U.S. offshore wind pipeline swells to 51 GW; Federal bureau calls for projects in Gulf of Maine

The wind power news you need to know.

Related Articles

US offshore wind activity grows, piling pressure on supply

There is currently over 51 GW of offshore wind capacity under development in the United States across 32 lease areas, mostly on the East Coast, according to a new report from the American Clean Power Association (ACPA).

The Biden administration has set a target of 30 GW of offshore wind by 2030 and aims to complete environmental reviews of at least 16 offshore wind projects by 2025, representing over 20 GW of new capacity.

There are currently 10 projects undergoing environmental reviews after having submitted their Construction and Operations Plans (COPs) and a string of lease auctions scheduled for the coming years ― in the Gulf of Mexico (2023), Central Atlantic (2023), Oregon (2023), and the Gulf of Maine (2024).

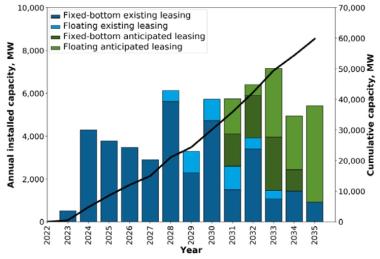

Forecast U.S. offshore wind installations

(Click image to enlarge)

Source: Department of Energy report on U.S. offshore wind supply chain, June 2022

Avangrid and Copenhagen Infrastructure Partners are currently building the 816 MW Vineyard Wind 1 off the coast of Massachusetts, the first large offshore wind farm in the U.S., and there is 16.6 GW of capacity in advanced development with offtake contracts secured, ACP said in its report.

There is 33.9 GW in early development, meaning yet to procure offtake contracts. New York, New Jersey, and Massachusetts have the biggest pipelines of all East Coast states and five lease areas are being developed off the coast of California following the first auction of West Coast leases last year.

Developers continue to face rising costs due to supply chain disruptions, commodity price increases, higher interest rates and rampant inflation, ACPA warned. High steel cost prices are of particular concern. ACPA said that at the end of 2022, steel prices in North America and North Europe remained 52% and 69% above January 2019 prices.

The nascent domestic supply chain should ease some of these concerns. A total of 14 manufacturing facilities have been announced or are under construction, including the country’s first offshore wind blade manufacturing facility, which is being built by Siemens Gamesa in Virginia.

More companies are set to announce supply chain investments in the coming months to take advantage of the tax incentives included in the Inflation Reduction Act.

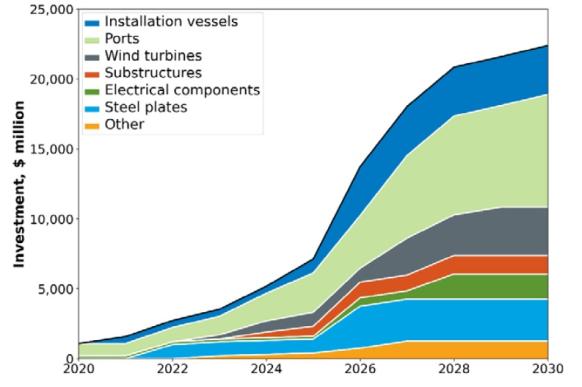

Investments needed to build a U.S. offshore wind supply chain

(Click image to enlarge)

Source: NREL's Offshore wind Supply Chain Road Map, January 2023.

Developers have also warned of a shortage of U.S.-built vessels, particularly the specialised wind turbine installation vessels that can handle the huge components used on offshore wind projects.

Around 30 new U.S. vessels have been ordered, but this includes only one installation vessel, the 472-foot Charybdis ordered by utility Dominion Energy, ACP said.

Lengthy permitting processes are also holding back projects, it said, and the Biden administration is looking to implement rule changes that would streamline the process.

BOEM calls for new offshore wind projects in Gulf of Maine

The Interior Department's Bureau of Ocean Energy Management (BOEM) has called for interest for new wind farm proposals off the coast of Massachusetts, New Hampshire and Maine, the first step in a new wave of development.

The Gulf of Maine hosts 156 GW of potential offshore wind capacity within 50 miles of the shore and resources peak in the wintertime, when electricity demand peaks. Massachusetts will host the first large-scale wind farm, the 800 MW Vineyard wind 1 project currently being co-developed by Avangrid and Copenhagen Infrastructure Partners.

In parallel, the BOEM has identified four areas off the coast of Maine to build a pilot floating wind project with up to 12 turbines that will have a capacity of up to 144 MW.

To review the potential environmental impacts, BOEM has opened a 30-day public comment period ending on June 5. The areas are: Lobster Management Area I (where there is high-density lobster fishing activity), Platts Bank (a potentially sensitive area because it supports local fisheries), Atlantic Large Whale Take Reduction Plan Restricted Areas (where fishing is restricted to support the conservation of several whale species, including the North Atlantic right whales), and Georges Bank (a potentially sensitive area that supports ocean upwelling and local fisheries).

The University of Maine has partnered with an industry consortium to develop the Aqua Ventus pilot floating wind farm project in a 9.8-million-acre Call Area situated 20 nautical miles off the coast of Maine, southeast of Portland.

Texas set to hit record power demand, drawing on renewables

Texas power demand is forecast to peak at 82.7 GW during hot weather this summer, exceeding last year's record and requiring renewable energy supplies to minimise disruption, the Electric Reliability Council of Texas (ERCOT) said.

Texas accounted for 26% of total U.S. wind generation last year, while solar capacity is rising fast and accelerating battery storage deployment.

ERCOT estimates that there will be 97 GW of power capacity available this summer but some of this will be intermittent wind and solar capacity. This total also includes 688 MW of planned thermal resources and 372 MW of planned solar resources that are forecast to be connected by July.

ERCOT adjusted its peak load forecast this year to incorporate new solar rooftop system additions representing 432 MW, as well as increased power demand from large consumers, such as crypto-mining facilities, which could demand 1.1 GW of additional energy.

Reuters Events