New York secures bids from offshore wind builders burnt by cost hikes

New York's accelerated auction mechanism attracted revamped bids from advanced offshore wind projects which should help minimise cost increases for ratepayers.

Related Articles

New York is racing to re-allocate offshore wind capacity in a fourth auction round after volatile costs and supply chain delays prompted cancellations of offtake contracts along the East Coast.

New York State Energy Research and Development Authority (NYSERDA) called for new project bids by January 25 and plans to award the power purchase agreements (PPAs) in February under a new accelerated allocation process.

The move comes after New York state regulators in October denied requests by developers to renegotiate offtake contracts that were signed before costs surged following the coronavirus pandemic.

Round 4 has led to fresh bids from developers, signaling greater comfort with prices and risk under the new mechanism.

Denmark's Orsted, the world's largest offshore wind developer, has rebid its 924 MW Sunrise Wind project in the auction in a bid to replace a previous contract signed before the pandemic. Norwegian oil group Equinor said it has rebid its 810 MW Empire 1 project while the 1.2 GW Empire Wind 2 “will be matured for future solicitation rounds” following its cancellation of the contract in January. Oil group BP said it has agreed with NYSERDA to terminate the power purchase agreement for its 1.2 GW Beacon project but did not confirm if it has formally bid in the latest auction.

In a bid to “improve project reliance,” the fourth round auction includes mechanisms that account for inflation and support the sharing of interconnection costs, measures that first featured in an accelerated third auction round in October, a spokesperson for New York State Energy Research and Development Authority (NYSERDA) told Reuters Events.

Last year, Orsted, Equinor and BP specifically asked that their contracts be adjusted to include these two provisions, which suggests that the latest auction is designed with the distressed contracts “in mind,” Theodore Paradise, a partner at law firm K&L Gates, said.

Equinor is “encouraged by the state’s commitment to offshore wind, as well as NYSERDA’s collaborative approach to move these important new sources of renewable energy forward in an expedited way,” a company spokesperson said ahead of the auction deadline.

Price risks

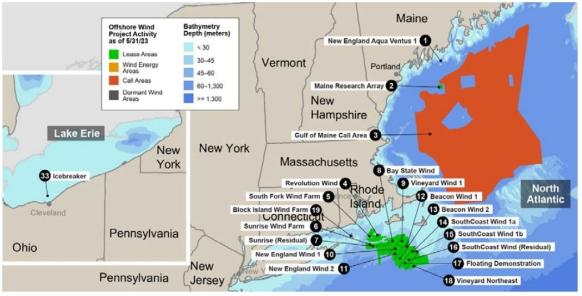

State mandates and ambitious federal targets boosted offshore wind activity on the East Coast but rapid cost increases have disrupted progress. Last year, developers sought higher offtake contracts on at least 10 East Coast offshore wind projects and many have cancelled contracts and plan to rebid in future auctions. New York aims to build 9 GW of offshore capacity by 2035 and has thus far awarded contracts for 8.3 GW, including the PPAs which developers now deem unprofitable.

Offshore wind projects in US North Atlantic

(Click image to enlarge)

Source: Department of Energy's 2023 Offshore Wind Market Report, August 2023.

A wave of projects scheduled to be installed in 2025-2028 has been particularly impacted and delays to these threaten supply chain investments critical to long-term growth. The 2022 Inflation Reduction Act provides tax incentives for offshore investments but suppliers require a long pipeline of projects to commit funds.

In the third auction round, New York awarded contracts to the 1.4 GW Attentive Energy One (TotalEnergies, Rise Light & Power, and Corio Generation), the 1.3 GW Community Offshore Wind (RWE Offshore Renewables and National Grid) and the 1.3 GW Excelsior Wind project (Copenhagen Infrastructure Partners).

The average strike price was $145.07/MWh, around 35% higher than the $107.50/MWh contract allocated for Empire Wind 2 back in 2018. Projects differ in scope and risk but the higher prices in round 3 show that significant tax credits for offshore wind in the 2022 inflation act have only partially offset global inflation pressures.

The projects with earlier offtake contracts, like Sunrise and Empire Wind, are further advanced in development than those selected in round 3, offering the potential for lower bids in round 4. Economies of scale will also play a key role.

Sunrise Wind is Orsted's third U.S. offshore wind farm following South Fork and Revolution Wind, already under construction, and Orsted expects to receive final permits for Sunrise Wind this summer.

Orsted is "building a future offshore wind hub that is strategic for Sunrise Wind...as well as for upcoming solicitations in the region, helping us to differentiate and de-risk potential future bids and projects,” said David Hardy, Executive Vice President and CEO of Region Americas at Orsted.

As the round 4 auction closed, Orsted said it would acquire full control of Sunrise and BP agreed to take over full control of the Beacon Wind project while Equinor takes over the Empire Wind projects.

New York will be keen to minimise price increases to limit the impact on ratepayers, but state officials will also be wary that developers may have the option of bidding their projects in other state auctions.

Massachusetts, Connecticut and Rhode Island are seeking to secure up to 6 GW of offshore wind power in a solicitation that closes on March 27. New Jersey has also accelerated its offshore wind auction schedule and last week allocated two projects for a total capacity of 3.7 GW.

Developers that participated in New York's latest auction will have any previous offtake contracts cancelled at no cost, unlike in Massachusetts and Connecticut where three developers had to pay a total of $124 million to cancel their contracts.

Factory aid

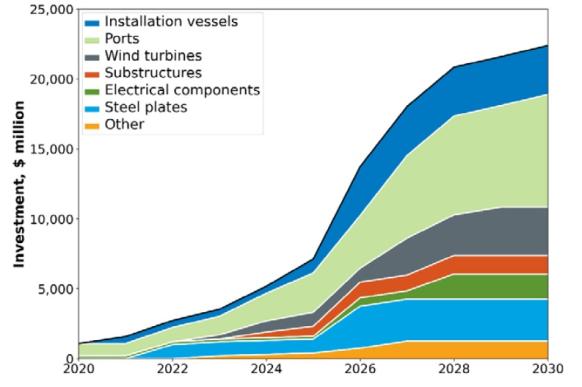

Alongside the auction, New York announced a $300 million investment to support the construction of a nacelle manufacturing and assembly plant by GE Vernova and a blade manufacturing facility by GE subsidiary LM Wind Power.

The combination of measures by New York State provides investors with the certainty they need “to continue to invest in New York but also in the U.S. market,” Ross Gould, Vice President for Supply Chain Development & Research at the Oceantic Network, said.

Investments needed to build a US offshore wind supply chain

(Click image to enlarge)

Source: U.S. National Renewable Energy Laboratory's Offshore wind Supply Chain Road Map, January 2023.

Dwindling onshore transmission capacity is a major challenge for New York and last year New York State announced $4.4 billion investment for 62 grid projects to reduce congestion and prepare the grid for future renewable energy projects, as well as nearly $3.3 billion for transmission to deliver 3 GW of offshore wind power from Long Island to the rest of the state.

New York’s efforts to proactively develop a “transmission backbone are helping de-risk offshore wind developments,” Fred Zalcman, director of the New York Offshore Wind Alliance, said. According to Zalcman, a shortage of land connection points means New York could currently only connect around 4 GW of offshore power.

“This is another major undertaking that the state of New York is pursuing, and I think it reflects the state's commitment to realizing its target and perhaps even go beyond 9 GW.”

Reporting by Eduardo Garcia

Editing by Robin Sayles