California grid plan could offer shorter queues across the Southwest

California has agreed to build upfront bulk transmission that will support solar, wind and storage projects across the Southwest region in a proactive move aimed at tackling connection delays.

Related Articles

California plans to spend $7.3 billion on 45 new power transmission projects by 2030 that will support the construction of 17 GW of solar capacity, 8 GW of wind and numerous battery storage projects, under plans approved by the grid operator CAISO last month.

CAISO will prioritize the connection of power plants where they “make the most economic and operational sense”, including areas with high solar and wind resources, and storage projects closer to the high load centres of the Los Angeles Basin, San Francisco's Bay Area and San Diego, it said.

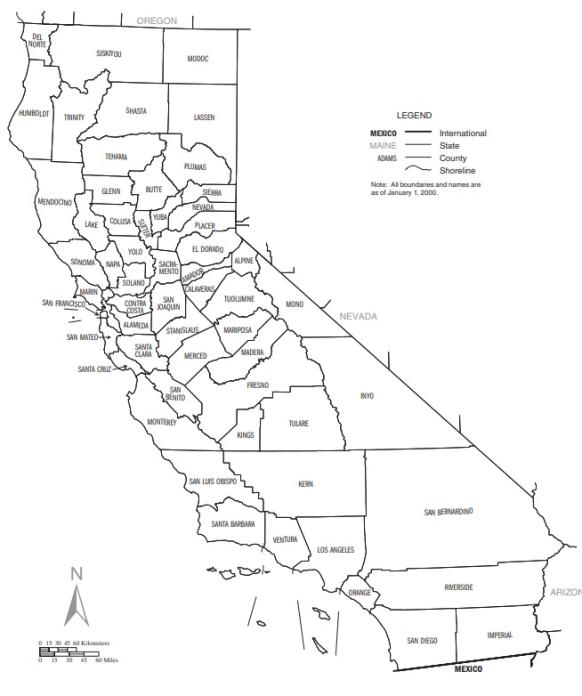

The plan, developed in coordination with the California Public Utilities Commission (CPUC) and the California Energy Commission, will support solar development in the Westlands area of the Central Valley, the southern areas of Tehachapi, the Kramer area in San Bernardino County and Riverside County as well as southern Nevada and western Arizona.

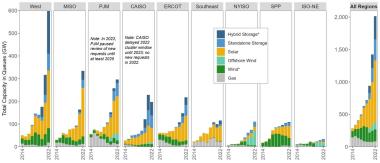

Across the United States, a lack of grid capacity and soaring connection queues are preventing renewable energy developers from installing the capacity required to meet ambitious national carbon reduction objectives. Connection approvals can take several years and last year CAISO shelved new applications for connections to tackle a backlog of projects. Eastern network operator PJM also paused new applications and developers flocked to the West region outside CAISO, causing applications to leap 306 GW and leave 597 GW of capacity in queues.

Power capacity in U.S. grid connection queues

(Click image to enlarge)

Source: Berkeley Lab, April 2023

Developers have called for more upfront transmission planning to make the process more efficient. CAISO's coordinated development of bulk transmission ahead of time “should reduce grid interconnection delays," a spokesperson for French-owned developer Engie North America, told Reuters Events.

The plan is “more proactive than we have seen in prior years” and serves as a potential model for other U.S. regions, the spokesperson said.

Solar openings

The strengthening of connections with Nevada, Arizona and New Mexico will enable increased imports from large-scale solar projects under development in those states.

Key transmission projects in the plan include new 500 kV lines from the Arizona border into southern Imperial County, and from southeastern Nevada to the eastern edge of the LA Basin. Other connections will be upgraded, including the 230 kV lines along the Interstate 10 highway that runs from LA to Phoenix and the Lugo–Victor–Kramer line that runs up the centre of California.

Large wind resources planned in Wyoming, New Mexico and Idaho should also “all benefit from the improved transfer capacity and expansion of [connection] points on CAISO’s eastern border," Patrick Ferguson, a renewable energy lawyer at Orrick, told Reuters Events.

The counties of California

(Click image to enlarge)

Source: U.S. Census Bureau

Solar developers will benefit from lines to Southern Nevada and Arizona, such as the Eldorado-Lugo-Mojave and East of Pisgah lines. Several gigawatts of new solar and storage projects will gain grid access through a new Ten West Link connecting Blythe in Riverside County to Tonopah in Arizona, a spokesperson for grid consultants GridSME said.

There are currently 135 solar projects in the CAISO connection queue totalling 31 GW, the spokesperson said. Most projects either include storage or provide an option to add it later.

“Because the CAISO and CPUC have significantly discounted the capacity value of solar-only resources, most solar projects include storage so that they can be deliverable in the evening hours and thus qualify to sell a larger volume of resource adequacy capacity," Ferguson said.

Now the plan is approved, CAISO will move towards a "competitive solicitation process" for the first high-voltage lines, it said in a statement.

"The competitive solicitation process for the greenfield projects recently approved by the ISO Board will start in June 2023, with the selection of the approved project sponsors anticipated in May 2024," a CAISO spokesperson said.

Cost risks

Developers will bid for clusters of grid capacity on the new transmission infrastructure or be assigned the capacity following previous applications. The Southwest Power Pool (SPP) grid operator has already used cluster-based assessments to reduce connection queues.

CAISO said long lead times and operational life of the new transmission lines would help minimise the cost increase for consumers, which would be determined through the regulated utility process. Customers have already been hit by cost increases that will fund energy storage integration and measures that protect the grid from wildfires.

Timelines of the projects will depend on the results of the bidding processes with developers, but some could also encounter hurdles during permitting, environmental review, and land acquisition.

Project stakeholders will need to work with numerous federal and state agencies such as the Bureau of Land Management, National Park Service, Bureau of Indian Affairs and CPUC, the GridSME spokesperson said.

Some areas currently have local moratoriums on utility-scale projects because of “issues with land space, community [opposition], proximity to military bases, and biological, environmental, cultural and archaeological resources,” the spokesperson said. For example, San Bernadino County has a ban on utility-scale solar projects in place in rural areas plus 14 specific communities, although “community-related renewable energy” projects are allowed.

CAISO will continue to build out its transmission plan and next year it expects to identify the need for 70 GW of new capacity by 2033, to meet increased demand from the transportation and building sectors. By 2045, some 120 GW of new capacity could be needed to reach the state's clean energy goal of a carbon-free power system, it said.

Next year's plan could include upgrades to connect new offshore wind farms on California's northern coast, a spokesperson for the American Clean Power Association (ACP) said.

The California Energy Commission (CEC) aims to install 2 to 5 GW of floating wind capacity by 2030 and last December federal authorities awarded the first five commercial floating wind leases off Central and Northern California.

Reporting by Neil Ford

Editing by Robin Sayles