional storage capacity arise,” he said.

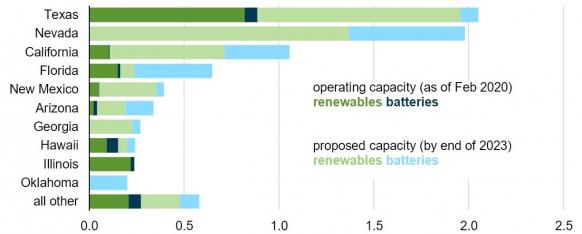

A spate of large US battery storage projects is due online in the coming years.

In 2019, the number of US solar plus storage projects, either announced or online, rose from 16 to 38, the Lawrence Berkeley National Laboratory (Berkeley Lab) said in a report.

By 2023, the number of US solar and wind assets co-located with batteries will double to 109, the US Energy Information Administration (EIA) said in May.

Top 10 US states for renewables plus storage

(Click image to enlarge)

Source: U.S. Energy Information Administration (EIA), Preliminary Monthly Electric Generator Inventory

In May, Quinbrook Infrastructure Partners received full federal approval for its groundbreaking 690 MW Gemini solar plus storage project in Nevada.

Located 33 miles north east of Las Vegas, the Gemini plant will include a 380 MW AC battery storage system, providing 2,125 MWh of storage capacity, proposal documents show.

Reuters Events