EU grid action sets course to faster offshore wind growth

Europe is fast tracking the development of international offshore transmission hubs that will create a clearer wind deployment outlook, if funding can be found.

Related Articles

European efforts to accelerate renewable energy growth following Russia's invasion of Ukraine are set to bring an interconnected offshore wind grid closer to reality.

The European Commission (EC) recently identified 12 offshore grid projects as projects of common interest (PCIs), allowing them to bid for European Union funding this year and gain faster permit approvals. The EC wants to double cross-border power capacity in the EU by 2030, adding 87 GW of onshore and offshore lines in just seven years.

Four of the identified projects will be in the North Sea, where offshore wind capacity is set to surge in the coming years, and they come alongside fast-tracked projects of mutual interest (PMIs) that forge stronger links between the EU and the UK.

Last year, North Sea country leaders pledged to install 120 GW of offshore wind capacity by 2030, up from 34 GW currently, to accelerate reductions in carbon emissions and reduce their reliance on Russian gas.

The PCIs include the early-stage development of a North Sea Wind Power Hub (NSWPH) that would consist of several offshore hubs with combined capacity of 70 to 150 GW by 2040, rising to 180 GW by 2045.

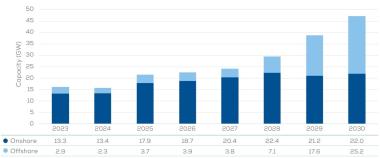

Forecast annual wind installs in European Union

(Click image to enlarge)

Source: WindEurope, February 2024

Offshore wind has thus far been developed using radial links to shore but new sites are shifting further offshore and developers are calling for pre-emptive development of meshed offshore grids to reduce transmission costs and risks.

The future European offshore system will be a combination of radial connections, cross-border interconnections and hybrid projects combining both functions, a spokesperson for TenneT, transmission operator in Netherlands and part of Germany, told Reuters Events.

For the first time, grid infrastructure is “being developed ahead of the new generation deployment,” Johan Soderstrom, Head of Europe, Middle East & Africa at Hitachi Energy, said.

Hitachi supplied equipment to the pioneering 400 MW Kriegers Flak hybrid offshore link between Germany and Denmark and the company has signed a 2 GW framework agreement with TenneT to supply offshore and onshore HVDC converter stations and related infrastructure.

Work accelerates

Enhanced integration of EU power markets will “reduce renewable energy curtailment, lower dependency on gas power plants and improve security of supply," a spokesperson for the European Network of Transmission System Operators (ENTSO-E) told Reuters Events.

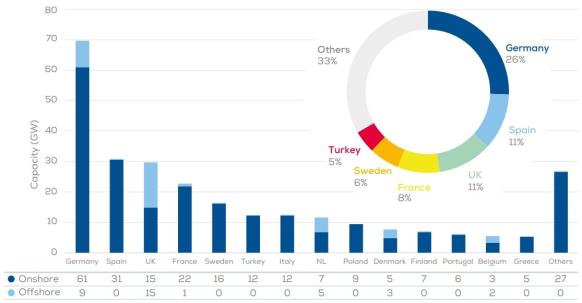

The latest offshore wind targets set by European countries will require massive grid expansion across the region. According to ENTSO-E, European offshore wind capacity could hit 382 GW by 2040. This represents an average growth rate of 22 GW a year, far exceeding the rate of 2.5 GW a year seen over the last decade.

The EU and UK installed a total 4.2 GW offshore wind in 2023 but EU countries plan to auction 40 GW of capacity this year, up from just 13.5 GW in 2023, while the UK could auction a further 10 GW, according to industry group WindEurope.

Installed wind power in Europe by country (end 2023)

(Click image to enlarge)

Source: WindEurope, February 2024

The North Sea Wind Power Hub, a joint project by Dutch grid operator TenneT, Danish grid operator Energienet, gas transmission operator Gasunie and the Port of Rotterdam, proposes the deployment of offshore wind hubs of capacity 10 to 15 GW.

The project would include power to gas infrastructure to support clean hydrogen transport and the long-term scope and international cooperation of the proposal will provide wind developers and suppliers with a clear development pipeline and will help to minimise costs, the consortium says.

The other EU PCIs include an offshore hybrid interconnector between Belgium and Denmark and two high voltage offshore substations with connections to France. Hybrid projects connect offshore wind farms to at least two markets and help reduce cabling costs.

Alongside these, national grid operators are developing two PMI's that gain similar benefits to PCI's. The 2 GW LionLink will interconnect the Netherlands and Suffolk in the south of England and the 1 to 2 GW Nautilus link will connect Belgium and Suffolk.

LionLink will offer 2 GW of new Dutch offshore wind capacity direct access to UK and Netherlands markets and will be the first hybrid connector in the two countries. This is far more capacity than the 400 MW Kriegers Flak link in operation since 2020.

LionLink is currently going through the consultation and licensing process and the final investment decision is expected in 2026 with completion slated for 2030.

Funding challenge

Finding the investments required for offshore wind grids will be a huge task.

ENTSOE-E estimates investments of around 400 billion euros ($434.0 billion) are required to "optimally integrate" offshore renewable energy facilities by 2050, according to its Ten Year Network Development Plan (TYNDP). This is based on 383 GW of capacity in EU 27 countries plus 15 GW in Norway and 97 GW in the UK. Huge amounts of investments are also needed for onshore grids.

Private and public funding will be required for PCI projects and one of the main challenges will be accurately allocating the cost and benefits between the affected stakeholders, since benefits can be unevenly spread, a spokesperson for Elia Group, the Belgian transmission operator, said.

Rising costs could also be a problem given the limited number of funding options for these types of infrastructure projects, the spokesperson said.

Alongside its priority projects, the EC has pledged to work with investors to identify “tailored financing models and strengthen dialogue to address obstacles to private financing” for new grid infrastructure and will assess bank lending, debt and equity market instruments, debt guarantees and blended finance.

Grid funding challenges are not limited to Europe. The U.S. federal government recently committed to invest in new onshore power lines in order to de-risk construction costs as it pursues similarly ambitious renewable energy targets.

Reporting by Neil Ford

Editing by Robin Sayles