Germany seeks more solar on farmland to meet green goals

Germany is committing to more solar on working farmland but developers also need faster action by local authorities and industry recruitment is a major challenge.

Related Articles

Earlier this month, Germany's energy and climate ministry BMWK set out a new solar strategy to improve land availability for developers, speed up permitting and grid connections, and support skills and supply chain development.

Solar installations must accelerate rapidly to achieve the government's solar target of 215 GW by 2030, compared with 63 GW in 2022. By 2030, the government aims to generate 80% of power from renewable energy, double the level seen in 2022, slicing carbon emissions and ending the country's reliance on Russian fuel supplies.

To achieve its goals, annual solar installations must rise from 7.4 GW in 2022 to 22 GW by the middle of the decade, including 11 GW of ground-mounted solar, BMWK said.

The government predicts 10 GW could be installed this year and the last auction of utility-scale solar contracts in April was oversubscribed for the first time since June 2022, indicating signs of growth amid a challenging cost landscape for developers.

In a key measure, the government will allow large agri-solar development, where solar arrays share land with farming, on set-aside land, Daniel Holder, Head of Global Policy and Markets at BayWa r.e, told Reuters Events. Based in Germany, BayWa develops agri-solar and other renewable energy projects across Europe.

The EU common agricultural policy (CAP) requires 4% of agricultural land to be set aside to promote biodiversity and agri-solar would qualify for this.

“If we only use about a quarter of this to generate solar energy, we would be able to achieve Germany’s current PV expansion targets," Holder said.

By opening up more land, the strategy addresses the right areas for developers, but this must feed through to local level action, Claus Urbanke, Vice President Wind, Solar & Storage Development Germany at operator Statkraft, said.

Nature protection rules must be standardised across local authorities and approval teams must be equipped with sufficient personnel and digital resources, he said.

Germany acts

Across Europe, solar and wind permitting currently takes several years, due to complex administrative processes and a lack of resources at approval authorities.

In a bid to speed up development, Germany is fast tracking new faster permitting laws that will soon be rolled out across the European Union.

The laws require governments to set aside land for faster solar and wind permitting and designate renewable energy as projects of overriding public interest.

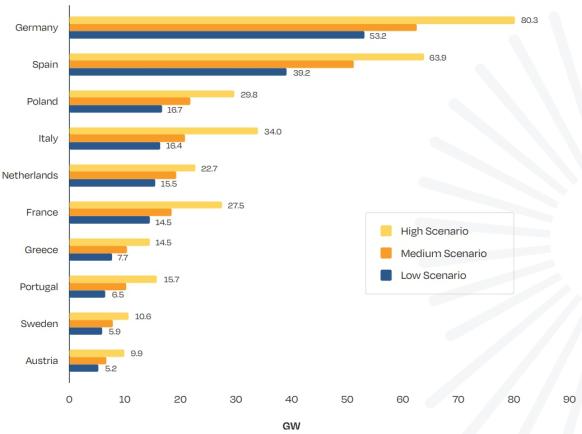

Forecast largest EU solar markets in 2023-2026

(Click image to enlarge)

Source: SolarPower Europe, December 2022

Germany's coalition government has shown it is willing to adjust regulations to achieve its deployment targets, a spokesperson for industry group SolarPower Europe said.

Germany's Federal Network Agency increased the maximum price limit in the last utility-scale solar auction to 74 euros/MWh ($79.3/MWh), prompting an unprecedented 2.9 GW of bids for 2.0 GW of available contracts. Developers have faced rising costs and delivery issues following the pandemic and Russia's invasion of Ukraine and industry officials have called for power authorities to factor in inflationary pressures in tender criteria. The average volume-weighted price was 70 euros/MWh and projects on former farmland and grassland accounted for 851 MW while projects on the side of railways and motorways accounted for 755 MW.

More action should be taken to prioritise new grid connections, Holder said.

A lack of available grid capacity continues to drive up project costs and regulation should oblige landowners to accept certain connection plans, he said.

Developers have seen a flurry of regulatory changes aimed at combating inflation and energy security concerns and this has brought wider risks.

To protect consumers, Germany applied a temporary windfall tax on renewable energy revenue above 130 euros/MWh until April 2024, lower than a 180 euros/MWh price limit set by the EU. Germany's tax threshold remains higher than the cost of developing solar and wind power, but it must not be extended beyond the current deadline, Urbanke said.

“It would destroy confidence in the investment climate in Germany," he said.

Skills shortage

Germany's solar developers will face a severe staffing shortage in the coming years unless recruitment rates are accelerated.

In its latest solar strategy, the government pledges to increase training opportunities across manufacturing, project planning, installation and maintenance. Last October, the government set out support for training, quality standards and reducing barriers to immigration.

Germany employed around 87,000 solar workers in 2021, according to SolarPower Europe’s latest annual jobs report, and could need as much as 240,000 by 2026, including rooftop solar and larger projects.

Combined, the solar and wind sectors currently lack around 216,000 skilled workers, according to a study by German skills organisation KOFA.

Key gaps for solar operators will include skilled engineers, technicians and field personnel for operations and maintenance (O&M), Holder said. Much of the industry will need to be comfortable with IT and digital tools, he noted.

Solar workers can be trained relatively swiftly but Holder said companies are competing for engineering and electronics workers against the wider energy sector as well as other key industries such as automotive.

The renewable energy space is an attractive prospect for many, but companies also "need to train people and...offer attractive employment conditions to motivate people," Urbanke said.

Reporting by Neil Ford

Editing by Robin Sayles