US East Coast floating wind farm offers springboard for growth

The 144 MW project in Maine will generate local performance data that propels large-scale floating wind deployment, if it passes environmental tests.

Related Articles

Last month, the U.S. Bureau of Ocean Energy Management (BOEM) started an environmental assessment of the first utility-scale floating wind farm in the United States.

The 144 MW project would be located 20 nautical miles off the coast of Maine and developed by Aqua Ventus, a partnership between Mitsubishi subsidiary Diamond Offshore Wind and German energy group RWE.

Construction of the 12 wind turbines could start in early 2024. The BOEM expects to issue a research lease for a 9,700-acre area by the end of this year, by which time Pine Tree Offshore Wind, a sister company of Aqua Ventus, aims to have a long-term power purchase agreement (PPA) in place with the Maine Public Utilities Commission (PUC).

The PPA will be the "first official procurement authorization for floating offshore wind power in the U.S.," Celina Cunningham, deputy director at the Governor’s Energy Office in Maine, told Reuters Events.

Meanwhile, state lawmakers are seeking to authorise the broader procurement of offshore wind in a new bill that sets clear goals and a schedule for a competitive bidding process. The Gulf of Maine hosts 156 GW of potential offshore wind capacity but the waters are generally too deep for conventional fixed-bottom technology.

The Aqua Ventus project uses a concrete-based substructure designed by the University of Maine that reduces steel usage and sources material from local manufacturers, Chris Wissenman, CEO of Diamond Offshore Wind, said.

Data from the project will be made available to commercial developers, helping them build confidence in floating wind technology and attract investors as they develop much larger arrays in the coming years.

The BOEM has issued its first leases for large-scale floating wind in California and the Aqua Ventus project will help to propel East Coast projects forward.

Maine could see commercial lease auctions in early 2025 and the insights from the Aqua Ventus project will be "instrumental in developing best practices," Walt Musial, principal engineer and leader of the offshore wind research platform at the National Renewable Energy Laboratory (NREL), said.

Project developers and stakeholders "can get information through the Maine research array in advance,” Musial said.

Performance data

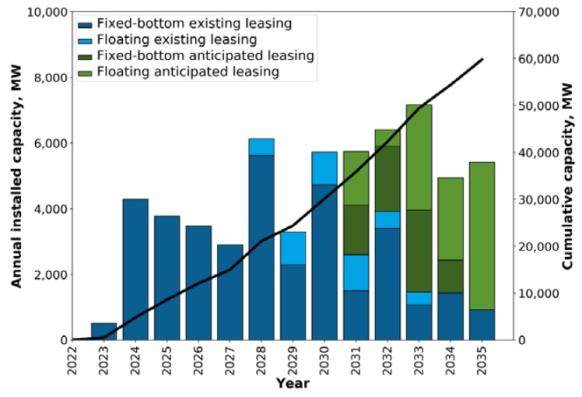

U.S. floating wind progress comes ahead of a surge in fixed-bottom offshore wind deployment this decade.

The Biden administration aims to install 30 GW of offshore wind by 2030, a hugely ambitious target, drawing on learnings from the more mature European market.

Last year, the administration set a target of 15 GW of floating wind capacity by 2035 and said it would look to reduce floating wind costs by 70% to $45/MWh.

Forecast U.S. offshore wind installations

(Click image to enlarge)

Source: Department of Energy report on U.S. offshore wind supply chain, June 2022

The U.K.'s first state-backed floating wind contract showed costs will fall if risks can be managed. Hexicon secured a 15-year contract at a highly competitive strike price of 87.3 pounds/MWh ($108.4/MWh) for a 32 MW project, in line with fixed-bottom offshore wind prices just a few years ago, albeit at a demonstration site 16 km from the coast.

Lower floating wind costs in the U.S. will require a buildout of supply chain and port infrastructure that provides economies of series to large-scale projects. To attract investment, developers must prove the technology can operate at scale.

The Aqua Ventus project will gather performance data on turbines, mooring systems, chains, anchors and environmental monitoring.

The project partners also hope to show that concrete floating wind substructures can be more cost-effective than steel.

Concrete can be manufactured locally, whereas steel would require "capital-intensive rolling mills and fabrication facilities that just do not exist on the East Coast," Wisseman said.

Volatile global steel prices in recent years have been a key challenge for offshore wind developers due to significant usage in wind turbines and the monopiles used for more conventional fixed-bottom windfarms.

Fishing feedback

The Aqua Ventus project will test the ability of floating wind farms to co-exist with local fisheries.

In December, the Maine Lobstermen’s Association (MLA) said the federal authorities were moving too fast in developing offshore wind in the Gulf of Maine and other parts of the East Coast. Concerns include access to fishing areas and the impact on endangered right whales and any knock-on effect on lobster fisheries. A group of environmental associations requested a full environmental impact analysis before development areas were designated and this was denied by federal authorities.

Stakeholders will be engaged in the planning process, Wissenman noted.

"For us to have a sustainable future, you have to really figure out what's best for all parties involved,” he said.

To inform its environmental assessment, BOEM held a 30-day public consultation that ended on June 5.

"BOEM appreciates the value of research demonstration projects to advance floating wind technology,” BOEM Director Elizabeth Klein said in a statement.

“The Tribes, states, ocean users and stakeholders in the Gulf of Maine have valuable expertise on the issues facing this region, and we look forward to collaborating and working with everyone as we move forward.”

Reporting by Nish Amarnath

Editing by Robin Sayles