EU nations sign wind charter to spur growth; Equinor, BP cancel New York offshore wind power contract

The wind power news you need to know.

Related Articles

EU countries endorse European Wind Charter

With the exception of Hungary, all European Union countries have agreed to implement the European Wind Charter to prop up the bloc's wind supply industry.

The charter calls for faster wind energy permitting and the introduction of non-price criteria in future auctions to support European wind manufacturing, as well as provisions to protect investors from inflation and volatile prices. Some 300 wind energy companies also endorsed the charter.

The countries agreed to include non-price criteria in auctions to ensure that original equipment manufacturers (OEMs) meet high sustainability, cybersecurity, innovation, and labor standards - measures that aim to favour local manufacturers over imports based on lower standards.

The signatories also committed to increase investments in new wind manufacturing capacity to meet rising demand for components.

“The actions on permitting, finance and auctions will help boost the expansion of wind energy and strengthen Europe’s wind industry. This is good for jobs and growth and for Europe’s energy security,” Giles Dickson, CEO of industry group WindEurope, said.

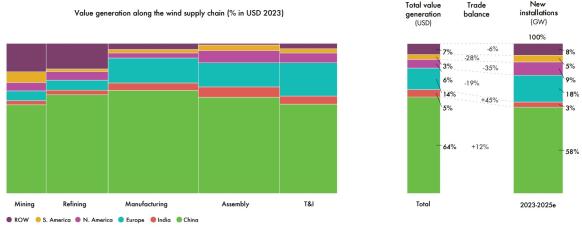

Value added to global wind supply chain by region

(Click image to enlarge)

Source: Global Wind Energy Council (GWEC), International Energy Agency (IEA), BCG Analysis (December 2023).

The charter builds on the European Wind Power Action Plan launched by the European Commission (EC) in October to support the domestic wind supply chain after rising costs and a slowdown in deployment sliced the profits of the region's largest turbine makers.

Under the action plan, turbine suppliers can tap into EU financing that was previously earmarked for innovation and research and obtain de-risking guarantees from the European Investment Bank (EIB).

These measures "will significantly reduce financing costs for the original equipment manufacturers and would allow the wind industry to allocate financial resources to increase their capacity,” Jon Lezamiz Cortazar, Head of Advocacy at Siemens Energy, the owner of Siemens Gamesa, told Reuters Events in November.

Orsted commits to build giant Hornsea 3 offshore wind project

Orsted has made a final investment decision (FID) on Hornsea 3, a 2.6 GW offshore wind project in north-east England that the Danish company previously said could be canceled without additional UK government support such as tax breaks.

The project, which will have capacity to power more than 3.3 million UK homes and is expected to cost 70-75 billion Danish crowns (8.1 to 8.6 billion pounds/$10.3-$11.0 billion), is scheduled to come online by the end of 2027.

Orsted was awarded a contract for difference (CfD) for Hornsea 3 in 2022 at an inflation-indexed strike price of 37.35 pounds per MWh, far lower than the price cap set for round 6 auctions this year to account for recent inflation.

Orsted has however been granted permission to submit up to 700 MW of the project's capacity in future bidding rounds, potentially allowing it to double the offtake price, the company said announcing its FID on December 20.

“Orsted will use this flexibility to submit a share of Hornsea 3’s capacity into the UK’s upcoming allocation round 6,” the company said in a statement.

The UK government will hike the price cap for offshore wind in its next renewable energy auction by 66% to 73 pounds/MWh after developers complained that prices were too low.

Orsted already operates 12 offshore wind farms in the UK, including Hornsea 1 (1.2 GW) and Hornsea 2 (1.3 GW). Synergies between the three projects and a well-established supply chain would keep construction and operating costs low, the company said.

Orsted has contracted Siemens Gamesa to supply 14 MW turbines for Hornsea 3, which it describes as the world’s single largest offshore wind project.

“Most of the capital expenditure for Hornsea 3 was contracted ahead of recent inflationary pressures, securing competitive prices from the supply chain and allowing time to work collaboratively on value creation opportunities,” the company said.

Orsted’s Hornsea 4 project, which could have a capacity of up to 2.6 GW, received its development consent order from the UK government in July and is now eligible for forthcoming CfD allocation rounds.

Equinor, BP cancel power contract for New York offshore wind farm

Equinor and BP terminated their agreement to sell power to New York state from the 1.3 GW Empire Wind 2 offshore wind farm, saying the contract was not viable due to “inflation, interest rates and supply chain disruptions.”

The announcement on January 3 came during a new renewable energy solicitation by the New York State Energy Research and Development Authority (NYSERDA) which allows companies to exit old contracts and re-offer power at higher prices.

“The Empire Wind 2 decision provides the opportunity to reset and develop a stronger and more robust project going forward,” said Molly Morris, president of Equinor Renewables Americas, in an apparent reference to the solicitation due to close on January 25.

An Equinor spokesperson told Reuters the company was "carefully assessing" the solicitation and was "encouraged by the state's commitment to offshore wind" but declined to comment on the bid strategy for Empire Wind 2.

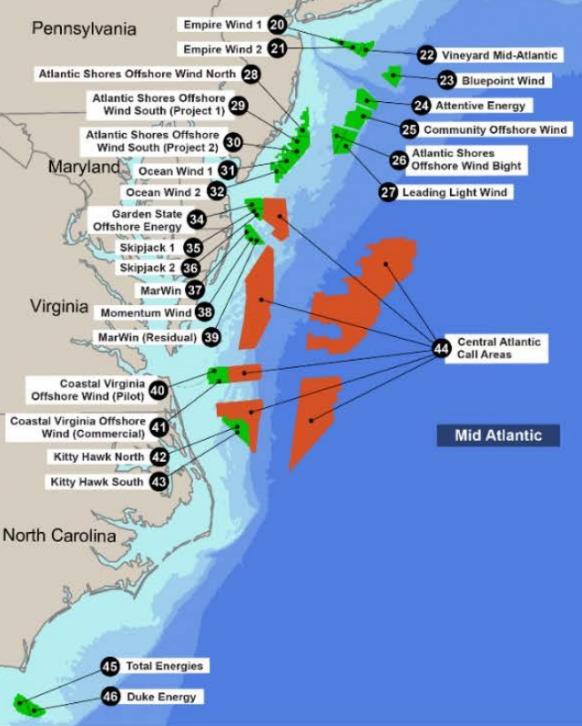

Offshore wind projects in US Mid Atlantic

(Click image to enlarge)

Source: Department of Energy's 2023 Offshore Wind Market Report, August 2023.

Several East Coast states have committed to fast-track new offshore wind auctions and adapt bid mechanisms this year after soaring prices prompted developers to cancel contracts. Regulators had rejected requests by developers to improve the financial terms of their power purchase agreements (PPAs), leading to delays and cancellations.

Petitioners in New York included Orsted, the world's largest offshore wind developer, which had asked for amendments to the PPA for its 880 MW Sunrise Wind project, as well as Equinor and BP, which requested modifications to the contracts for their Empire 1, Empire 2 and Beacon Wind projects with a total capacity of 3.3 GW.

Following the regulatory setback, the office of New York Governor Kathy Hochul released an "action plan" to support the renewable energy industry, awarded provisional contracts to three new offshore wind projects with a combined production capacity of 4 GW, and announced the new solicitation process.

US to review multiple offshore wind leases at once

To speed up permitting, the U.S. Bureau of Ocean Energy Management (BOEM) will for the first time conduct an environmental impact assessment across multiple offshore wind lease areas simultaneously.

The agency will review six lease areas in close proximity off the coast of New York and New Jersey that span 488,000 acres and contain up to 7 GW of potential offshore wind capacity.

The leases were granted to Bluepoint Wind (Ocean Winds and Global Infrastructure Partners), Attentive Energy (TotalEnergies, Rise Light & Power, and Corio Generation), Community Offshore Wind (RWE Offshore Renewables and National Grid), Atlantic Shores Offshore Wind Bight (Shell and EDF Renewables North America), Invenergy Wind Offshore (Invenergy and energyRe), and Vineyard MidAtlantic (Copenhagen Infrastructure Partners and Avangrid).

“We are confident that this comprehensive approach can create efficiencies for future project-specific wind energy reviews in a manner that protects the ocean environment and marine life,” said BOEM Director Elizabeth Klein.

Reuters Events