US solar employment forecast to hike 8%; Oil group Galp to build 10 GW of renewables

Our pick of the latest solar news you need to know.

Related Articles

US solar jobs multiply as installations soar

US solar employment is forecast to rise by 7.8% this year to 269,500 jobs due to a surge in new installations, the Solar Foundation said in its latest National Solar Jobs Census.

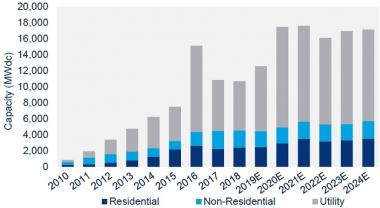

Around 18 GW of solar power is expected online in 2020, including 12.6 GW of utility-scale PV, according to the latest quarterly market report by Wood Mackenzie Power and Renewables and the Solar Energy Industries Association (SEIA). The U.S. Energy Information Administration predicts 13.5 GW of utility-scale solar capacity this year.

US PV installation forecast

(Click image to enlarge)

Source: Wood Mackenzie Power and Renewables, September 2019

Employment in solar installation, the largest job sector, is expected to grow by 9.5% this year, adding around 15,000 jobs to the US economy, the Solar Foundation said. Employment in operations and maintenance (O&M) is expected to rise by 4%, equivalent to 463 new jobs nationwide, it said.

In 2019, Solar employment rose by a modest 2.3% to 250,000 workers as Section 201 import tariffs curbed demand for new projects. Over the last year, falling costs and growing project efficiency have refueled bullish sentiment.

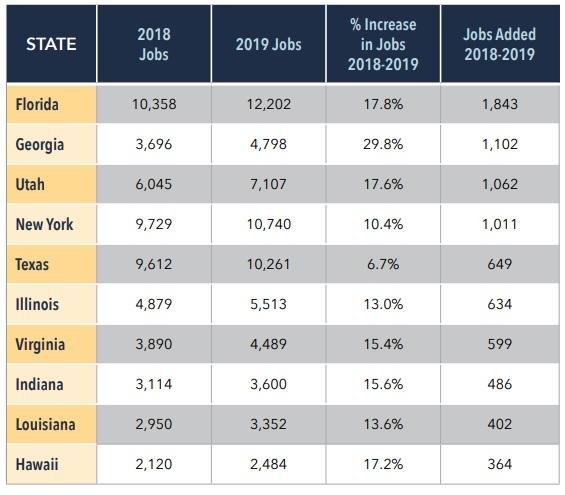

Job growth was fastest in Georgia, where employment rose 29.8% to 4,798 jobs. Florida was top on total jobs added, creating 1,843 new positions in 2019 for a total 12,202 workers.

Top 10 US states for solar jobs growth in 2019

Source: National Solar Jobs Census 2019 (Solar Foundation).

Oil group Galp to build 10 GW of renewables by 2030

Portuguese oil and gas group Galp plans to build around 10 GW of new renewable energy capacity by 2030 in a major diversification into low carbon technologies, the company announced February 18.

Galp plans to spend 1.0 billion-1.2 billion euros ($1.3-1.6 billion) per year in 2020-2022, of which 10 to 15% will be on renewable energy projects, the company said at its annual capital markets day. Galp will focus most of its renewable energy investments in Spain and Portugal, but will also seek opportunities in other markets, it said.

Last month, Galp agreed to buy stakes in 2.9 GW of Spanish PV capacity, in operation or under development, from ACS Group.

Valued at 2.2 billion euros, the portfolio includes 900 MW of operational capacity and 2 GW of projects scheduled to be built by 2023. The deal is expected to be closed in the second quarter of 2020, at which time Galp will make a payment of 450 million euros and assume 430 million euros of project finance liabilities for operational plants.

Including other solar assets under development, Galp will have 3.3 GW of installed solar capacity by 2023, making it one of the largest solar operators in Spain. Equity returns from this portfolio are expected to be above 10%, it said.

Falling solar technology costs and growing offtaker demand have reignited Spain's solar market. Spain was the largest solar market in Europe last year and is forecast to install 3.5-4 GW/year of new capacity in the next five years, according to industry group SolarPower Europe.

Galp plans to allocate 40% of new investment in businesses that help to reduce carbon emissions. The group plans to finance new solar plants through project finance and will look for partnership opportunities.

As consumers and businesses shift away from fossil fuel resources, oil groups are accelerating "zero carbon" objectives and investing in renewables. Earlier this month, London-based oil and gas group BP said it aims to reach "net zero" by 2050.

Iberdrola installs jump five-fold as investments soar

Iberdrola accelerated renewables construction and installed 5.5 GW of new global power capacity in 2019, five times its annual average over the last few years, the Spanish utility said in its annual results presentation February 26.

Iberdrola's net profit rose by 13% in 2019 to 3.4 billion euros as heavy investment in renewables and networks took effect. Iberdrola increased investments by 32% in 2019 to 8.2 billion euros, with 41% spent on renewables and 44% on networks.

The company will increase investments to more than 10 billion euros in 2020, some 40% higher than the average for the last three years, installing 4 GW of new capacity.

Iberdrola is building an additional 9 GW of new capacity globally, scheduled to be commissioned in 2021 and 2022, and has a development pipeline of 40 GW. Spain is a key growth market for the group, along with Portugal, the UK, US, Mexico and Brazil and Australia.

"We have around 100 projects under construction around the world at the moment," Iberdrola CEO Ignacio Galan told Reuters.

Iberdrola's EBITDA (operating profit) rose 8.1% in 2019 to exceed 10 billion euros for the first time. Positive impact from networks, retail and rising generation capacity outweighed the negative impact of lower hydroelectric power generation.

Iberdrola raised its net profit outlook to "high single-digit" average growth for the period 2020-2022, boosted by strengthening climate policies in Europe and the US.

New Energy Update