US federal grid spending boosts prospects in high wind, solar regions

New federal transmission investments will unlock wind and solar projects in Central U.S. and other zones but funding must be spread far wider to meet U.S. climate targets.

Related Articles

Four U.S. power transmission projects awarded federal funds in October will address the lack of grid capacity that's hampering new wind and solar power development.

The Biden administration's Inflation Reduction Act has catalysed wind and solar activity but dwindling grid capacity and slow approval processes are delaying deployment and increasing project costs. New grid connections can take several years, endangering President Biden's target of a decarbonised power sector by 2035.

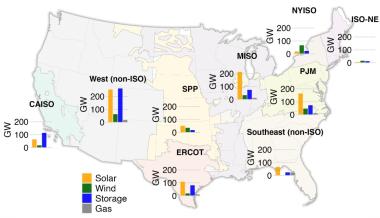

Power capacity in connection queues (end 2022)

(Click image to enlarge)

Source: Lawrence Berkeley National Laboratory

To reduce delays, the Department of Energy (DOE) will provide $1.3 billion to three long-distance transmission lines connecting renewable power generation to load centers in the West and Northeast in the first wave of investments under a new Transmission Facilitation Program (TFP).

In parallel, the DOE's Grid Resilience Innovation Partnerships (GRIP) program will provide $464 million towards coordinated links planned by two transmission operators in the Midwest that will help to unlock around 30 gigawatts (GW) of wind and solar projects clogged up in interconnection queues.

Part of the 2021 Bipartisan Infrastructure Law, the GRIP scheme allocated $3.5 billion to projects that strengthen and expand the U.S. power grid. In November, the DOE announced a second round of funding for an additional $3.9 billion in 2024-2025 and the GRIP program provides a total $10.5 billion in 2022-2026.

The TFP and GRIP programs will help to accelerate the connection of new assets by increasing the interplay between networks, Abe Silverman, director of the Non-Technical Barriers Program in the Center on Global Energy Policy at Columbia University, told Reuters Events.

"Building that connective tissue between the grids enables everything else. Hooking up generators gets cheaper and faster, connecting new manufacturing plants and other large users of electricity gets easier," Silverman said.

Midwest action

The U.S. needs to expand its transmission grid by around 57% to 47,300 GW-miles by 2035 to meet its clean energy targets, based on a scenario of moderate load and high clean energy deployment, the DOE said in a National Transmission Needs Study published in October.

Grids must be reshaped and extended to transfer power from high wind and solar regions to the large load centres. Significant transmission deployment is needed by 2030 in regions including the Great Plains, Midwest and Texas, but the largest benefits will come from increasing interregional transmission.

The GRIP investments in Central U.S. will unlock abundant wind and solar resources within the Midwest Independent System Operator (MISO) network and the Southwest Power Pool (SPP), Silverman said.

MISO and SPP are coordinating the planning, design, and construction of five high-voltage transmission projects across Iowa, Kansas, North Dakota, Nebraska, Minnesota, Missouri and South Dakota. The projects are part of the Joint Targeted Interconnection Queue (JTIQ) Portfolio defined by MISO, SPP, the Minnesota Commerce Department and the Great Plains Institute to speed up new generator connections. The GRIP funding will cover around 25% of transmission costs.

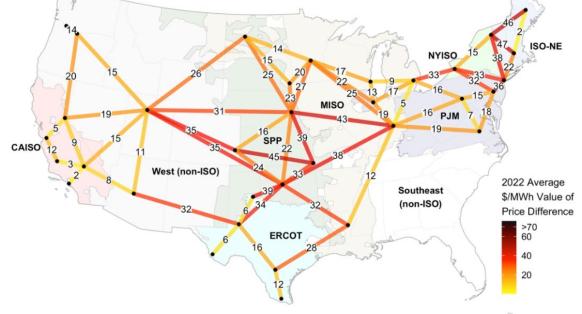

Average difference between zonal power prices in H1 2022

(Click image to enlarge)

Source: Lawrence Berkeley National Laboratory

The coordinated grid build should allow faster study of new connection applications, reducing costs for wind and solar projects and lessening the need to purchase power at higher prices from other parts of the system, according to Jessica Burdette, director of Commerce Energy Reliability & Security at the Minnesota Commerce Department.

"The federal award is going to help by reducing the per-project interconnection cost, alleviating some of the costs that will be passed on to those building the projects and ultimately those who have utility bills that pay for the projects," she said.

Capacity contracts

In a first phase of the Transmission Facilitation Program (TFP), the DOE will acquire capacity contracts from the Southline, Cross-Tie and Twin States transmission projects that together span six states in the West and Northeast and will add 3.5 GW of grid capacity.

The DOE will buy up to 50% of the total power line capacities for up to 40 years, encouraging other customers to purchase the remaining capacity and reducing the risks for the line developers. The department will use the proceeds from reselling the line capacity to maintain funds in the TFP and support multiple projects over time.

"The TFP is a kickstarter for big transmission lines," said Michael Skelly, chief executive officer of Grid United, co-developer of the 748 MW Southline transmission line. The 175-mile Southline Transmission Project will enable delivery of new wind, solar and geothermal energy in southern New Mexico to growing markets in Arizona and a further expansion is planned in a later phase.

The DOE funding will "accelerate our efforts to commercialize this project and get the contracts in place...allowing us to get into construction," Skelly said.

The TFP is also supporting the development of the 1.5 GW Cross-Tie bi-directional line connecting Utah and Nevada, which will enable delivery of solar generation in Utah, Nevada and California as well as wind generation in Wyoming and Idaho.

"I'd say this is a key piece in connecting the overall Western grid as a whole," Justin Joiner, president of CrossTie developer TransCanyon, said.

"It will allow us to connect to other projects under development...and have a more robust and better-connected system," he said.

The third project selected for the TFP, the 1.2 GW bi-directional line Twin States Clean Energy Link between New England and Quebec, Canada, will allow hydropower imports from Canada and exports of surplus offshore wind power from New England to Quebec in the future. The project will provide 79% of inter-regional transmission needs, according to the DOE.

Funding gap

The DOE has also been authorised through last year's inflation act to provide $2 billion in direct loans through the TFP program.

“This program is currently under development and more information will be available in the coming months,” the DOE said in an email.

The federal initiatives are a positive step towards addressing the critical issue of grid infrastructure but far more investments are required to achieve the levels of wind and solar power required to decarbonise the power network.

The U.S. must find ways to attract more money into the transmission sector, Silverman said.

"There has to be a future expansion of these programs or different programs of some sort," he said.

One solution could be a federal tax credit for transmission projects, similar to the credits offered for clean technology deployment and manufacturing in the inflation act.

Wind and solar deployment is spreading into new parts of the U.S. and grid investments will need to follow suit.

"We haven't really even begun to touch the transmission needed outside of that Western area," Silverman noted.

"Very little of this money is committed to the East,” he said.

Reporting by Anna Flavia Rochas

Editing by Robin Sayles