New Jersey awards 3.7 GW of offshore wind; Installations rebound in Europe

The wind power news you need to know.

Related Articles

New Jersey awards two offshore wind contracts

New Jersey has awarded offshore wind contracts to the 1.3GW Attentive Energy Two and the 2.4 GW Leading Light Wind projects in an accelerated auction round.

Attentive Energy Two is a joint venture between TotalEnergies and Corio Generation. Leading Light, which is expected to start producing power in 2031, is a partnership between U.S. energy firms Invenergy and energyRe.

“Today’s Third Solicitation awards are undeniable proof that the future of offshore wind in New Jersey is as strong as ever,” said Governor Phil Murphy.

The New Jersey Board of Public Utilities said the two projects would bring about $6.8 billion in economic benefits to the state and provide enough clean energy to power around 1.8 million homes.

The projects will support the construction of a turbine tower factory at the New Jersey Wind Port and invest in the expansion of the EEW monopile facility at the Port of Paulsboro, the board said in a statement.

The awards came after a tumultuous year that saw the cancellation of several offshore wind projects in the U.S. Northeast due to higher costs. In October, Orsted canceled Ocean Wind 1 and 2 off the coast of New Jersey citing soaring inflation, rising interest rates and delays in securing ships needed to build the projects.

New Jersey, which plans to build 11 GW of offshore wind energy by 2040, is slated to launch another offshore wind solicitation this year and expects to award those new contracts in early 2025.

U.S. offshore wind developers restructure ownership

Orsted, Eversource, BP and Equinor have agreed to restructure the ownership agreements for four offshore wind projects on the U.S. East Coast.

Orsted signed an agreement to acquire Eversource’s 50% share of the 924 MW Sunrise Wind off the coast of New York. The Danish company has rebid the offtake contract for the project in a solicitation by New York that closed on January 25.

“We’re building a future offshore wind hub that is strategic for Sunrise Wind, if awarded, as well as for upcoming solicitations in the region, helping us to differentiate and de-risk potential future bids and projects,” David Hardy, Orsted’s Executive Vice President and CEO of Americas, said in a statement.

Orsted is also building South Fork in New York and Revolution Wind in New England, both of which are already under construction.

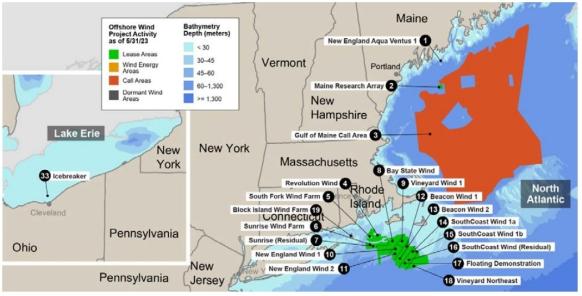

Offshore wind projects in US North Atlantic

(Click image to enlarge)

Source: Department of Energy's 2023 Offshore Wind Market Report, August 2023.

Meanwhile, Equinor entered into a swap transaction with BP, under which Equinor will take over the 810 MW Empire 1 and 1.2 GW Empire 2 projects, while BP will take over full control of the 1.2 GW Beacon Wind project.

Equinor said it has rebid the offtake contract for Empire 1 in New York's latest auction while Empire 2 “will be matured for future solicitation rounds” following its cancellation of the contract in January. BP said it has agreed with NYSERDA to terminate the power purchase agreement (PPA) for Beacon project but did not confirm if it has formally bid in the latest auction.

New England states extend deadline for offshore wind bids

Massachusetts, Connecticut and Rhode Island extended the deadlines for their latest offshore wind auctions from January 31 to March 27 to allow for pending IRS guidance on tax credits. Massachusetts now plans to announce the selected projects in August, it said.

The three states have agreed to seek multi-state proposals for large-scale offshore wind projects, which could help reduce construction costs and lower energy prices for consumers.

The states plan to launch procurement auctions for a total of 6 GW of offshore wind energy this year, and under the terms of a memorandum of understanding (MoU) announced in October, they may decide to select multi-state proposals and split the renewable energy generated by such projects.

The deadline extension comes as the U.S. Internal Revenue Service (IRS) is expected to issue more guidelines regarding tax credits included in the 2022 Inflation Reduction Act.

"Extending the schedule for our current solicitation creates additional time for developers to react to the possibility of further guidance from the IRS regarding key tax credits available to offshore wind projects," Lauren Diggin, a spokeswoman at the Massachusetts Department of Energy Resources (DOER), told Reuters.

Diggin said the guidance could allow developers to fully cash in on federal tax credits, hence “lowering the price of offshore wind for our ratepayers and improving project viability for offshore wind developers.”

The tax benefits are set to improve the profitability of offshore wind projects. Developers including Equinor, BP, Orsted and Avangrid have canceled several contracts on the U.S. Northeast citing higher costs due to inflation, interest rate hikes, and supply chain disruptions.

Offshore wind rebounds in Europe but onshore dips

European offshore wind installations bounced back to a record 4.2 GW in 2023, up from 2.5 GW in 2022, driven by growth in UK, France and the Netherlands, WindEurope said.

EU countries installed 3 GW, up from 0.9 GW a year earlier, the industry group said.

Offshore wind investments soared to 30 billion euros ($32.5 billion) last year, enough to finance 9 GW of new offshore capacity. Investments reached an all-time low of 400 million euros in 2022 due to “legal uncertainty and unhelpful market intervention,” WindEurope said.

EU countries plan to auction at least 40 GW of offshore wind capacity this year, compared with 13.5 GW in 2023, WindEurope said.

Meanwhile, onshore wind installations fell by 18% in 2023 to 14 GW as volatile costs and permitting delays slowed development, WindEurope data showed.

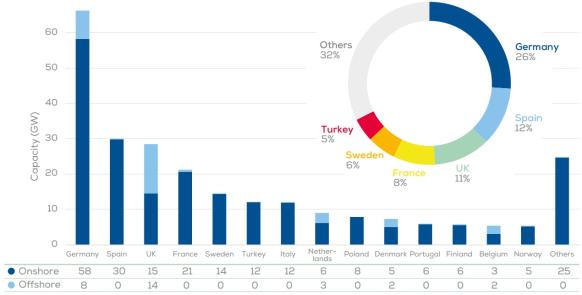

Germany built the most new onshore wind capacity followed by the Netherlands and Sweden.

Total wind power installed in Europe at end of 2022

(Click image to enlarge)

Source: WindEurope, February 2023.

The EU has rolled out policies to support the wind sector, which has faced higher costs due to inflation and higher interest rates. The EU in October published its Wind Power Action Plan with 15 immediate actions to support the wind sector, and in December, all EU members except Hungary signed the European Wind Charter, committing to swiftly implement measures ascribed to them in the EU's action plan.

EU unveils plan for offshore grid corridors

The European Union has released a plan to build five offshore grid corridors that could lower transmission costs and connect new wind farms to multiple national markets.

The European Network of Transmission System Operators’s (ENTSO-E) Offshore Network Development Plans (ONDPs) call for the construction of five offshore transmission networks in the North Seas, the Baltic, the Atlantic Basin, the West Mediterranean, and the East Mediterranean and Black Sea.

The ONDPs recommend the construction of transmission infrastructure that will be “cost-effective and environmentally friendly,” as well as offshore wind farms that will supply electricity to more than one country, WindEurope said in a statement.

The ONDPs are a “significant step forward” and are part of a string of EU policies that give offshore wind developers, investors and supply companies more visibility regarding future demand, the industry group said.

While developers are keen to build offshore wind farms that connect to multiple countries, the current regulatory framework does not provide clear cost mechanisms for cross-border sharing.

“It’s essential to resolve the cost-sharing issue as soon as possible. Otherwise the EU risks missing out on investments,” WindEurope CEO Giles Dickson said in a statement.

The ONDPs are part of EU efforts to improve interconnections between energy infrastructure in Europe. They will be reviewed every two years.

Reuters Events